High-altitude climbers know very well that the descent from the top can be as dangerous as the ascent, so they advance cautiously in this second stage of the journey to ensure a healthy return home. Something similar could be said of monetary policy. Risks do not disappear in the decline period of the interest rate. Therefore, just as in the mountains, the downward cycle of the policy rate should be carried out cautiously so as not to frustrate the return of inflation to its target.

Similarly, during its increases, cuts in the policy interest rate require a detailed assessment of the performance of inflation and its expectations, economic growth, and other key variables affecting macroeconomic stability. This analysis is carried out regularly by Banco de la República’s (the Central Bank of Colombia) technical staff and is published quarterly in the Monetary Policy Report. In addition, the Board of Directors' Report to Congress presented at the beginning of March included a broad analysis of the Colombian economy in 2023 and its outlook for 2024.

These documents allow to understand the main reasons that led the Board of Directors of Banco de la República to initiate the cycle of policy rate reductions. This decision took the form of 25-basis points (bps) cuts at each of the Board's December and January sessions and of 50 bps in its March session. As a result, the policy rate fell from 13.25% in November to 12.25% at the end of March 2024, as part of a process of monetary policy easing that the Board Members believe could continue.

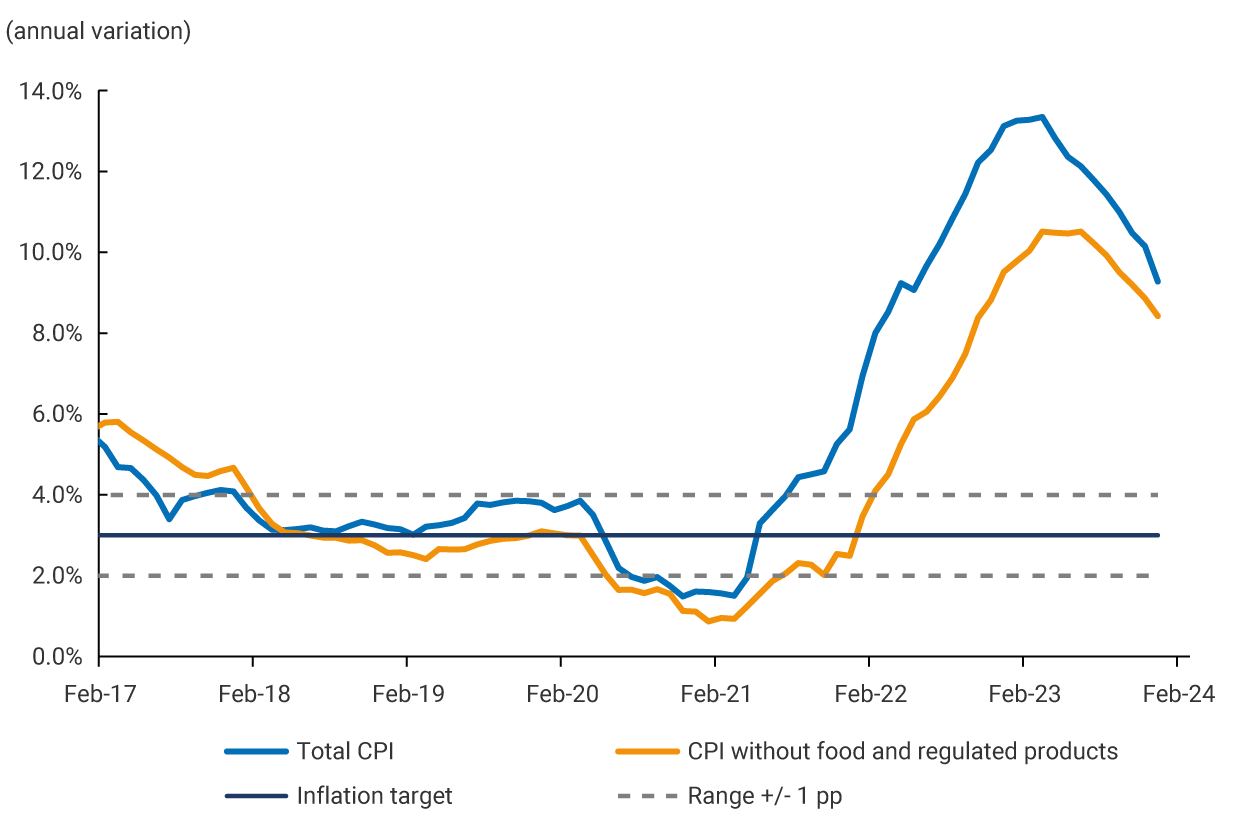

Graph 1. Headline Inflation and Non-Food and Regulated Inflation

Source: National Administrative Department of Statistics (DANE) and Banco de la República

The first thing that influenced this decision was the decline in headline inflation as of the second quarter of 2023 (Graph 1). After inflation reached an annual peak of 13.3% in March 2023, it went on a downward path that continued uninterrupted for the rest of the year. Thus, at the end of 2023, the annual inflation rate in Colombia was 9.3%, returning to single-digit territory after 17 months of remaining above 10%. This trend was accentuated in January and February 2024, with annual inflation rates of 8.4% and 7.7%, respectively. The recent decline in inflation reveals the effectiveness of the previous monetary policy, which usually shows a significant lag in price performance. This effectiveness was observed despite the fact that--for good reasons related to the need to reduce the fiscal deficit-the Government authorized gasoline price increases that were consistent with the policy of bringing this price to the international parity level . Graph 1 also exhibits core inflation, measured as the CPI excluding food and regulated products, which, after reaching an annual peak of 10.5% in June, dropped consecutively to an annual 7.3% in February 2024. Within this sub-group , inflation in the goods group has exhibited greater downward flexibility than that of services. The former decreased from 14.3% to 4.3% per annum between June 2023 and February 2024, while the latter went from 9.0% to 8.5% in the same period. The rigidity of inflation in services is due to the fact that their prices tend to adjust in line with observed inflation and wage increases, as is the case of the items mentioned above.

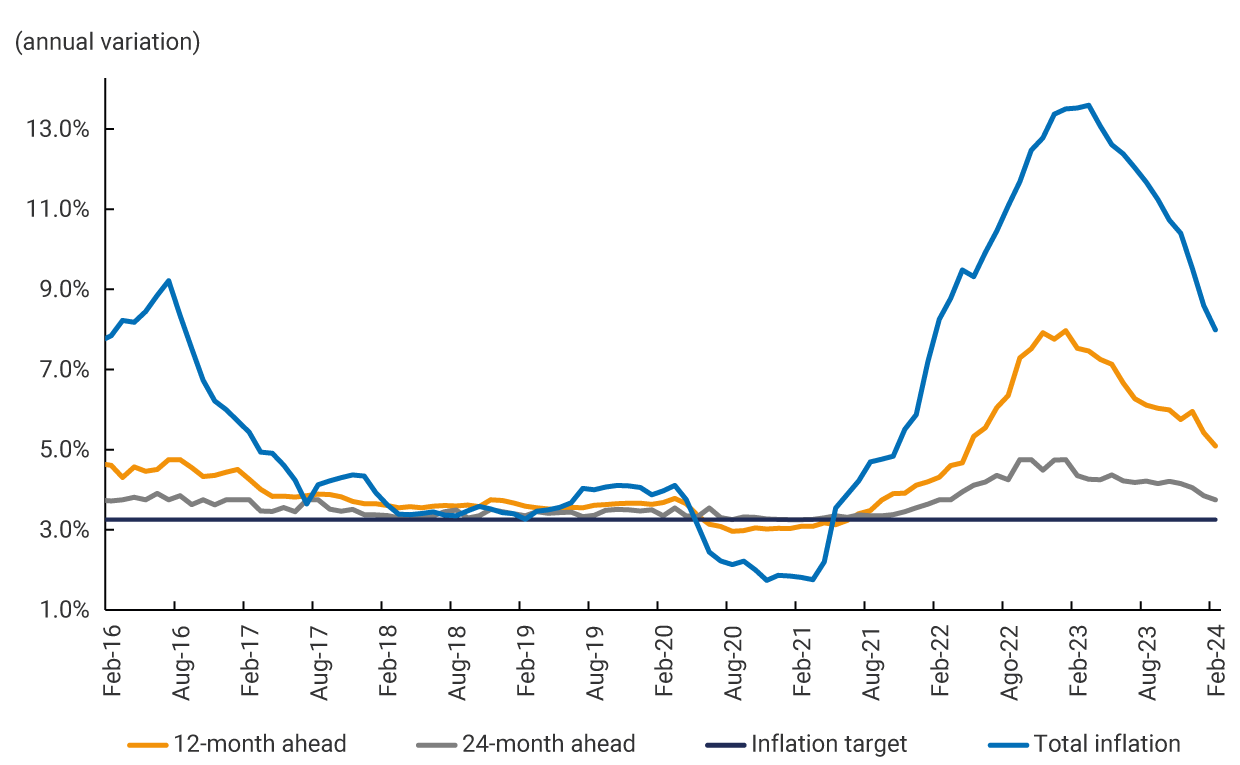

Graph 2. Inflation, Target Inflation, and Expectations

Source: DANE and Banco de la República

* The information corresponds to the median of the Monthly Survey of Economic Analyst Expectations (EME in Spanish), with data as of February 2024.

A second variable influencing the monetary authority's recent decision is the performance of inflation expectations. Graph 2 exhibits the evolution of inflation expectations at different terms obtained from the EME (only available in Spanish) conducted by Banco de la República. As can be seen, for a 24-month term, they are less volatile and closer to the inflation target. This suggests that economic analysts remain confident that inflation will converge to the target in the medium term. However, in the shorter term, these expectations are strongly affected by the performance of observed inflation. Hence the pertinence of the decline in headline inflation described above, because it induced a significant decrease in short-term inflation expectations. This reduction in expected inflation will promote convergence of inflation to the target, which opens a space to ease monetary policy.

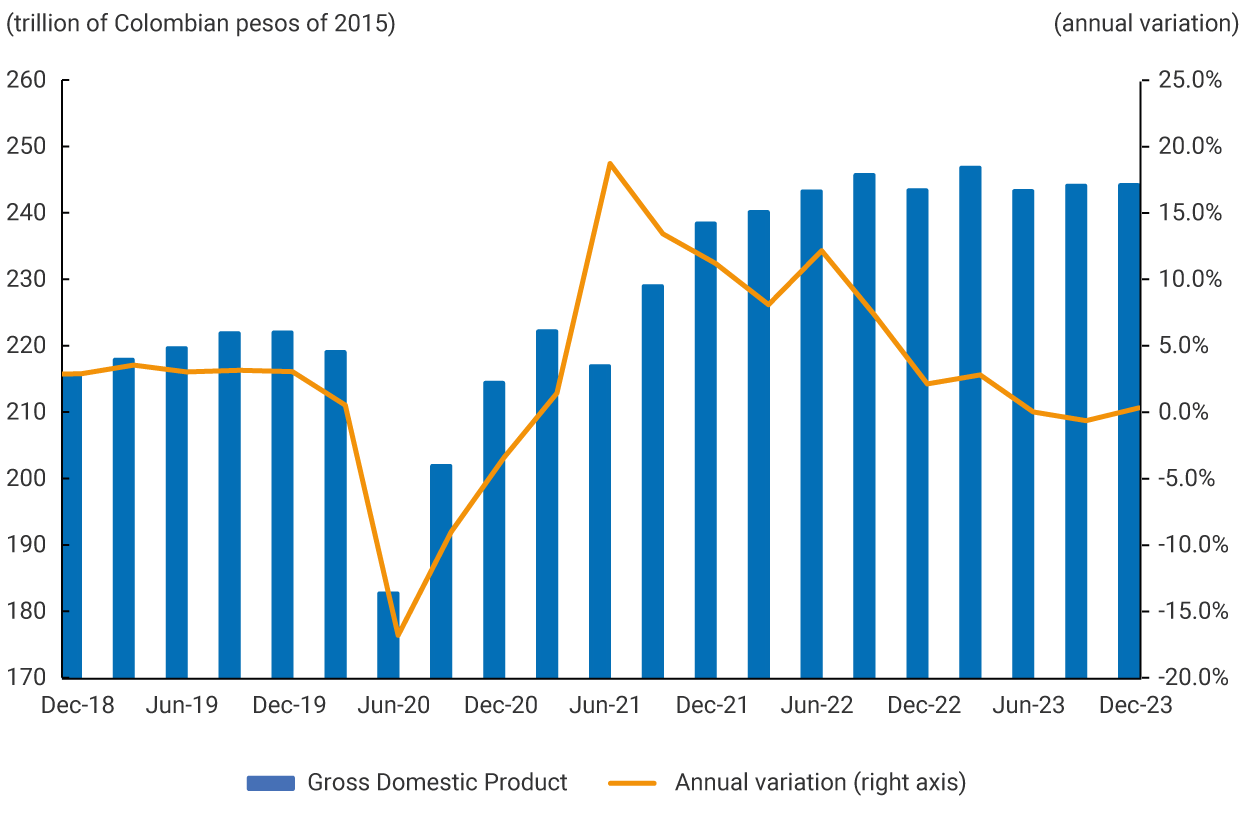

Graph 3. Gross domestic product (GDP)*

(quarterly and annual variation)

Source: DANE, calculations by Banco de la República

* Seasonally adjusted series and adjusted for calendar effects.

GDP performance is another key variable in monetary policy decisions. Graph 3 presents the annual variation in GDP in each quarter (orange line) and its quarterly level measured in trillions of Colombian pesos of 2015 (blue columns). The significant contraction in output in the wake of the pandemic can be seen, followed by a strong recovery in 2021 and 2022 that brought GDP to levels above those that would have been observed if the pre-pandemic trends had continued. The slowdown in economic activity in 2023 is also noted, with a growth rate of only 0.6% for that year. This slowdown was due to the moderation of domestic demand that contracted by 3.8% in 2023, partly due to the monetary and fiscal policies implemented to promote the adjustment process required by the economy to achieve more sustainable growth. The lower dynamism of domestic demand came mainly from investment , which fell 24.8% in 2023. The low economic growth corrected important imbalances in the economy, both domestically with growth that exceeded its productive capacity, and externally, with a current account deficit that exceeded 7.0% of GDP in the third quarter of 2022 and which, by the end of 2023 was reduced to 2.7% of GDP. The adjustment of these imbalances contributed to reducing inflationary pressures and restoring the sustainability of economic growth, providing room for monetary policy normalization.

This achievement is significant and has demanded great sacrifices. Now is the time to consolidate these achievements and maintain caution in the return stage to a more normal situation. The risks have decreased, but they have not disappeared. Annual inflation of 7.7% in February doubles the 3.0% target to which the Board of Directors of Banco de la República is committed in compliance with its Constitutional mandate. There is significant uncertainty about the degree of services indexation and the effects that El Niño may have on food and energy prices. Twelve-month inflation expectations based on the February survey of economic analysts stand at 4.8%. This level exceeds the tolerance range of 4.0% above the target and compromises the first half of 2025, when the Board of Directors expects to move definitively closer to the 3.0% target.

On the external front, global financial conditions have become more uncertain due to the possibility that the U.S. Federal Reserve will delay its interest rate cut, given the rigidity that core inflation in the United States has been showing. Inflation in Colombia exceeds that of other countries in the region such as Brazil, Chile, Peru, Uruguay, or Costa Rica, which have inflation levels below 5.0%, some of which waited to have lower inflations than Colombia when they started their down cycles, as documented in a recent Blog in this series.

The conditions described above make it difficult for the monetary authority to be very aggressive with cuts in the policy interest rate since there is a risk that very rapid reductions may have to be reversed if there were events that make it difficult to achieve the inflation target in the first half of 2025, which is the compliance horizon determined by the Board of Directors. This time frame was chosen to balance the risks of loss of monetary policy credibility and the cost of disinflation. The speed of rate cuts should be assessed in light of this horizon.

We all wish for a vigorous economic recovery, and monetary policy easing will undoubtedly help. But as the old adage goes, "getting up earlier won't make the sun rise sooner”. A mistake in this last stage of the path would bring serious consequences. Great climbers know this.