Report on the Evolution of the Balance of Payments and International Investment Position – First Quarter of 2025

The quarterly report on the performance of Colombia’s balance of payments and international investment position outlines the main results for the country's current and financial accounts, as well as the evolution of their items.

1. Overall Results for the Balance of Payments

During the first quarter of 2025, Colombia’s current account of the balance of payments registered a deficit of USD 2,290 million (m), equivalent to 2.2% of the quarterly Gross Domestic Product (GDP). In turn, the financial account, including the variation in reserve assets (USD 564 m), recorded net capital inflows for USD 1,835 m (1.7% of the quarterly GDP). Errors and omissions were estimated at USD 456 m.

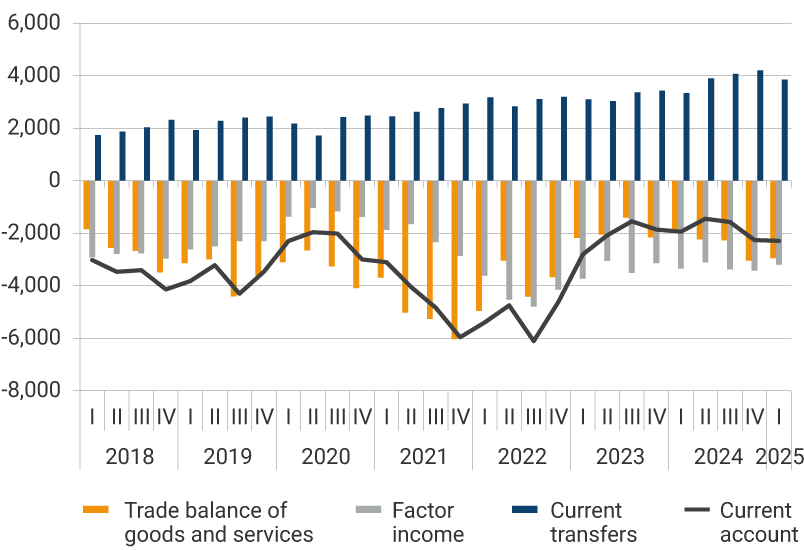

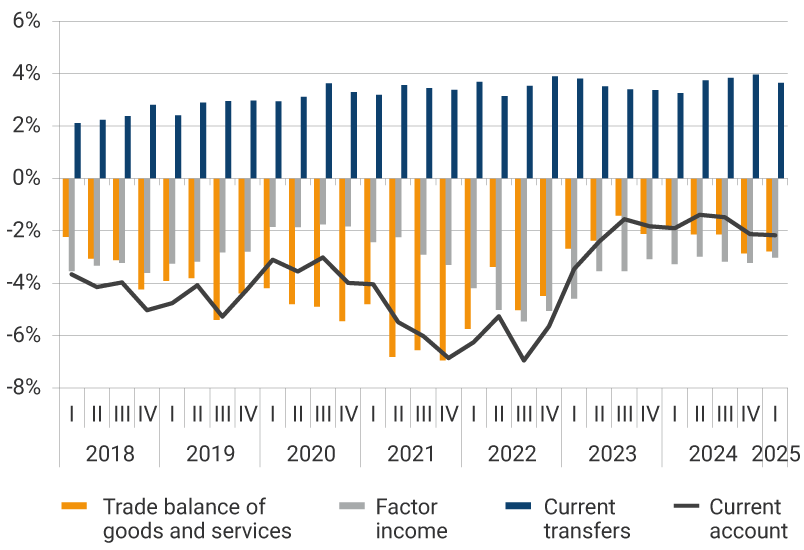

By components, the current account deficit (USD 2,290 m) in the first quarter of 2025 was due to net factor income outflows amounting to USD 3,196 m and deficit balances in foreign trade of goods for USD 3,088 m. These results were partially offset by net income from current transfers for USD 3,849 m and a surplus in trade in services for USD 145 m (Graph 1).

Graph 1. Components of Colombia’s Current Account of the Balance of Payments

Source: Banco de la República

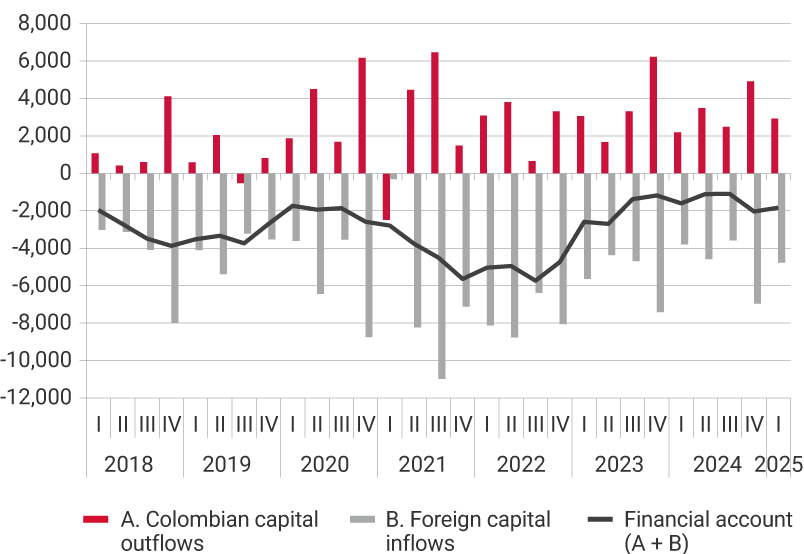

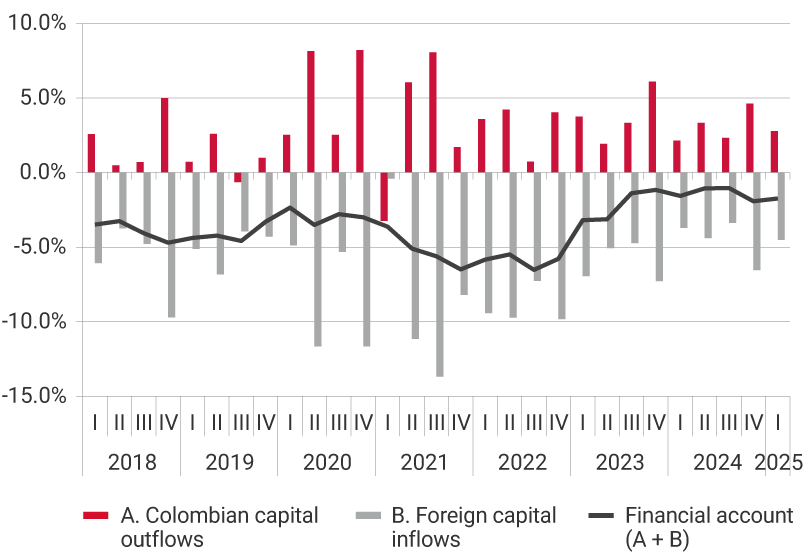

Regarding the financial account for the first quarter of 2025, net capital inflows are estimated at USD 1,835 m. This corresponds to foreign capital inflows (USD 4,765 m), Colombian capital outflows (USD 2,789 m), payments from non-residents to residents for gains in financial derivatives transactions (USD 422 m), and the increase in foreign reserves due to balance of payments transactions (USD 564 m) (Graph 2).

Graph 2. Components of the Financial Account of Colombia’s Balance of Payments

Note: According to the Sixth Edition of the International Monetary Fund's Balance of Payments Manual, the financial account is presented with the same sign as the current account. For example, if the current account is in deficit, the financial account is negative. This indicates that the economy is resorting to external financing and/or liquidating its external assets to finance its excess current expenditure.

Source: Banco de la República

2. Quarterly and Annual Evolution of the Current and Financial Accounts of Colombia’s Balance of Payments

(a) Current Account

The estimated current account deficit for the first quarter of 2025 (USD 2,290 m, 2.2% of GDP) increased by USD 32 m compared to the immediately preceding quarter. This was mainly due to a surplus reduction from current transfers and a larger deficit in the trade balance of goods. This increase was partially offset by improvements in the trade balance of services and a decrease in net factor income outflows (Graph 1).

Compared to the first quarter of 2024, the current account deficit in the first quarter of 2025 was USD 346 m higher (0.3 pp. of GDP). This performance is mainly explained by the widening of the trade deficit of goods and the surplus reduction in the trade balance of services. These results were partially offset by an increase in net income from current transfers and lower net factor income outflows.

(b) Financial Account

Net capital inflows of USD 1,835 m (1.7% of GDP) recorded in the financial account during the first quarter of 2025 decreased by USD 204 m compared to the immediately preceding quarter. This result is explained by the accumulation of loan portfolio external assets and a decline in foreign direct investment flows, partially offset by the liquidation of deposits held abroad.

Compared to the first quarter of 2024, the financial account in the first quarter of 2025 showed higher net inflows for USD 234 m. This trend is mainly explained by higher external financing for loans and loan portfolio investment, as well as the liquidation of deposits held abroad, partially offset by higher accumulation of loan portfolio external assets.

3. International Investment Position (IIP)

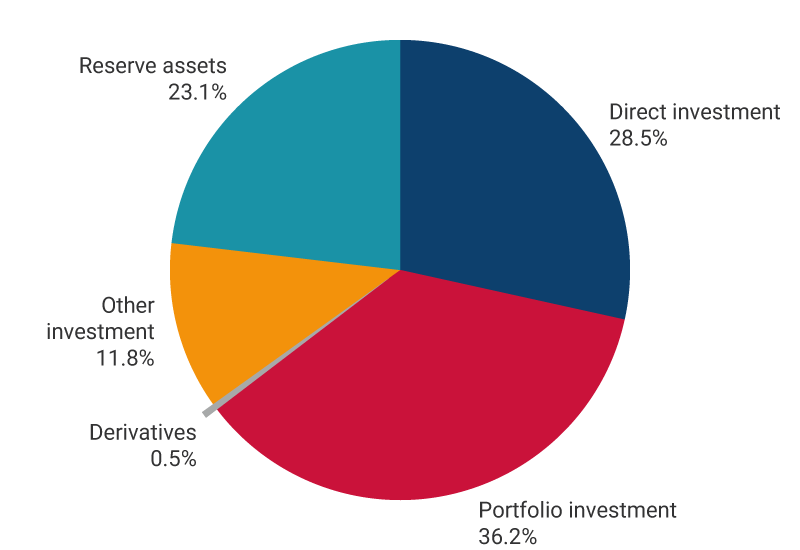

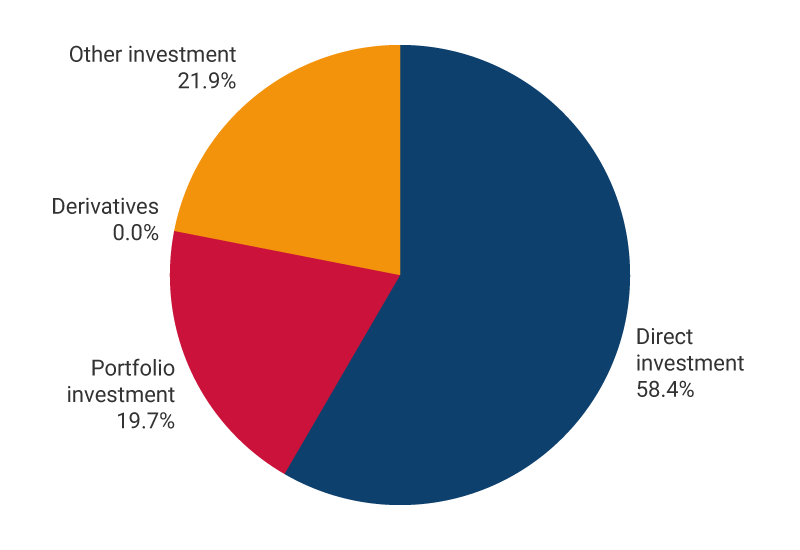

As of the end of March 2025, Colombia recorded a negative net international investment position of USD 192,257 m (45.9% of annual GDP), resulting from USD 276,232 m in assets (65.9% of annual GDP) and liabilities for USD 468,489 m (111.8% of annual GDP). Of the total asset balance, 36.2% corresponds to loan portfolio investment, 28.5% to Colombian direct investment abroad, 23.1% to reserve assets, and the remaining 12.2% to other assets including loans, other foreign credits, deposits abroad, and financial derivatives. Liabilities are broken down into 58.4% foreign direct investment, 21.9% other liabilities (where external loans stand out), and the remaining 19.7% loan portfolio investment.

Graph 3. International Investment Position as of March 2025 (USD 192,257 m, 45.9% of GDP 1)

USD 276,232 m

USD 468,489 m

1 The GDP figure in dollars corresponds to the sum of the last four quarters.