The COVID-19 pandemic caused an economic contraction and an increase in the unemployment rate unprecedented in Colombia’s history. At the time of its greatest impact, in April 2020, through the Economic Tracking Indicator (ISE in Spanish), the National Administrative Department of Statistics (DANE in Spanish) estimated that economic activity contracted at an annual 20.1% rate. It also reported that the unemployment rate reached 19.8% nationwide and 23.5% in the thirteen main cities. This happened in the context of a global economy strongly hit by the pandemic, a collapse in the prices of our exports, and enormous uncertainty about the country’s external financing sources. Thus, Banco de la República (the Central Bank of Colombia) faced the greatest challenge in almost one hundred years. The seriousness of this situation lay not only in the unusual magnitude of the shock, but also in the fact that it was unpredictable and challenging to manage due to its health rather than to its economic origin. At the same time, the strong disruptions produced by the shock in the financial markets threatened their proper functioning and the provision of credit at a time when the economy needed it most. The Board of Directors of Banco de la República (BDBR) recognized the exceptional nature of this crisis and the danger it represented for the country’s economic stability. Therefore, the BDBR decided to act quickly and forcefully to mitigate the economic effects of the shock, even amid the volatility and uncertainty generated by the arrival of the virus in the country. (See the Report of the Board of Directors to the Congress of Colombia - March 2021).

During the first stage, the Bank’s actions focused on three main objectives: i) to protect the payment system; ii) to stabilize the foreign exchange market and the public and private securities market; and iii) to ensure that credit continued flowing to the economy. To this end, it significantly increased the liquidity provision by increasing the amounts, counterparties, and eligible collateral of its Repo operations, the outright purchases of public and private securities, and the reduction of the legal bank reserves. It also carried out non-deliverable forward dollar sales and dollar swaps to increase hedging and provide dollar liquidity in order to reduce pressure on the foreign exchange market. On the other hand, it strengthened the country’s international liquidity position by purchasing foreign reserves and extending the Flexible Credit Line with the International Monetary Fund (IMF) to reduce uncertainty regarding its external financing and capacity to meet external payments.

In the second stage, the Central Bank focused on supporting the reactivation of economic activity. To this end, it reduced the policy interest rate by 250 basis points (bps) from an initial level of 4.25% in February to 1.75% in September 2020, placing it at an all-time low. In addition, reducing the average banking reserves from 7.0% to 5.0% permanently freed resources to the economy and strengthened incentives for financial intermediation.

Graph 1 exhibits that between February and December 2020, the monetary base increased to COP 31.1 trillion, equivalent to a nominal increase of 30.6%, and reflects an exceptional increase in the primary liquidity provided by the Central Bank. Among the sources of monetary expansion was the purchase of private debt securities and TES (bonds issued by the Colombian Government and managed by Banco de la República), which contributed to stabilizing these markets.

Graph 1. Sources of Expansion of Banco de la República’s Primary Issuance

(change between 29 February and 31 December 2020)

Source: Banco de la República.

The increase in peso liquidity quickly reduced the initial pressures on public debt markets. As shown in Graph 2, after registering a substantial increase, the TES interest rate declined to levels below those observed before the pandemic. On the other hand, the greater dollar liquidity and the foreign exchange hedging offered contributed to stabilizing the foreign exchange market, which was also helped by the recovery of oil prices and the confidence of economic agents in the support provided by the adequate level of foreign reserves.

Graph 2. Five-year peso TES zero-coupon rates

(change between 29 February and 31 December 2020)

Source: Electronic Trading System (SEN in Spanish). Calculations by Banco de la República.

In a context of ample liquidity, the 250 basis points (bps) cut in the policy interest rate was quickly transmitted to the financial system’s deposit and placement interest rates.

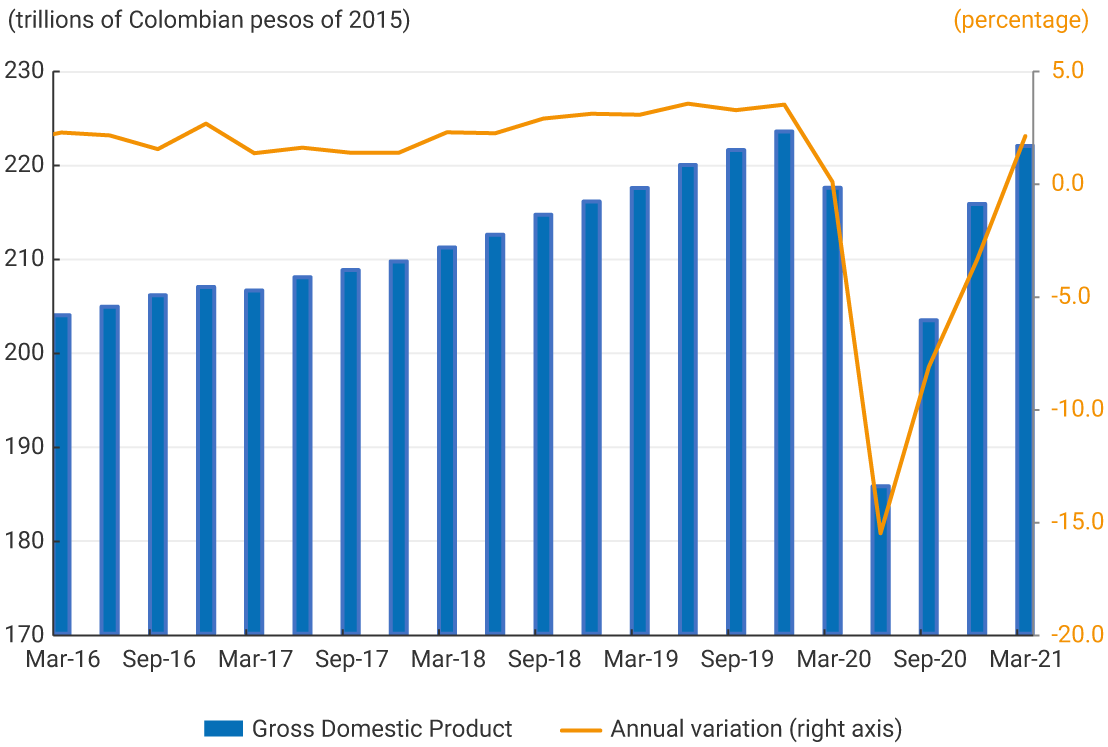

The stimulus offered by monetary policy and the National Government's transfers to entrepreneurs and consumers over the course of 2020 strengthened domestic demand, which was severely hit at the beginning of the pandemic. This policy response initially contributed to a recovery trend starting in the third quarter of 2020, as social distancing measures were relaxed (Graph 3). This trend was accentuated in the first quarter of 2021 when the economy grew by 1.1% and by 2.0%, if the figure is adjusted for calendar effects associated with the dates on which public holidays occurred each year. This result was above the expectations of independent analysts and the forecast of Banco de la República’s technical staff. The expansionary monetary policy implemented by Banco de la República has been a key element in inducing this economic recovery process, and in the absence of other shocks, it will continue to boost it in the remainder of 2021.

Graph 3. Quarterly Gross Domestic Product*

(levels and annual variation)

Source: DANE, calculations by Banco de la República

*Seasonally adjusted series and adjusted for calendar effects.