A paper recently published in the Working Papers on Economics, number 1267, analyzes some aspects of economic and financial education in Colombia using a survey that follows the methodology known as the “Big Three.” This methodology was developed by experts Annamaria Lusardi and Olivia Mitchell in 2004. The method was first applied in a study on health and retirement in the United States. Since then, it has been replicated in several countries around the world and has been used to diagnose and make international comparisons on the levels of economic and financial education of different populations. The first two questions in the set address compound interest and inflation, while the last question assesses knowledge about risk diversification in investment decision-making. The questions are known for being simple, brief, and concise and do not require familiarity with mathematics from the respondents. Additionally, no prior definitions of the concepts included in them are necessary to answer the questions.

The data for Colombia was obtained from a perception and knowledge survey of Banco de la República (the Central Bank of Colombia). Its most recent version was conducted between 11 May and 1 June 2023. This survey was applied to a representative sample of the adult population, as has been done in other countries. In addition to the questions necessary to diagnose the economic and financial education levels , it is possible to establish relationships between the level of financial knowledge and variables such as consumption, investment, and inflation expectations by way of the answers to other questions in the same survey.

The three questions on financial knowledge formulated in the Lusardi and Mitchell (2011) study and adapted for the Colombian case in the survey were as follows:

- (On interest rate)

Suppose you have 100 Colombian pesos in a savings account with a 2.0% annual interest rate. How much money would you have after five years without touching this account?- More than 102 Colombian pesos*

- Exactly 102 Colombian pesos

- Less than 102 Colombian pesos

- Doesn't know/Does not answer

- (On inflation)

Imagine that the interest rate on your savings account was 1.0% annually, and inflation was 2.0% annually. After a year, how much could you buy with the money in this account?- More than today

- Exactly the same as today

- Less than today*

- Doesn't know/Does not answer

- (On risk diversification)

State whether this statement is true or false: "The purchase of a single company's stocks generally provides a safer return than an equity mutual fund."- True

- False*

- Doesn't know/Does not answer

* Correct answer

Some outstanding results

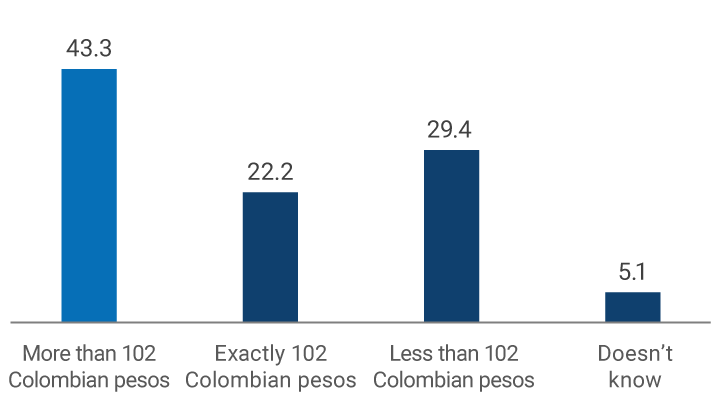

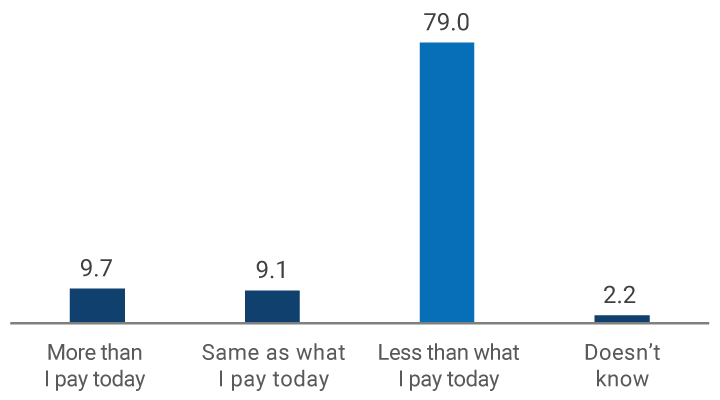

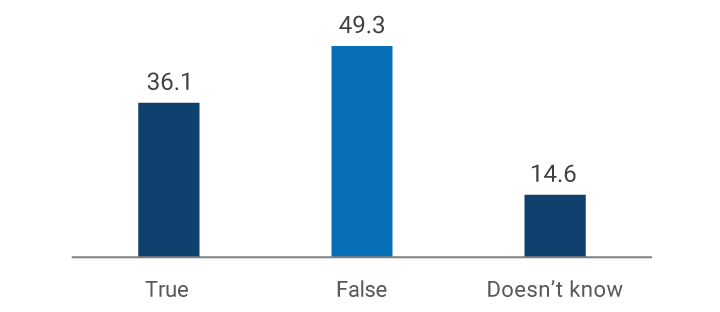

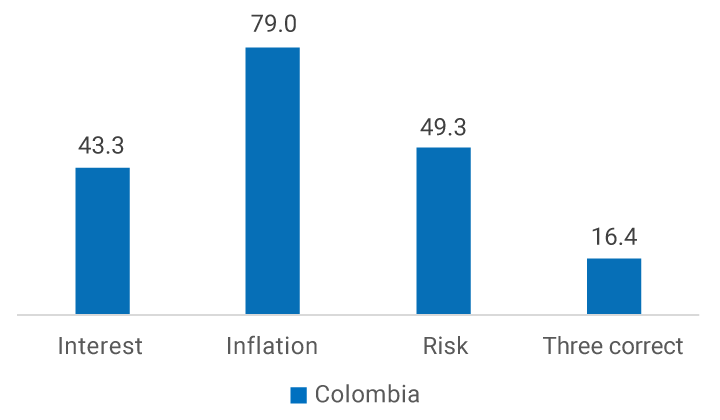

A high percentage of respondents chose the correct answer to each question (Graph 1). However, less than half of the population answered the interest rate question correctly (43.3%), and close to half answered the question related to risk diversification (49.3%) correctly. On the contrary, Colombians' knowledge of the concept of inflation stands out with a high percentage of correct answers (79%), which is even higher than in several developed countries.

Graph 1. Individual Answers - The Big Three

A. Interest Rate

B. Inflation

C. Risk diversification

Source: Invamer survey (2023)

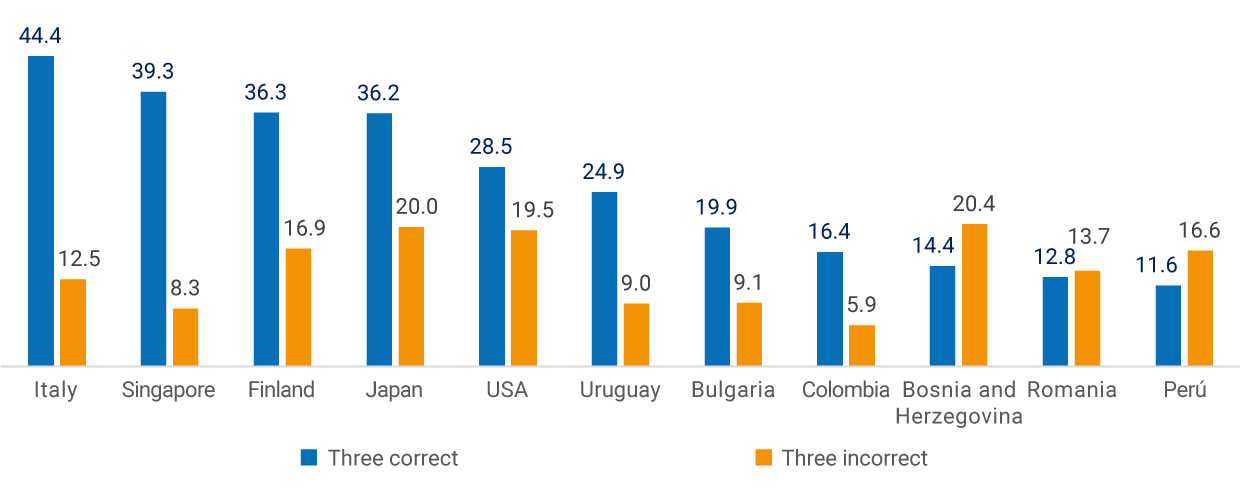

Graph 2 exhibits the fractions of respondents who answered correctly (blue) and incorrectly (orange) the three questions in various countries, including Colombia1. There seem to be significant differences: for example, only 16.4% of the Colombian population can answer the three key questions correctly, above Bosnia-Herzegovina (14.4%), Romania (12.8%), and Perú (11.6%), but below countries such as Italy (44.4%), Singapore (39.3%), Finland (36.3%), and Japan (36.2%). In turn, Colombia had the lowest level of combined incorrect answers (5.9%), followed by Singapore (8.3%), Uruguay (9.0%), and Bulgaria (9.1%). The case of developed countries such as Japan (20.0 %) and the United States (19.5%) is surprising since almost one-fifth of the respondents answered some of the financial knowledge questions incorrectly.

Graph 2. Three Correct and Incorrect Answers by Country

Sources: Banco de la República (2024) and surveys conducted by country, available in the Journal Financial Literacy and Wellbeing.

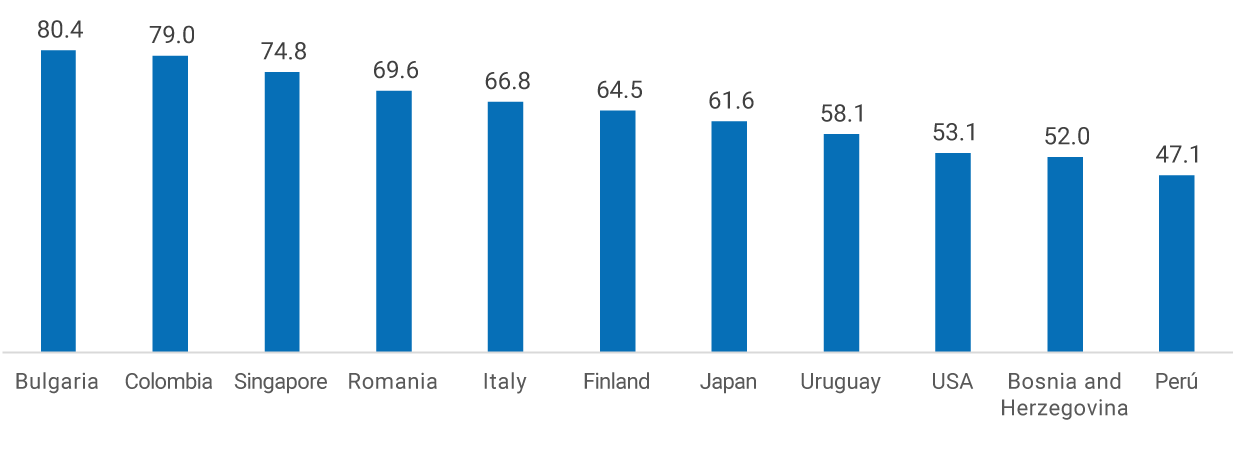

Regarding the question on inflation (Graph 3), this concept is well known in Colombia, as 79% of the respondents answered it correctly. Compared to other countries where similar surveys have been conducted, this percentage was higher only in Bulgaria (80.4%). However, countries such as the United States (53.1%), Singapore (74.8%), Romania (69.6%), Italy (66.8%), Finland (64.5%), Japan (61.6%), Uruguay (58.1%), Bosnia-Herzegovina (52.0%), and Perú (47.1%) recorded lower results than Colombia. Conclusions from these comparisons must be taken with caution because not all surveys were conducted in equal environments. However, they shed some light on where the smallest and largest knowledge gaps in financial education in Colombia are.

Graph 3. Answers on Inflation by Country

Sources: Banco de la República (2024) and surveys conducted by country, available in the Journal Financial Literacy and Wellbeing.

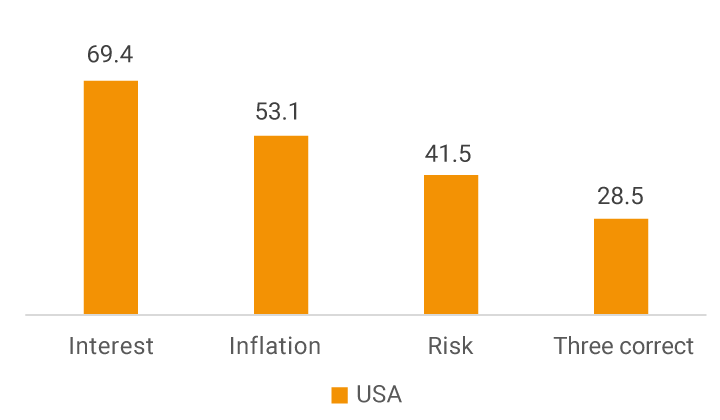

Graph 4 shows the results of the surveys conducted in the United States and Colombia, although one must be cautious in the comparisons because of what has already been noted2. In the case of the USA, their highest knowledge is on interest rates (69.4%), followed by inflation (53.1%) and risk diversification (41.5%). Compared to the results for Colombia, we see that the concept of inflation is the one most widely known (79%). It is curious, however, that Colombia obtained a better result in the question about risk diversification (49.3%) than the US. Regarding interest rates, the percentage of correct answers in Colombia (43.3%) is lower than in the United States, as expected, partly due to lower financial education and less exposure to financial credit products.

Graph 4. Percentage of Correct Answers per Question

A. Colombia

B. USA

Sources: Banco de la República (2024) and National Financial Capability Study (2021).

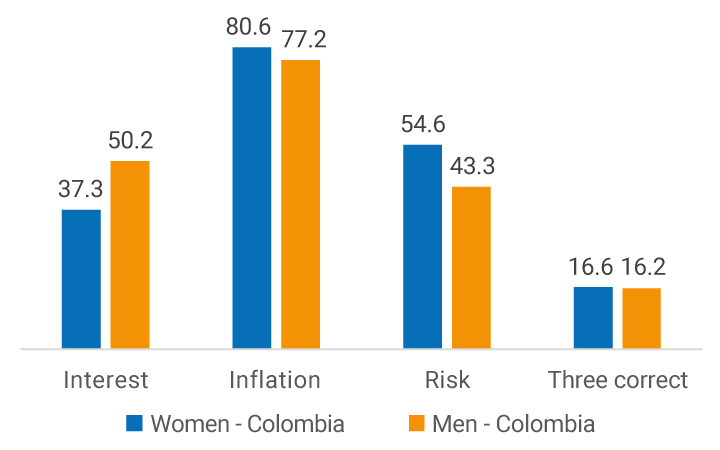

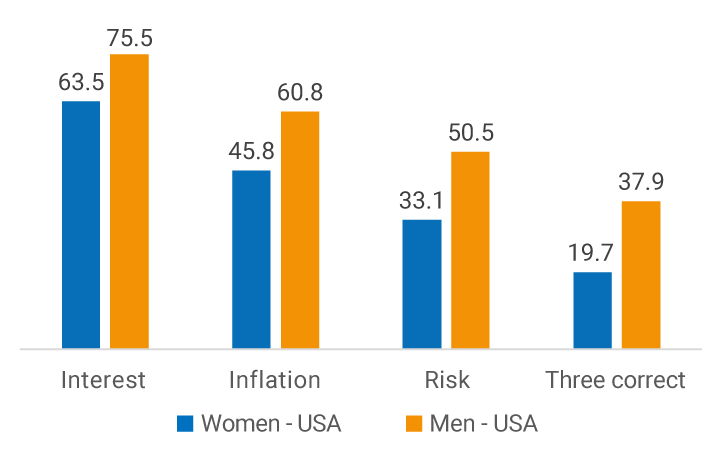

It is also possible to analyze the results by gender in each of the surveys. This information can be helpful in designing public policies and financial education programs that contribute to closing gender gaps that often significantly impact saving-for-old-age behavior. Graph 5A shows that the interest rate concept in Colombia is more familiar to men than to women, while in the other two questions (inflation and risk diversification), women are more knowledgeable than men. In turn, in the United States (Graph 5B), the percentage of men who answered each and every question correctly is higher than that of women.

Graph 5. Correct Answers by Gender

A. Colombia

B. USA

Sources: Banco de la República (2024) and National Financial Capability Study (2021).

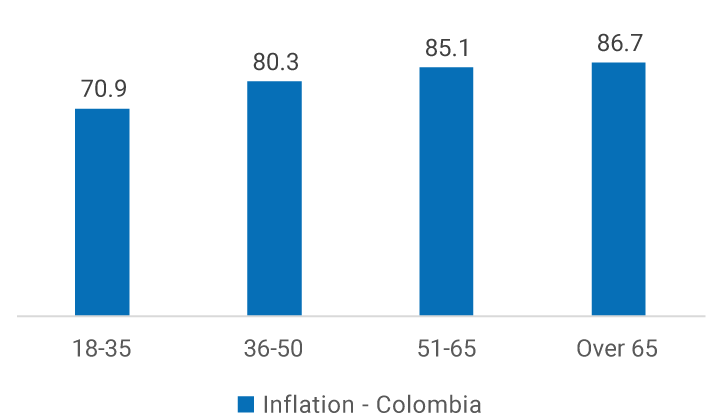

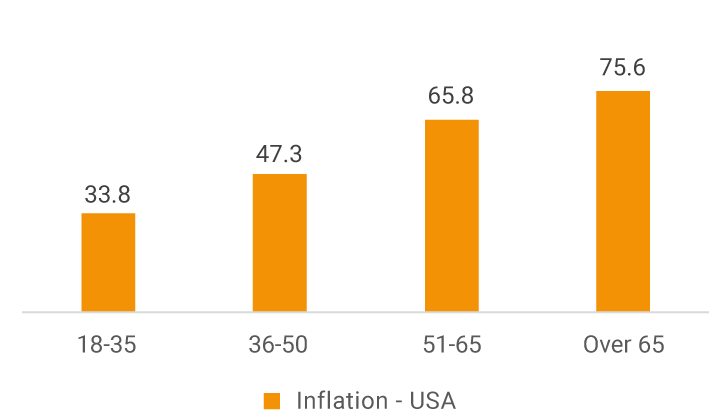

Regarding the analysis by age range (Graph 6), it is found that in both the United States and Colombia, knowledge of the concept of inflation increases as age increases, which can be explained by the greater exposure that individuals have throughout their lives to this economic phenomenon.

Graph 6. Correct Answers on Inflation by Age Range

A. Colombia

B. USA

Sources: Banco de la República (2024) and National Financial Capability Study (2021).

These results shed some light on Colombians’ economic and financial knowledge. A better understanding of these topics can improve the efficiency of monetary policy communication. If people's economic and financial education levels are not sufficiently high, the impact of monetary policy may be hindered by an inadequate education on price expectations by economic agents. The economic and financial education programs designed by central banks for children, young people, and general public seek to improve this knowledge among citizens and complement monetary policy communication by using simple and everyday language that most of the population can understand.

1 ↑ All surveys in the different countries were conducted using nationally representative samples of the population over 18 years of age from all socioeconomic levels. These surveys were all implemented after the pandemic, between late 2021 and mid-2023, so their interpretation must consider the various contexts. For example, in the United States, it was applied at the end of 2021, and one in five respondents reported having been fired or suspended from their jobs between 2020 and 2021. In the case of Colombia, the survey was applied in the context of unusually high inflation in the last 20 years.

2 ↑ For example, the sample in the United States was 27 times larger than in Colombia and included all states. The survey was longitudinal, applied via the Internet, and incentives for participation were offered.