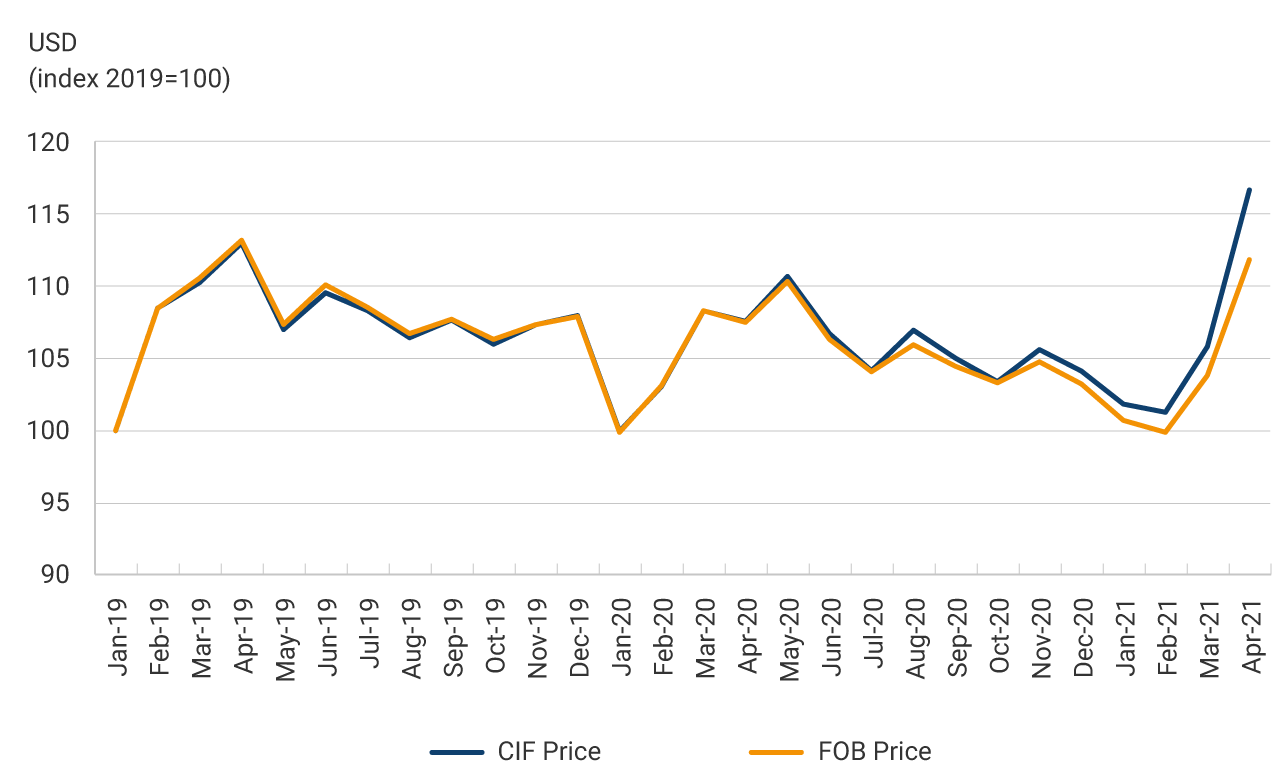

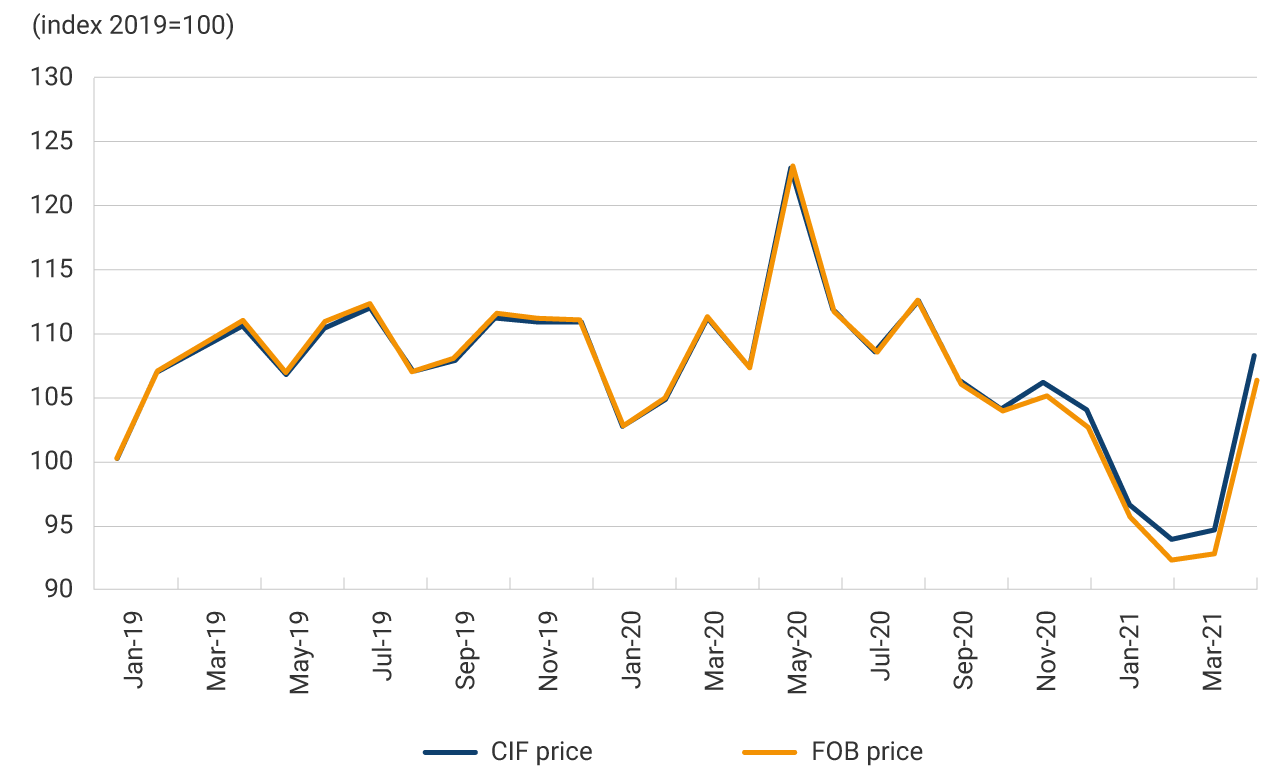

A box in the most recent Monetary Policy Report of Banco de la República (the Central Bank of Colombia)(only in Spanish) analyzes the recent increase in Colombian import prices, which is illustrated in Graph 1. The graph exhibits dollar price indexes of Colombian imports in FOB (Free on Board) and CIF (Cost, Insurance, and Freight) values from January 2019 to April 2021. FOB values correspond to import prices at the port of origin, while CIF values additionally incorporate insurance and transportation costs from the port of origin to the Colombian port.

The CIF import price index increased 8.6% between April and December 2020, and through April of this year, it had a further increase of 12%. As a result, the gap between CIF and FOB prices widened significantly, as exhibited in Graph 1. This trend has been driven by the significant increase in international transportation costs caused by global supply and demand forces affecting supply chains worldwide, including Colombia.

(USD, base 2019)

On the demand side, the increase in international trade due to higher consumption of goods has contributed to the capacity of global logistics chains. The recovery of the global economy, the change in consumption patterns, the fiscal stimulus, and the demand contained by the quarantine in large economies are some of the factors that explain the increase in demand for goods. On the supply side, the pandemic has meant persistent constraints on productive capacity in various regions of the world and has affected global freight logistics. The transportation cost index implied in Graph 1 increased more than 135% between January and April 2021, which is also similar to the increase in overall transportation cost indexes.

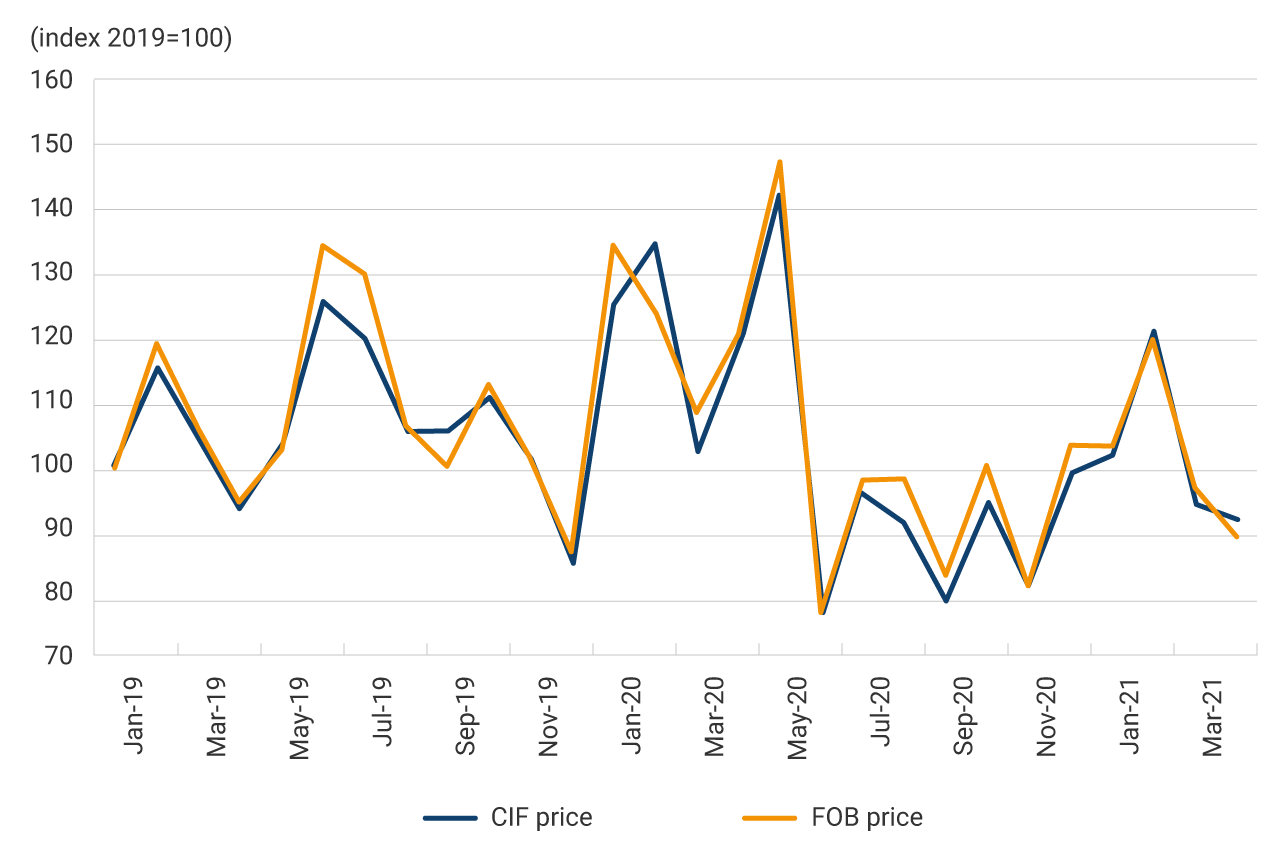

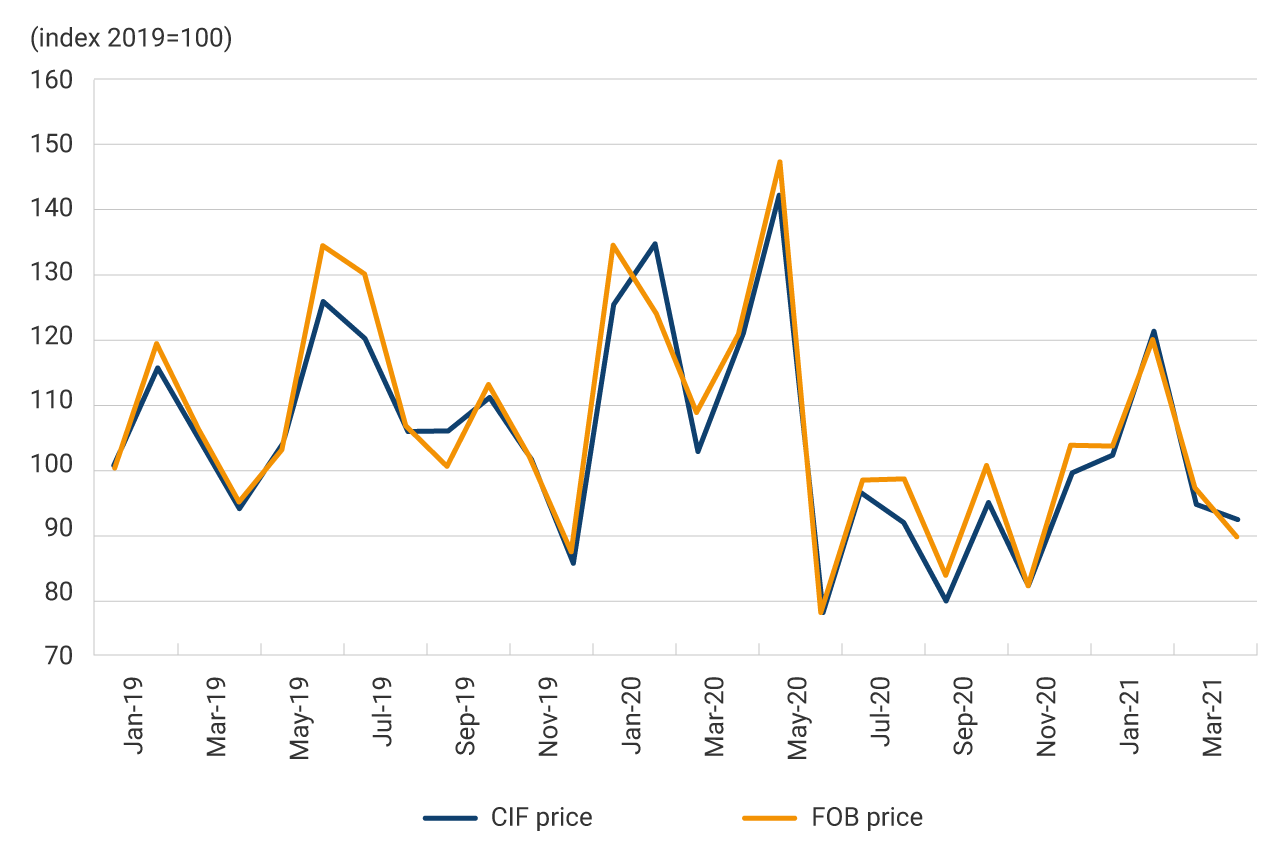

The increase in import prices has been clearer in the case of intermediate goods. As shown in Graph 2, the US dollar price indexes for imports of consumer goods and capital goods exhibit increases in 2021; however, these are comparable with price fluctuations observed in recent years. In contrast, the noticeable increase in the price index for imports of intermediate goods has brought it to levels above those observed since 2019. It is also noted that logistics costs, given by the difference between CIF and FOB values, have increased disproportionately in the case of intermediate goods.

Graph 2: Import Price Indexes by Type of Product

(USD, base 2019)

Although a substantial part of intermediate goods imports corresponds to gasoline, whose final price is regulated, a detailed analysis of the data at the product level reveals that the price increase is spread throughout the import basket. Particularly, imported intermediate goods for industry and agriculture have shown price increases in 2021 that had not been seen in recent years.

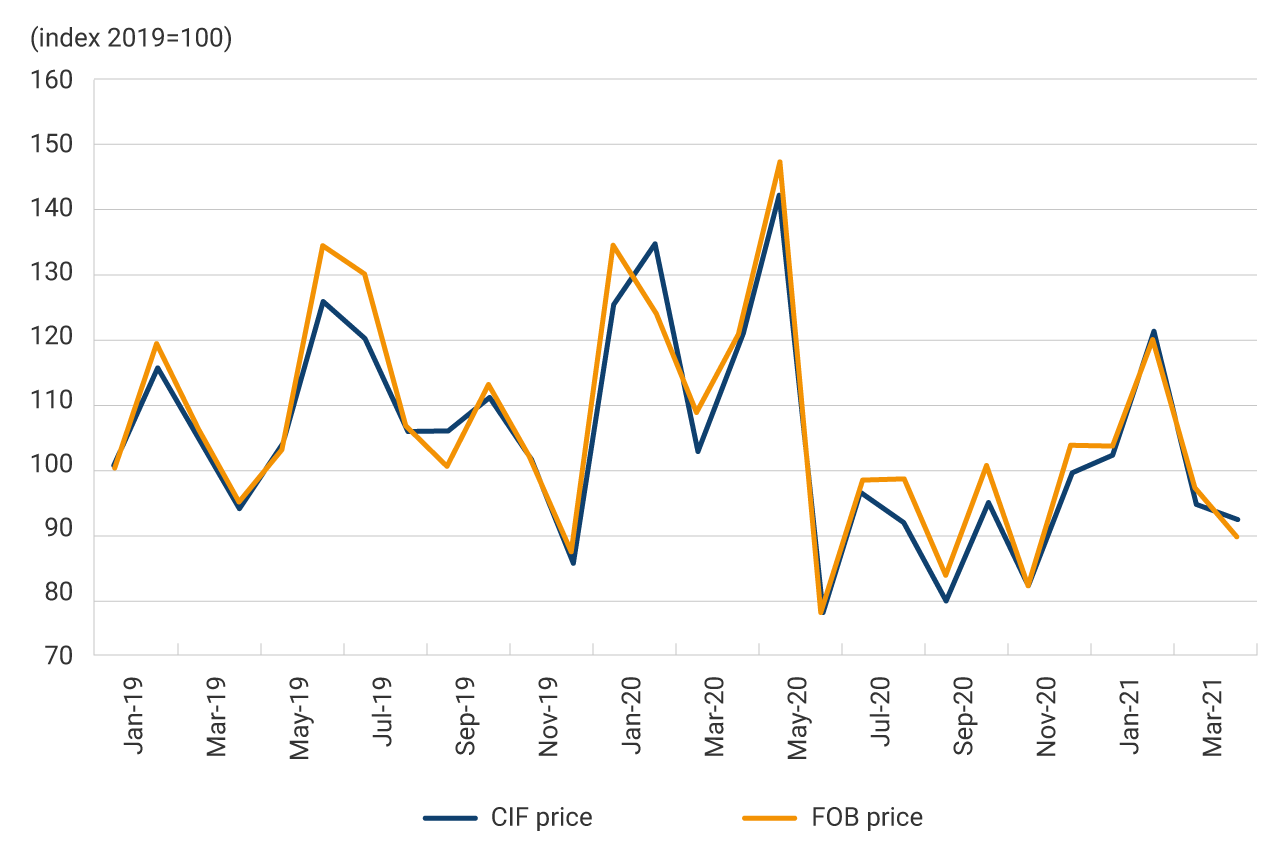

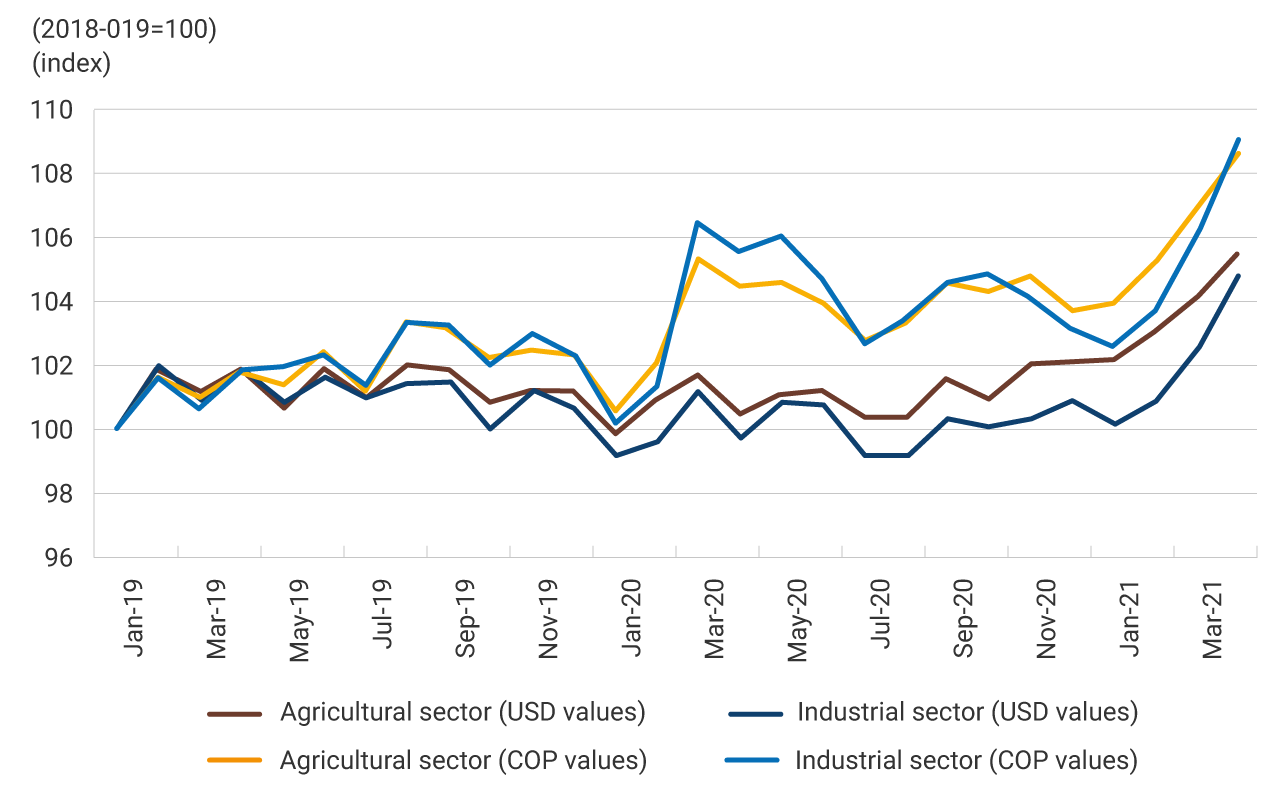

To give an idea of the impact of these price increases on domestic value chains, a cost index for industry and agriculture was calculated based on the cost structure of the 2018 national accounts and the composition of imports by sector in 20191. The results of these calculations are exhibited in Graph 3.

As can be seen, the cost indexes in pesos (COP) for industry and agriculture exhibit an increase in 2020 and a further increase in 2021. The cost indexes in dollars (USD) remained relatively constant throughout 2020 but increased in 2021. This suggests that the increase in costs in pesos in 2021 is largely explained by increases in dollar prices.

(base 2018 and 2019)

Expectations on the evolution of these costs in the coming months depend on the expected evolution of global supply and the demand factors mentioned above. On the one hand, there is still uncertainty regarding the evolution of the pandemic and its impact on the performance of global supply and demand for goods. In addition, the capacity of the productive system and global trade chains to adjust to the temporary and permanent shocks experienced by the global economy is still uncertain.

1 The calculation assumes that everything remains constant except import costs, and is made using the import price index in dollars or pesos (based on the representative exchange rate of each period).