Economic-knowledge: Why does inflation occur?

In the previous edition of Economic-knowledge we defined inflation as the generalized and sustained increase in the prices of the most representative goods and services of household consumption in a country. Moreover, we analyzed each of its components to understand its meaning.

However, just knowing the definition of inflation is not enough to understand why Banco de la República (the Central Bank of Colombia) aims to keep it low and stable. That is why, in this article, we will explain the most common causes for which the prices of those goods and services may increase in a given period. Once we understand the definition of inflation and its causes, we will be ready to understand its consequences and why it is so important to control it.

Let’s refresh our memory

| Surely you have heard the words supply and demand and, even more likely, you understand their economic meaning. However, when asked, some may mislead supply (oferta, the Spanish word that also means sales) with those discounts for certain products or demand with the legal action against someone. Therefore, to understand the explanation about the causes of inflation in this article, it is important to remember the meaning of these two terms in the economic field. |

| In this sense, demand refers to the quantity of a good or service a buyer is willing to pay to purchase it, whereas supply is the number of goods and services producers are willing to sell at a specific price. |

In order to understand why inflation occurs, we will classify its causes into two categories: demand-pull inflation and costs-push inflation. We will also explain the importance of inflation expectations for the decision-making of Banco de la República’s Board of Directors, which is the county’s monetary authority.

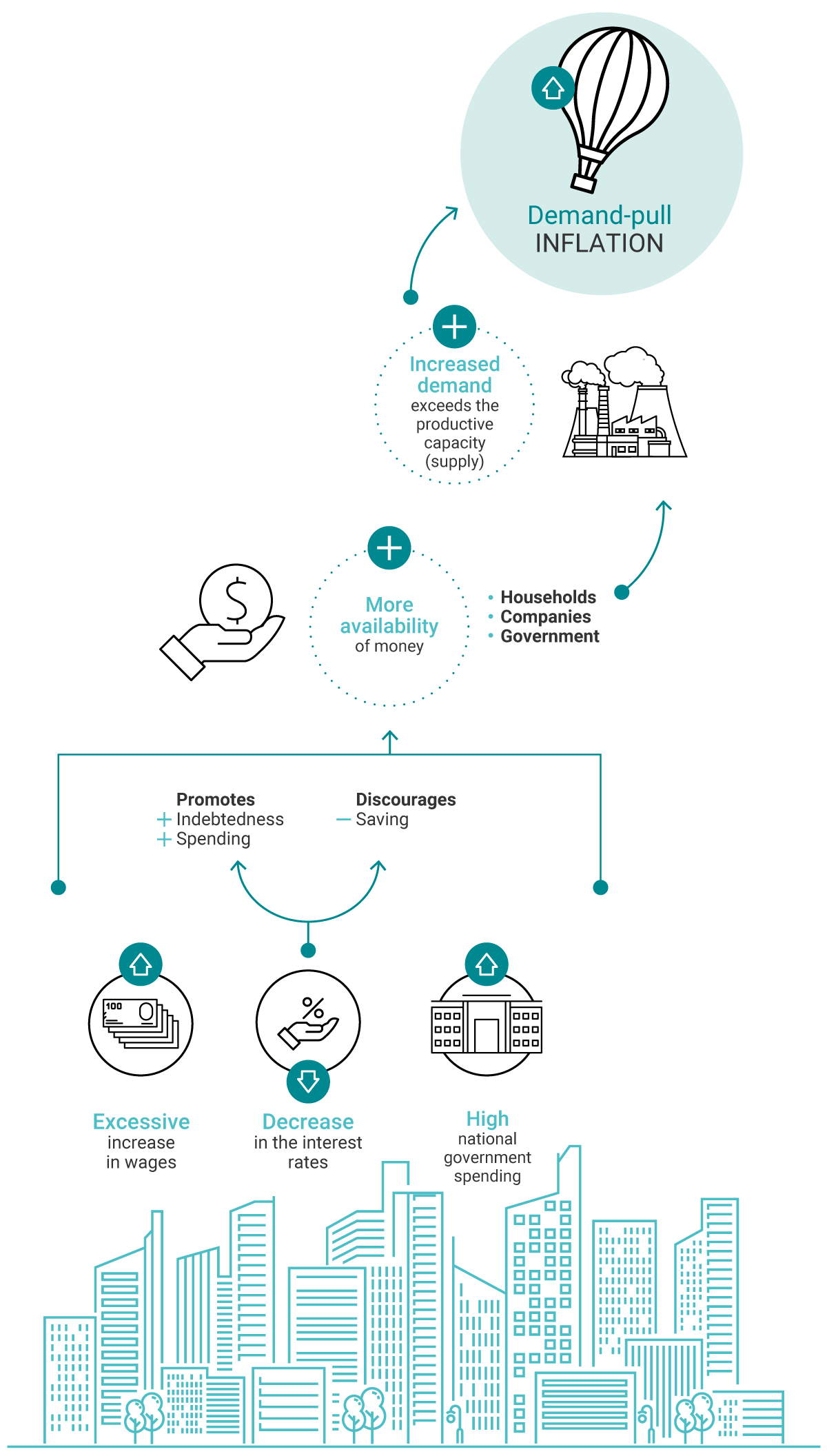

Demand-pull inflation

The prices of goods and services in a country can increase when families, companies, or the government are willing to buy more products than are available for sale.

A simple way to understand why prices may increase when there is a higher demand is to think about what happens at an auction. In these events a product desired by attendees is offered, and, based on the interest shown, the price will increase until it is awarded (sold) to the buyer, who is willing to pay the highest price. Since the demand for this product is high, the auction participants are probably willing to offer more money than others to have it; therefore, the auctioneer gradually raises the price until she/he sells it to the highest bidder. The same thing happens in some situations or times of the year when the seller knows that she/he can strategically raise the price of her/his products because plenty of buyers are willing to purchase them. This is the case of the Christmas season, special occasions (such as Mother’s or Father’s Day), holidays, or paydays in which employers are paid a bonus payment, among others.

Now let’s think again about the auction and imagine that, unexpectedly, each participant entered the room with twice the money they initially had; that is, they have more money available to buy that product. Rationality makes us think that if the product is of their liking, and they have more money to spend, they will unexpectedly be willing to bid more money than before for the same good, and surely the auction price will be much higher.

Something similar happens in an economy when there is more money available than before. It is either due to an excessive increase in the salaries, or a decrease in the interest rates1 offered by the financial system, which encourages us to take on more debt to spend money (or save less), or a high national government expenditure, among other reasons. As happened in the second round of the auction, with more money available from families, companies, or the government itself, the country’s aggregate demand will surely increase, and if it exceeds the economy's productive capacity (that is, supply), the prices paid by consumers would be pushed up, resulting in demand-pull inflation.

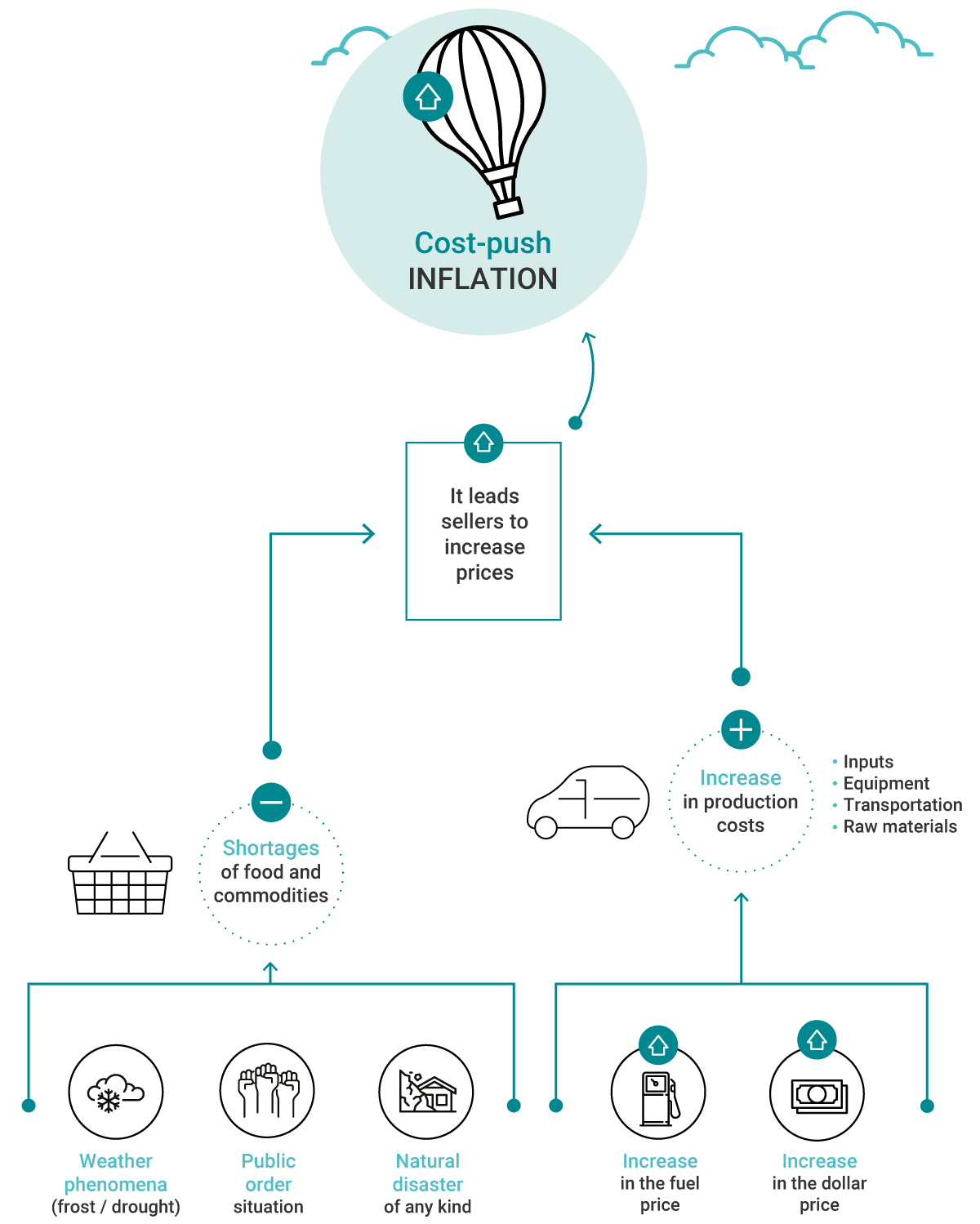

Costs-push inflation

Other reasons why prices may increase are due to situations that disturb producers and sellers (suppliers) one way or another, without changes in the demand for their products. Most of these causes are easily understood by imagining similar cases that have affected us regularly.

Let’s suppose a scenario where a certain number of buyers regularly go to a marketplace, but due to some climate phenomenon (such as drought or frost) food is scarce, with not enough products for everyone. This encourages sellers to increase prices to benefit the most from this food shortage. Similar cases occur when product shortages are caused by public order situations or natural disasters that affect the country’s mobility, and insufficient stockpiling of products for the points of sale, pushing up prices due to a temporary reduction in supply, without changes in demand.

However, not everything is related to a lower quantity of products offered; there are also causes of consumer prices increases that are associated with the increase in production costs. Two typical cases that sellers have to face are caused when fuel prices rise or when there is an increase in the value of the dollar in the country (Colombian peso devaluation). In the first case, the increase in fuel prices will certainly have an upward effect on inflation because the costs of transportation rise; both for supplies and products in the family consumption basket. In the second case, the depreciation of the Colombian peso would cause inflationary pressures arising directly from the increase in the prices of imported goods, indirectly generating upward pressures due to the increase in the costs of imported inputs, equipment, or raw materials that are part of the production costs of many goods and services of our basic consumption basket.

All the cases mentioned above lead sellers to increase their prices to compensate for the scarcity of the goods and services offered, or their higher costs; therefore, we would be experiencing demand-pull inflation.

Expectations

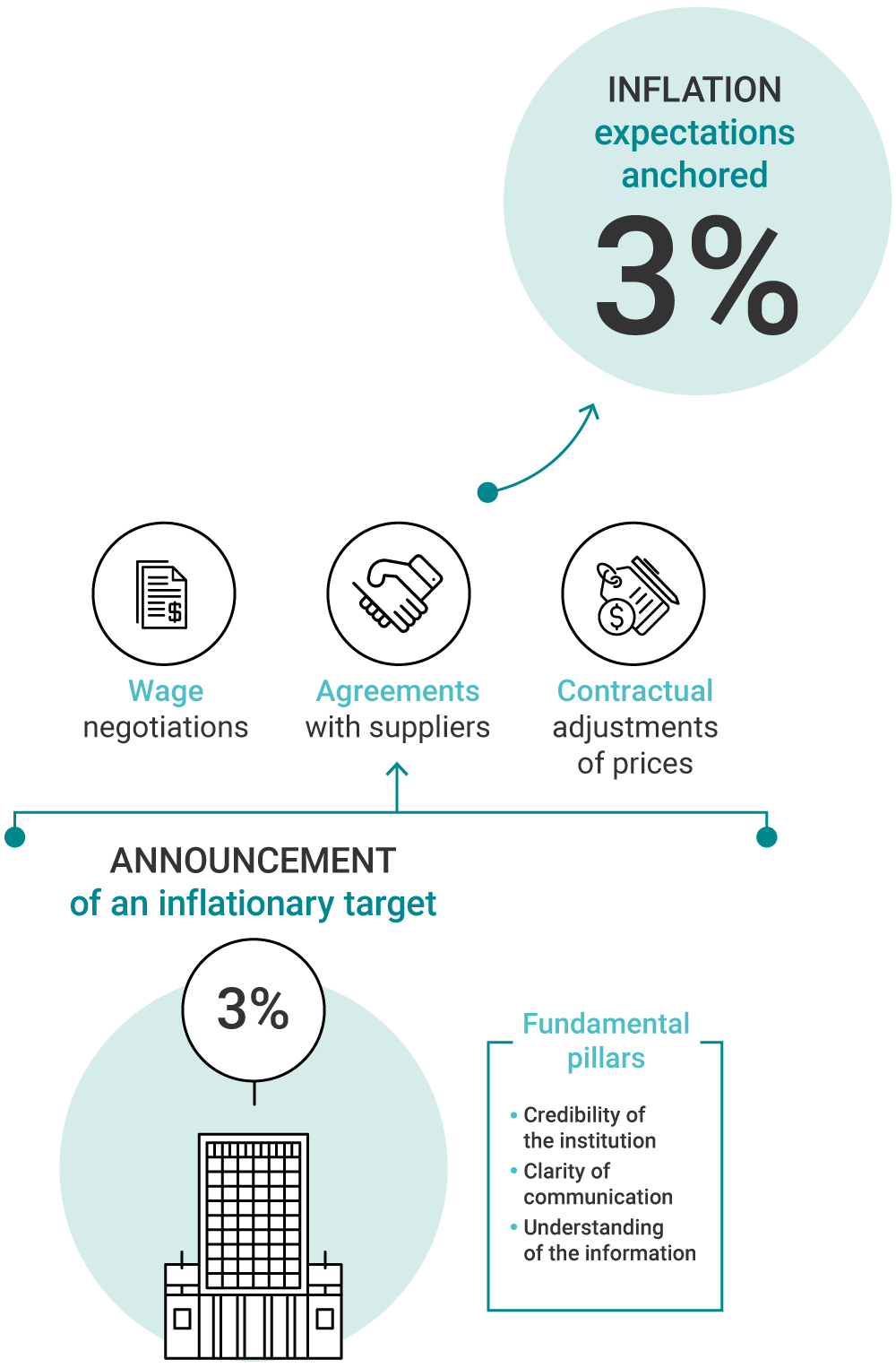

Although we do not locate it in any of the above categories, expectations also play a crucial role in the formation of inflation. If, for example, families or companies expect inflation to increase by a certain percentage in the future, let’s say by 3.0%, they will surely include those expectations in their wage negotiation, agreements with suppliers, and contractual adjustments of prices, among others, which ultimately will translate into an increase close to that 3.0%. This is known in psychology as the self-fulfilling prophecy, which means that beliefs about certain situations can generate such an effect in people’s mind that, in consequence, such situations actually end up being fulfilled.

Since evidence has shown that this is a very important inflationary channel, the control of expectations by the monetary authority depends on several factors, such as institutional credibility, clarity in communication, and economic education, that helps to understand monetary policy decisions. These three factors are fundamental pillars in the current monetary policy schemes, and they seek to influence the inflation expectations of economic agents in their decision-making.

After knowing the main causes of inflation, we are now ready to understand in the following article of Economic-knowledge the consequences of inflation, the importance of Banco de la República to control it, and how it contributes to the well-being of the country’s inhabitants.