National Financial Accounts Bulletin by Institutional Sector - Second Quarter 2024

Below is a summary of the financial accounts by institutional sector and by financial instrument. For further details, please refer to the Technical Bulletin (Only in Spanish).

Financial flows for the second quarter of 2024

1. By institutional sector

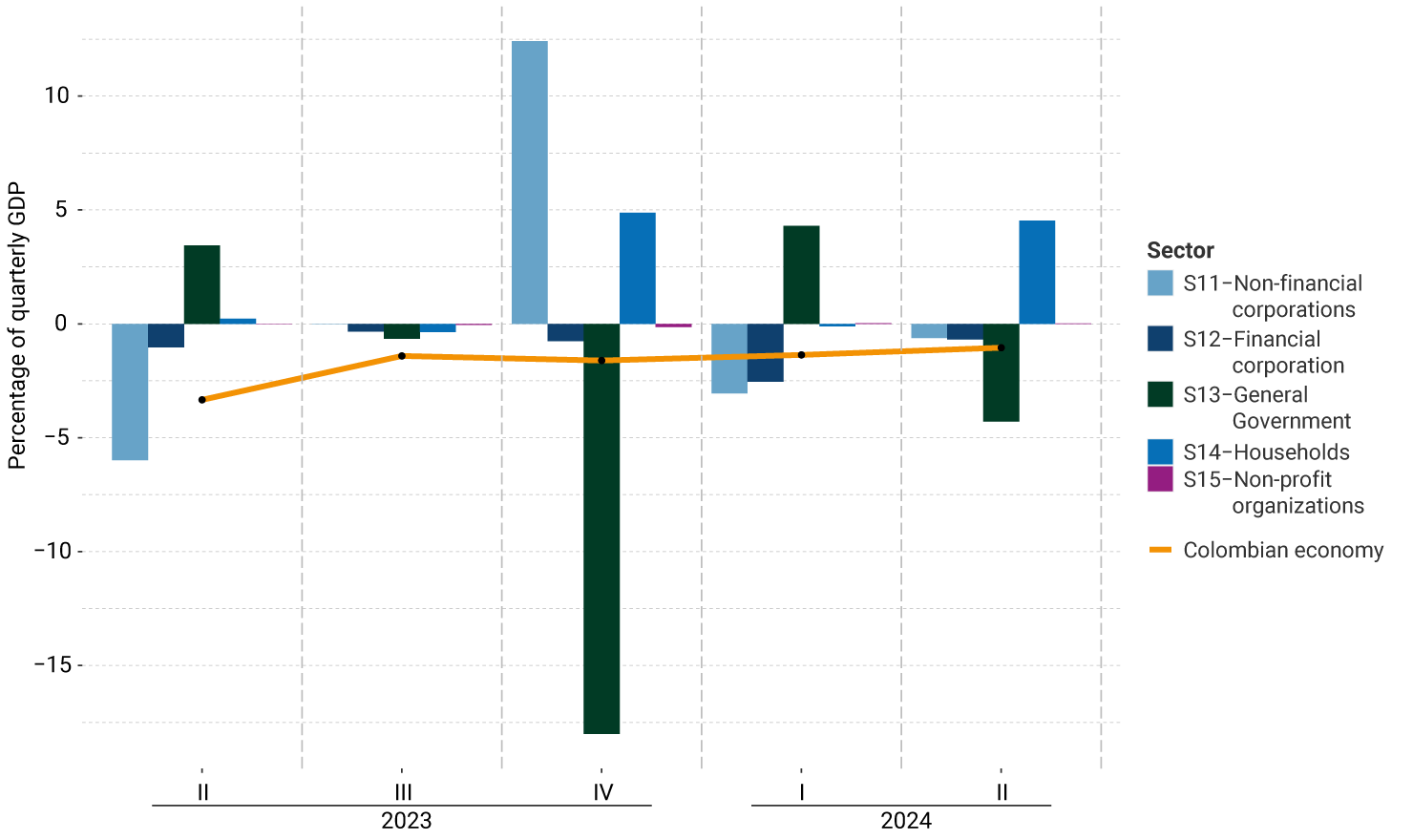

According to the financial accounts calculated by Banco de la República (the Central Bank of Colombia, Banrep), in the second quarter of 2024, the current account deficit of the Colombian economy reached 1.0% of quarterly Gross Domestic Product (GDP), compared to 3.3% in the same period of 2023. This is primarily explained by the deficits of the General Government (4.3%) and non-financial corporations (0.7%).

Graph 1. Current Account Deficit of the Colombian Economy and Saving-Investment Balances by Institutional Sector, Q2 2023 – Q2 2024

Source: Banco de la República - Financial Accounts

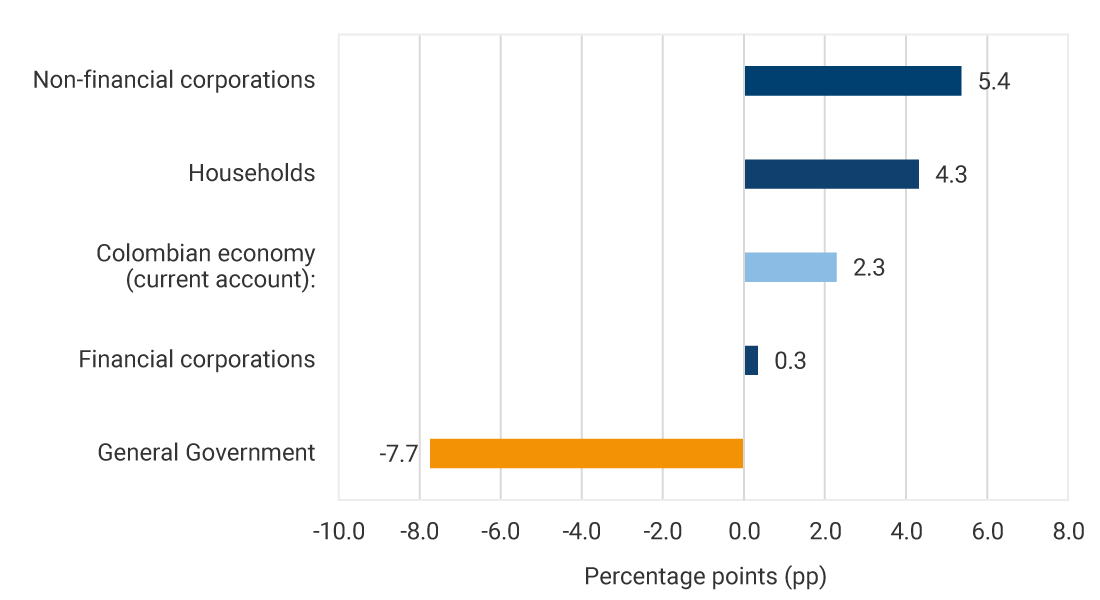

Compared to the second quarter of 2023, internal and external financing needs decreased by 2.3 pp. This was mainly explained by the lower net financing needs of non-financial corporations (5.4 pp) and households (4.3 pp). These changes were partially offset by an increase in the General Government's net financing needs (7.7pp).

Graph 2. Explanation of the Change in the Colombian Economy's Saving-Investment Balance by Institutional Sectors, Q2 2023 – Q2 2024

Source: Banco de la República - Financial Accounts

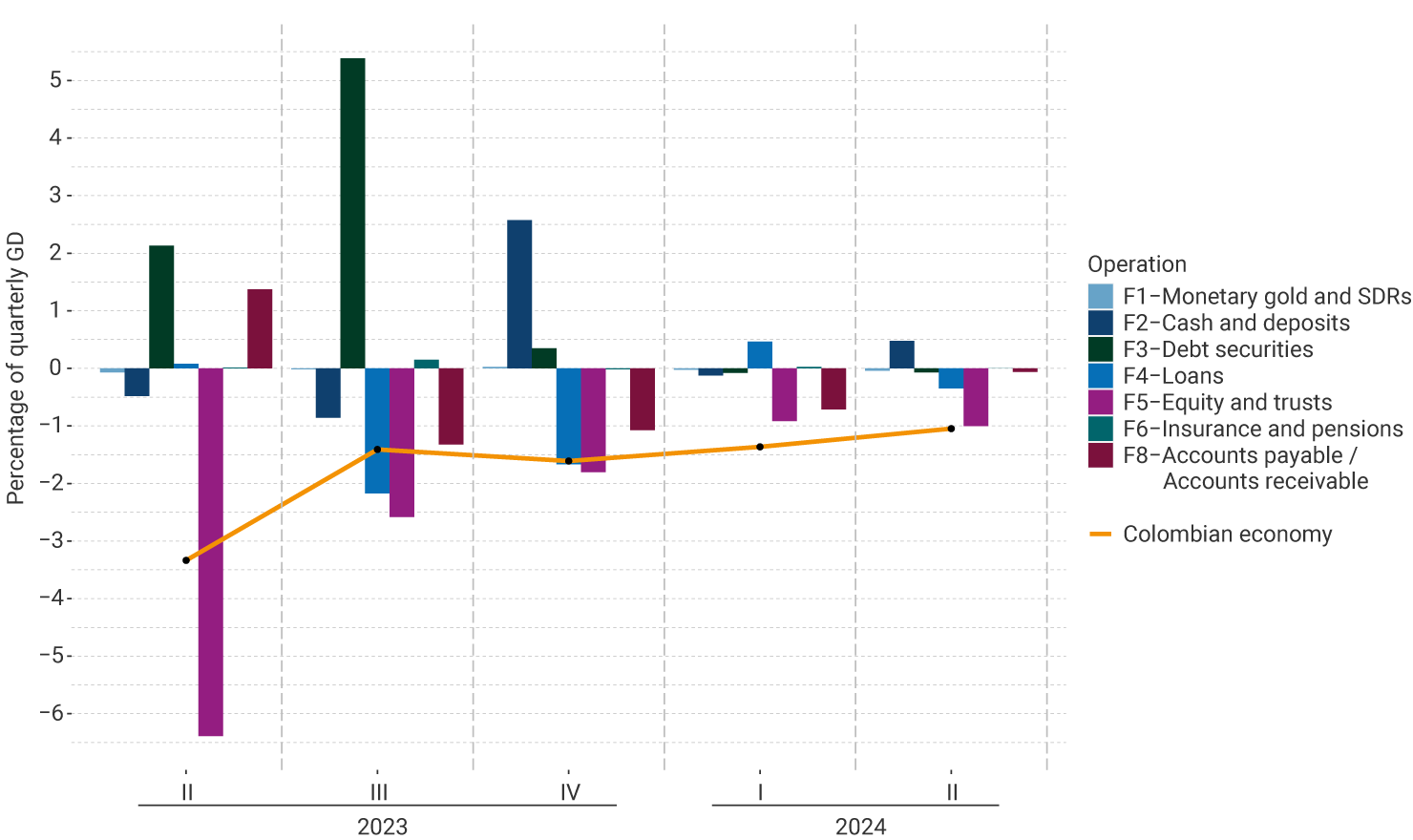

2. By financial instrument / Net external financing

The negative quarterly saving-investment balance of the Colombian economy was covered by net external financing flows equivalent to 1.0% of quarterly GDP. Net inflows of financial resources from the rest of the world were mainly channeled through foreign direct investment and other equity investments (F5) of 1.0% and through loans (F4) from the rest of the world of 0.3%. This was offset by a net increase in foreign deposits (F2) of 0.5% of quarterly GDP.

Graph 3. Net External Financing of Colombia's Saving-Investment Balance by Financial Instrument, Q2 2023 – Q2 2024

Source: Banco de la República - Financial Accounts

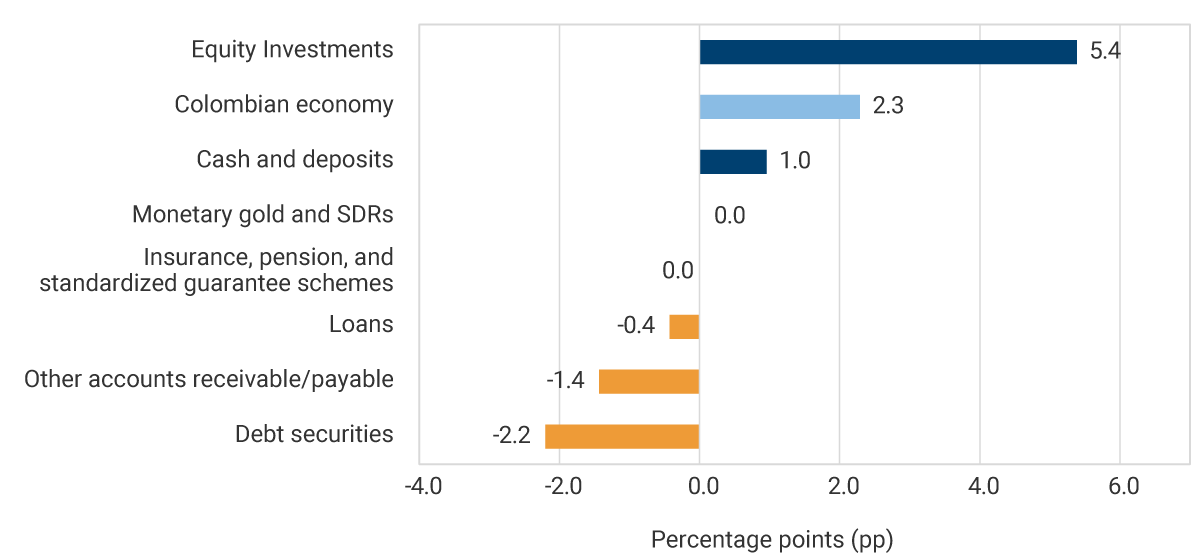

Compared to the second quarter of 2023, the decrease in external financing flows of 2.3 pp was mainly explained by lower foreign direct investment and other equity (F5) by 5.4 pp. This was partially offset by the lower external acquisition of debt securities (F3) by 2.2 pp and an increase in external financing through accounts payable (F8) by 1.4 pp.

Graph 4. Explanation of the Change in the Financing Needs of the Colombian Economy by Financial Instrument, Q2 2023 – Q2 2024

Source: Banco de la República - Financial Accounts

Financial Account Balances for the Second Quarter of 2024

1. Net Financial Position by Institutional Sector

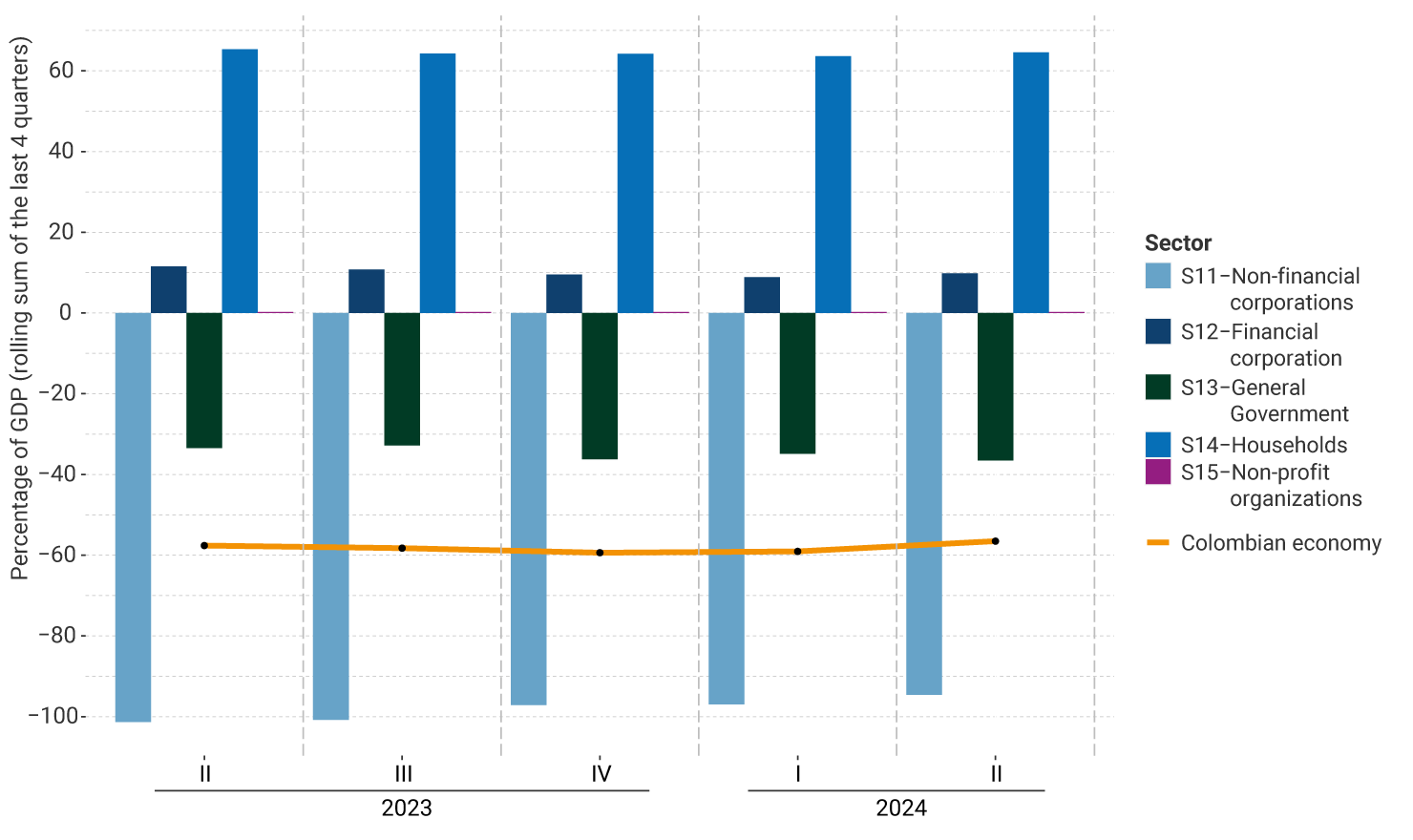

At the end of the second quarter of 2024, the Colombian economy recorded a net debtor position with the rest of the world equivalent to -56.5% of annual GDP. This is explained by the net debtor position of non-financial corporations (-94.6%) and the General Government (-36.6%). This was partially offset by the net creditor positions of households (64.6%) and financial corporations (9.8%).

Compared to the second quarter of 2023, there was a 1.1 pp reduction in the external debtor position of the economy, explained by a reduction in the net debtor position of non-financial corporations (6.8 pp). These changes were partially offset by an increase in the net debtor position of the General Government (3.1 pp) and a decrease in the net creditor position of financial corporations (1.7 pp).

Graph 5. Colombia's Net Financial Position by Institutional Sector, Q2 2023 – Q2 2024 (percentage of annual nominal GDP *)

* Corresponds to the rolling sum of quarterly GDP for the last 4 periods

Source: Banco de la República - Financial Accounts

2. Net External Position by Financial Instrument

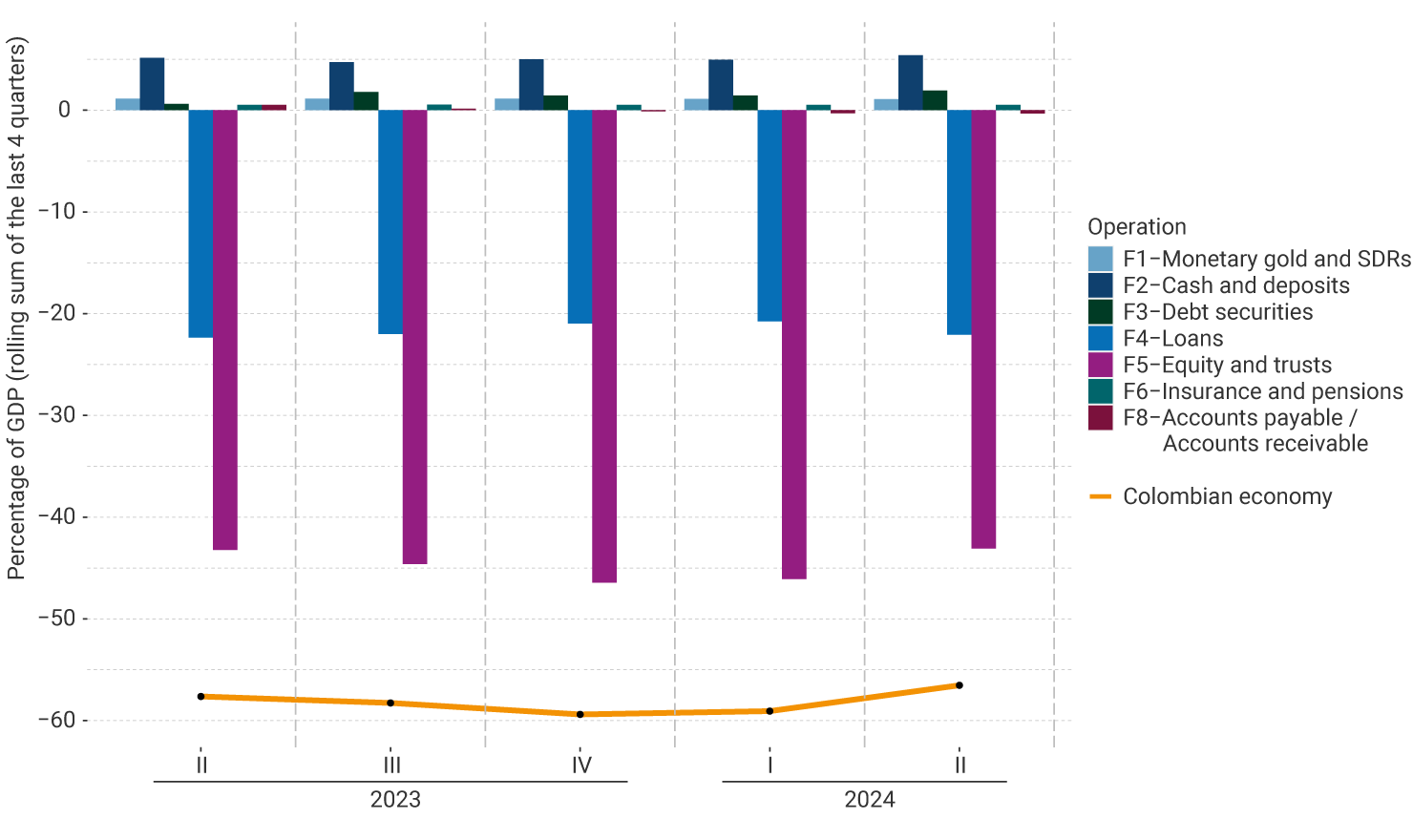

At the end of the second quarter of 2024, the net debtor position of the Colombian economy with the rest of the world, equivalent to -56.5%, was mainly represented by equity (F5) of -43.1% and loans (F4) of -22.1% of annual GDP. This was partially offset by Colombians' foreign holdings of cash and deposits (F2) and debt securities (F3) of 5.4% and 1.9%, respectively.

Compared to the second quarter of 2023, the reduction in the economy's net debtor position of 1.1 pp was mainly due to higher foreign investment in debt securities by 1.3 pp, accompanied by greater holdings of deposits abroad of 0.3 pp. This variation was offset by a higher level of debt through accounts payable (F8) by 0.8 pp.

Graph 6. Net External Financial Position of the Colombian Economy by Financial Instrument, Q2 2023 - Q2 2024 (percentage of annual nominal GDP *)

* Corresponds to the rolling sum of quarterly GDP for the last 4 periods

Source: Banco de la República - Financial Accounts