Monetary Policy Report - April 2024

The Monetary Policy Report presents the Bank's technical staff's analysis of the economy and the inflationary situation and its medium and long-term outlook. Based on it, it makes a recommendation to the Board of Directors on the monetary policy stance. This report is published on the second business day following the Board of Directors' meetings in January, April, July, and October.

Inflation continues to fall, but it is above the 3% target, and it is projected to continue falling until it reaches it in 2025. Economic growth is low, but it would recover, and by 2025, economic activity would reach a path that can be sustained over time without causing unwanted changes in inflation, employment, or the external balance. The current monetary policy interest rate is compatible with the convergence of inflation to the target in 2025 and with the recovery of economic growth in the next two years.

Annual inflation has been decreasing for a year and is projected to continue, with inflation at 5.5% in December and the 3% target to be reached in 2025.

- In March, total inflation was 7.4% and completed a year of reductions from the maximum recorded a year ago (13.3%). In the first quarter of this year, all the main components of inflation fell (food, services, goods, and regulated).

- The decrease in inflation has been greater than expected due to the behavior of food prices and some goods.

- The lower pressures of the exchange rate on prices, the slowdown in demand, and the completion of adjustments in fuel prices contributed to reducing inflation.

- The reduction in inflation has been limited by the rise in some service rates, largely because several of these were updated with the high inflation observed (what is known as indexing).

- The accumulated effect of monetary policy actions, weak demand in the presence of excess productive capacity of the economy, and an exchange rate behavior that would continue to exert downward pressures on prices will continue to contribute to the decrease in inflation and its convergence towards the 3% target.

- There are some risks that could reduce inflation more slowly than projected, such as possible pent-up increases in public services and transport rates, an unexpected increase in the exchange rate and/or adverse weather conditions that affect food prices.

The economy would recover in 2024, and by the end of the following year, it would reach a path that would not cause unwanted changes in inflation, employment, or the country’s external balance.

- After the significant economic growth in 2022 (7.3%) that placed the GDP at high levels, the expansion of economic activity for 2023 was 0.6%. In the first quarter of 2024, the economy would have improved compared to what was observed at the end of 2023, driven by high levels of activity in the agricultural sector that reflect the high supply recorded in these months.

- The necessary adjustment of economic activity occurred amid the accumulated effects of monetary policy actions to combat high inflation, high external financing costs, and low levels in businessmen’s and consumers’ confidence indicators.

- The labor market continues to show unemployment rates at low levels compared to its history, although with deteriorations in employment in recent months.

- Going forward, economic activity would continue to recover. This would occur in an environment of less restrictive external financing conditions, and reductions in the monetary policy interest rate, as inflation gradually approaches the 3% target.

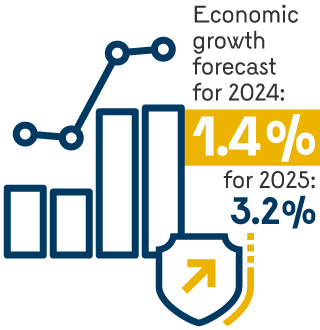

- For 2024, economic growth of 1.4% is projected, driven by consumption and despite a weak expected investment performance.

- For 2025, growth would be 3.2%, with consumption that would continue to improve, an investment that would recover from the very low levels of 2024, and a gradual recovery of exports.

- The lower growth of the Colombian economy has been reflected in a reduction of the broad external imbalance observed in 2022, which results in less vulnerability to changes in international conditions.

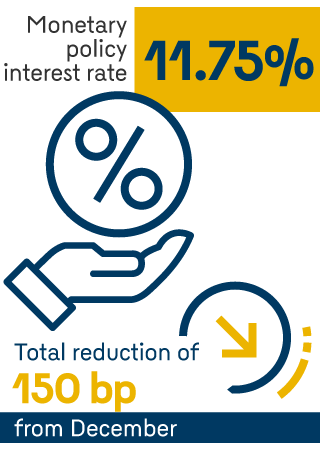

Given the decline in inflation and its expectations, the slowing of domestic demand, and a more sustainable external balance, the Board of Directors of the Banco de la República decided at its April meeting to continue the monetary policy interest rate reductions, bringing it to 11.75%.

- The stance of monetary policy has contributed to ameliorating the country’s macroeconomic imbalances, such as high inflation, excess spending and credit, and the wide external deficit.

- In the context of decreasing inflation and adjusting some macroeconomic imbalances, the Board of Directors began to reduce the monetary policy interest rate from December 2023, with a total reduction of 150 basis points by April.

- The current monetary policy interest rate is compatible with inflation, reaching the 3% target in 2025 and sustainable economic growth over time.

Monetary Policy Presentation (Only in Spanish)

Box Index

Box 1 - A Transportation Services Indicator to measure Colombian Economic Activity

Pulido-Mahecha, Karen L.; Silva-Rodríguez, Juan Sebastián; Carmona-Pascuales, Juan Felipe

Box 2 - Investment Outlook and Recent Development

López, Camilo; Herrera, Andrés; Rodríguez, Nicol; Quintero, Sebastián

Box 3 - Assessment of the 2023 Macroeconomic Forecast Error

Muñoz-Martínez, Jonathan Alexander; Pérez-Amaya, Julián Mauricio