The Colombian tax system contains multiple reliefs and discounts and simultaneously supports a high degree of evasion. This implies that the statutory or nominal rates established by the law are an imprecise indicator of the actual tax burden on taxpayers, whether they are consumers, individuals, or legal entities. Such tax benefits--or “fiscal expenditure” are introduced into the system through exclusions, exemptions, deductions, special treatments, and discounts. To better understand the magnitude of these taxes, it is necessary to calculate the effective tax rates understood for each type of tax as the ratio between the collection generated by that tax and its potential taxable base. Such a quantification was done by senior economists Hernán Rincón and Martha Elena Delgado (2017) and Hernán Rincón (2021) published by Fedesarrollo and Banco de la República (the Central Bank of Colombia), respectively, based on the National Accounts, which include all national and territorial taxes.

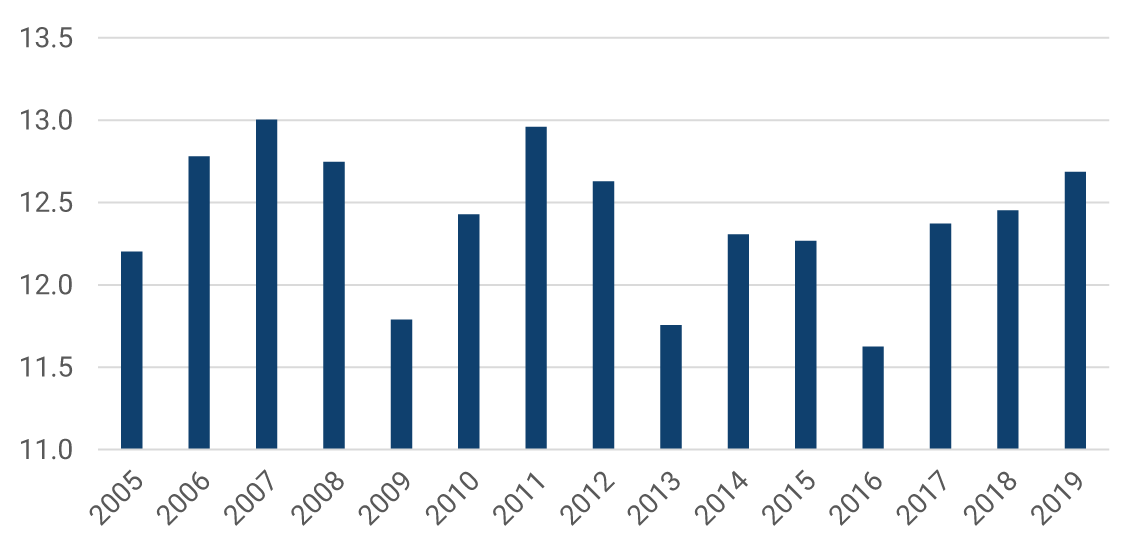

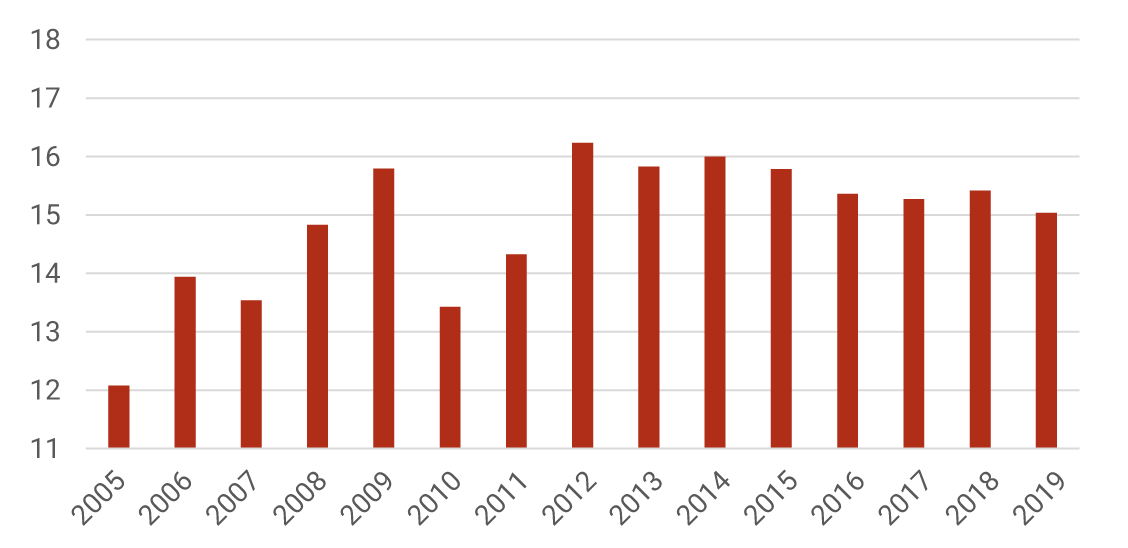

In 2019, for example, the general statutory rate on consumption was 19%, while its average effective rate was 12.7%. Regarding wages, the average nominal rate was 11%, while the average effective rate was only 2.3%. If the other tax costs of hiring labor, such as payroll and social security contributions, are added to the effective rate on wages, the effective burden increases to 18%. The statutory rate on the profits of companies was 33%, while the effective rate was 21.1%. The weighted sum of the average effective rates on the profits of the companies and those of their owners, i.e., the rate on the profits of their capital, was 15%.

The differences between the levels of the statutory and effective rates are due to the combination of the tax benefit scheme mentioned above with evasion and avoidance. According to calculations by the Comisión de Expertos en Beneficios Tributarios (Commission of Experts on Tax Benefits) (2021)1, tax benefits in Colombia amounted to COP 69.1 trillion (6.5% of GDP) in 2019, divided between COP 51.6 trillion (4.9% of GDP) in VAT and COP 17.1 trillion (1.6% of GDP) in the income of legal entities. On the other hand, VAT evasion amounted to COP 20.7 trillion (1.9% of GDP), and the income of legal entities to COP 21.6 trillion (2.0% of GDP). The value of tax benefits, the evasion of other national and territorial taxes, and the cost of tax avoidance should be added to the above estimates.

Effective tax rates provide valuable information for tax and macroeconomic policy. They show that using statutory rates to measure the actual tax burden has severe limitations. They also make visible how much taxes actually affect consumption and the cost of factors of production, labor, and capital. In addition, they reveal the importance of tax benefits, avoidance, and evasion in the drain of tax collection. Therefore, effective rates are essential in making tax and macroeconomic policy decisions.

Graph 1 exhibits the evolution of the average effective tax rates on consumption and production, labor, and capital factors between 2005 and 2019. The breakdown of the tax burden on labor shows that the tax burden on wages is 2.3%, payroll 2.7%, and social security 13%. The latter is undoubtedly the most significant burden on the labor factor. On the other hand, the tax rate on business capital is 21.1%, while the tax rate on household capital, who own the companies, is only 3.8%.

Graph 1. Evolution of Average Effective Tax Rates

Consumption (percentage)

Labor (percentage)

Capital (percentage)

Source: Rincón-Castro (2021).

On this basis, Table 1 reports the average effective rates of consumption, labor, and capital and the percentage shares of each of their components in their respective rate for 2019. Concerning the labor rate, wage share was 12.5%, payroll 15.3%, and social security 72.2%. This suggests that social security contributions for pension, health, occupational hazards, and some insurance are the most relevant tax burdens on the labor factor. In addition, payroll contributions, such as the National Training Service (SENA in Spanish), the Colombian Institute for Family Welfare (ICBF in Spanish), and family compensation funds significantly increase hiring labor costs.

Regarding the tax on capital, Table 1 exhibits that the tax on the profits of company owners contributes 9.0%, while the tax on the profits of companies contributes 91%. This highlights a clear disparity between companies' and owners' taxation efforts.

Table 1. Effective Rates on Consumption, Labor, and Capital, and Shares of their Components for 2019

| Effective rates | ||

|---|---|---|

| Percentage shares of the effective labor rate | ||

| Consumption | Job | Capital |

| 12.7 | 18.0 | 15.0 |

| Wages | Payroll | Social Security |

| 12.5 | 15.3 | 72.2 |

| Percentage shares of the effective capital rate | |

|---|---|

Owners | Companies |

| 8.9 | 91.1 |

In summary, national and territorial taxes in Colombia are not as high as the statutory rates would suggest, nor are they distributed equitably. The burden on the labor factor is relatively higher than on the capital factor of the companies and their owners. Taxation of wages is relatively lower than the tax costs of hiring labor. Finally, the profits of companies are taxed considerably more than those of their owners.

1 Commission of Experts on Tax Benefits (2021): https://www.dian.gov.co/dian/Documents/Informe-Comite-Expertos-DIAN-OCDE2021.pdf