Monetary Policy Report - July 2024

The Monetary Policy Report presents the Bank's technical staff's analysis of the economy and the inflationary situation and its medium and long-term outlook. Based on it, it makes a recommendation to the Board of Directors on the monetary policy stance. This report is published on the second business day following the Board of Directors' meetings in January, April, July, and October.

During the second quarter, headline inflation remained stable, while core inflation (the measure of inflation that excludes temporary movements in the prices of food and regulated items) continued to decline. The aggregate effects of monetary policy, together with low exchange rate pressures, would contribute towards maintaining inflation’s downward trajectory, moving it closer to the 3.0% target by yearend 2025. Economic activity levels would continue to recover for the remainder of 2024 and moving into 2025. As long as inflation and its expectations continue to distinctly converge towards the 3% target, monetary policy can assume a less restrictive stance and contribute further towards the recovery of economic activity.

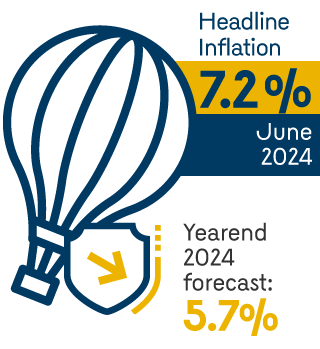

During the second quarter, headline inflation remained stable, while core inflation continued to fall. Inflation would continue its measured downward path to meet its 3.0% target by the end of 2025.

- Inflation in June fell to 7.2%, slightly lower than the 7.4% figure observed in March. In the second quarter, inflation decreased for all components except for food (goods, services, and regulated items).

- Goods continued at the forefront of the downward course assumed by core inflation (which excludes food and regulated prices from the CPI basket) in an environment of slow-growing household consumption, relative exchange rate stability, and lower price pressures from imported inputs.

- Services also contributed to core inflation’s decline, albeit falling by a lesser degree, as many of these prices were adjusted based on past inflation (known as indexation).

- In the regulated items group, lower fuel price adjustments also contributed to tempering inflation. Nonetheless, significant price increases in certain utilities, particularly electricity, continue to be noted.

- Inflation’s downward trend was partly hampered by a rebound in food prices, explained by El Niño phenomenon-related effects, mainly involving perishable products.

- Despite a brief standstill observed in the second quarter, inflation would continue to decline gradually and converge to the 3.0% target by the end of 2025. The cumulative effects of monetary policy efforts, low exchange rate pressures, still weak economic activity and the presence of excess productive capacity would contribute to this decline.

- The forecasts continue to face high uncertainty, largely associated with multiple factors, including the future behavior of the exchange rate, the degree of persistence of climatic phenomena affecting food prices, and the provisions regarding utility and transportation price adjustments, among others.

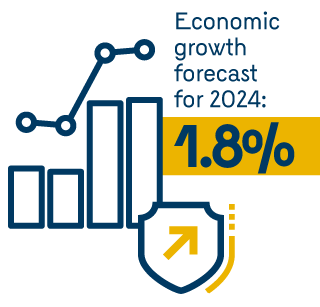

Although the Colombian economy continued to show low growth levels, there have been signs of improvement so far this year. In the remainder of 2024 and into 2025, economic activity levels should continue to recover.

- In the first quarter, the economy saw an annual growth of 0.9%, slightly higher than that observed at the end of 2023. This growth reflects a consumption that continued relatively steady at rather high levels and investment that remained weak yet exhibited some small improvement attributable to investment in machinery and infrastructure works. The positive performance of exports also contributed to the economy's improved performance.

- In the second quarter, GDP continued to recover (1.8% year-over-year), partly owing to encouraging results seen in the primary sector, chiefly agricultural activities, and a positive dynamic in the services sector related to public administration, entertainment, and insurance.

- In an environment of slow-growing economic activity compatible with the convergence of inflation to its target, the unemployment rate recorded slight increments early in 2024, only to remain relatively stable into the year. However, increases in informal employment have been observed.

- In the remainder of 2024 and into 2025, economic activity levels would continue to recover amid a more favorable international environment and a less restrictive monetary policy compatible with an inflation rate of 3% by yearend 2025.

- For 2024, economic growth of 1.8% is foreseen, together with a gradual improvement in household consumption. By 2025 the Colombian economy is expected to continue on a recovery path towards growth levels compatible with its productive capacity.

- In this context, the country's external deficit is not expected to increase significantly, making the country more resilient to possible adverse changes in international conditions.

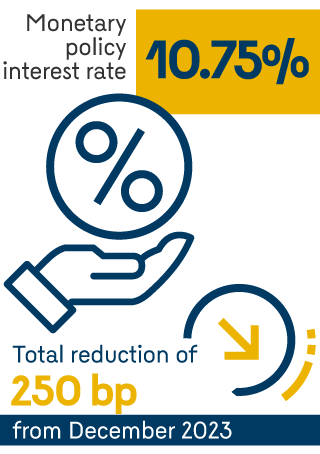

Against a backdrop where inflation and its expectations continue to decline yet continue above its 3% target, and domestic demand remains weak, the Board of Directors of Banco de la República decided at its July meeting to continue reducing the benchmark rate, placing it at 10.75%.

- Monetary policy has contributed to reducing the country's macroeconomic imbalances, such as high inflation, excess spending and credit, and a large external deficit.

- Consequently, in July, the Board of Directors of Banco de la República cut the monetary policy interest rate by a total of 2.5 percentage points to stand at 10.75%.

- However, inflation and its expectation measures remain above target, indicating the need to continue a contractionary monetary policy stance to help inflation meet its 3% target by 2025.

- To the extent that inflation and its expectations continue to converge towards the target and the country’s favorable macroeconomic stability conditions remain in place, monetary policy easing can continue.

Monetary Policy Presentation (Only in Spanish)

Box Index

Box 1: Behavior of the current account deficit and its long-term relationship with some critical determinants in the case of Colombia and other regional countries

Barbosa-Buitrago, Johanna; Perdomo-Sánchez, Darío; Salazar-Silva, Marlon