The relationship between the management of public finances and the business cycle has been of great interest in economic research. Studies on the subject coincide in pointing out that industrialized countries are characterized by a counter-cyclical fiscal policy, while emerging countries are characterized by a procyclical one. This means that advanced countries tend to reduce public spending during boom times and increase it during slowdowns, which helps stabilize their economies. In contrast, emerging economies increase spending during booms and cut it during slowdowns, thus accentuating their business cycles. The reasons for this phenomenon are related to the insufficient quality of institutions and difficulties in accessing foreign credit in emerging economies. Many emerging economies have escaped the procyclicality trap in recent years thanks to their greater integration into international capital markets and necessary institutional improvements such as adopting fiscal rules.

This issue has been assiduously researched in Colombia, with results consistent with the international literature. However, in the Colombian case, the pattern of fiscal procyclicality that has been identified is moderate compared to that of other emerging economies. Such pattern is observed both in Central National Government (CNG) spending and in the management of statutory tax rates, as documented in a paper by Banco de la República (the Central Bank of Colombia) on fiscal policy and macroeconomic stabilization published in the Ensayos sobre Política Económica journal (ESPE) in April 2019 (ESPE 90, 2019)(only in Spanish) .

In a more recent research paper on investment in transport infrastructure in Colombia published last May (ESPE 99, 2021) (only in Spanish), a clear pattern of procyclicality was again identified, both for the National Government’s total investment in gross capital formation (GCF) (i.e., hydroelectric facilities, aqueducts, hospitals, etc.) as well as for investment in transportation infrastructure. This result deserves special attention because, beyond its macroeconomic effect, it may also help explain the backwardness of Colombia’s infrastructure. This is because investment cuts in ‘bad’ periods of the economy cause the interruption or delay in the short-term of projects initiated in ‘good’ periods, which in turn stagnates investment and thus has long-term implications.

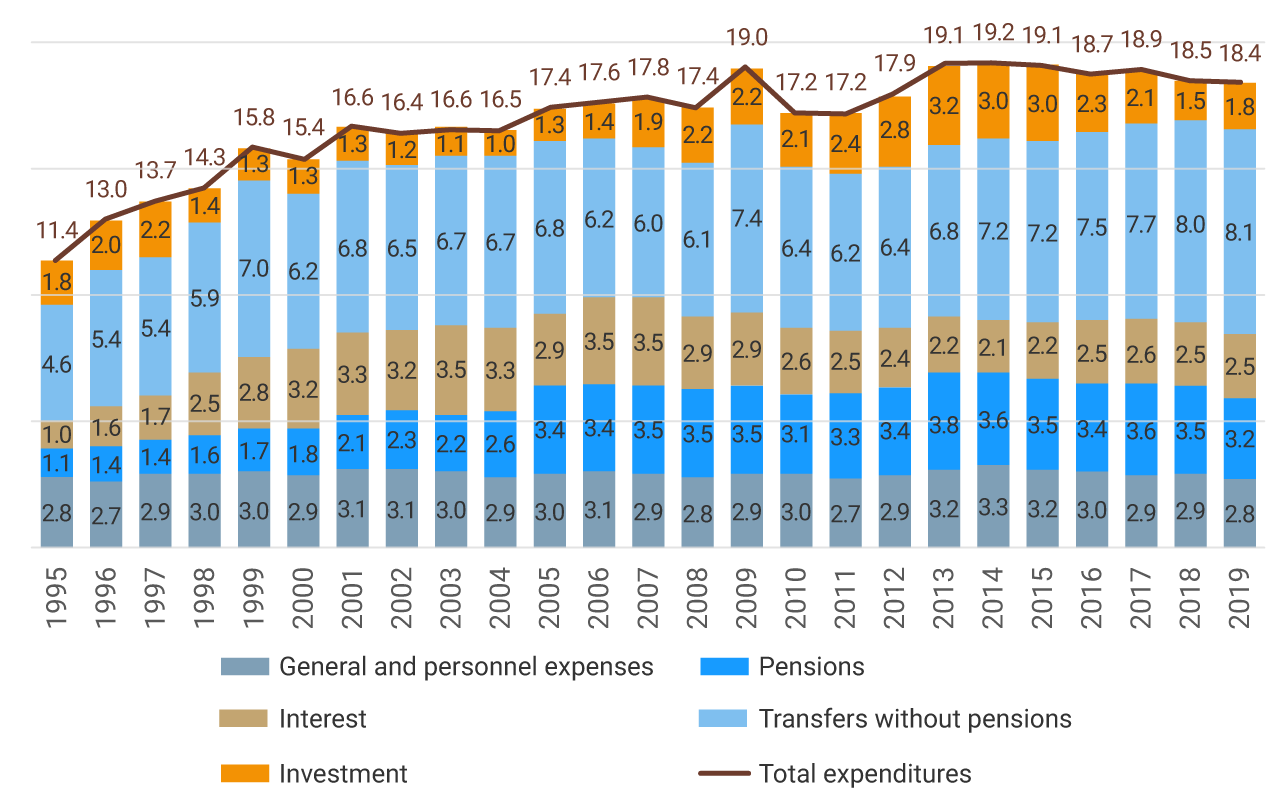

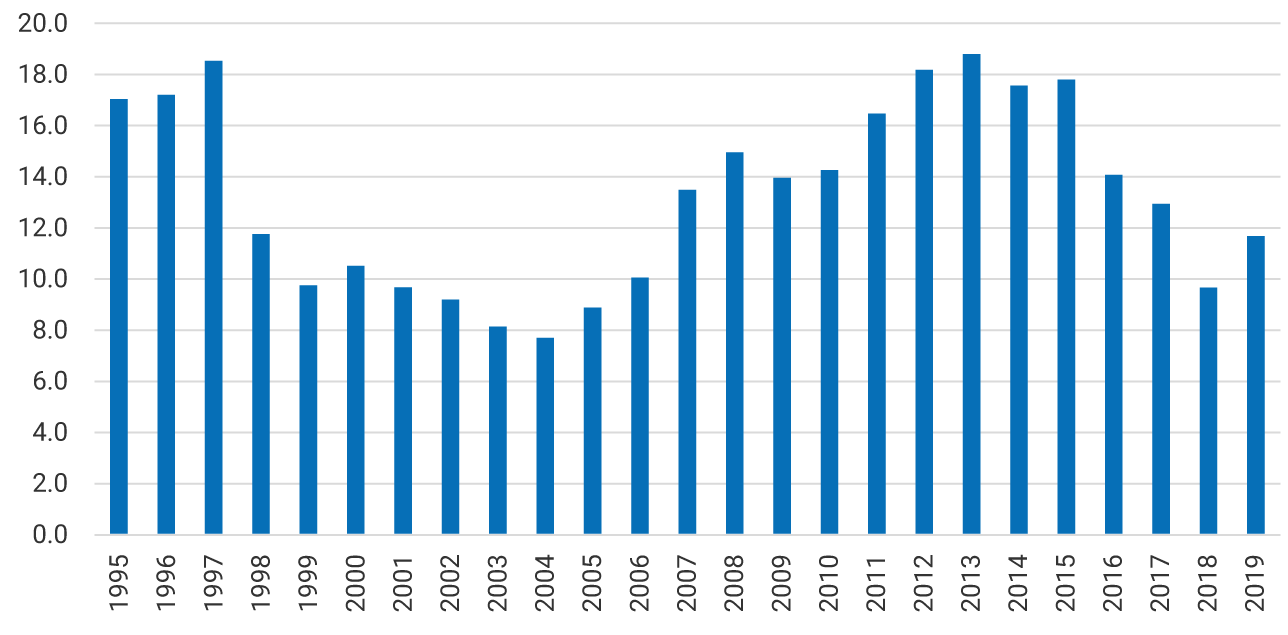

The first evidence of this phenomenon emerges when observing the evolution of the different CNG expenditure items during the last twenty-five years, as presented in Graph 1. This shows a relative investment stagnation in GCF, which contrasts with the growing trend in transfers and pensions. Indeed, CNG investment remained around 2.0% of Gross Domestic Product (GDP) between 1995 and 2019, while transfers increased from 4.6% to 8.0% of GDP, and pension spending rose from 1.1% to 3.5% of GDP. The relative stagnation of government investment is confirmed when observing its share in primary expenditure (total expenditure excluding interest), which registers substantial cycles but without a clear trend during the period analyzed (Graph 2). The lack of dynamism in government investment is part of the so-called bias against capital expenditure. This phenomenon, characteristic of many developing economies, prevents investment from acquiring greater importance within primary expenditure.

Graph 1. Composition of Total Expenditure - CNG

(Percentage of GDP)

Source: Ministry of Finance and Public Credit.

Graph 2. Share of investment in primary expenditure - CNG

Source: Ministry of Finance and Public Credit.

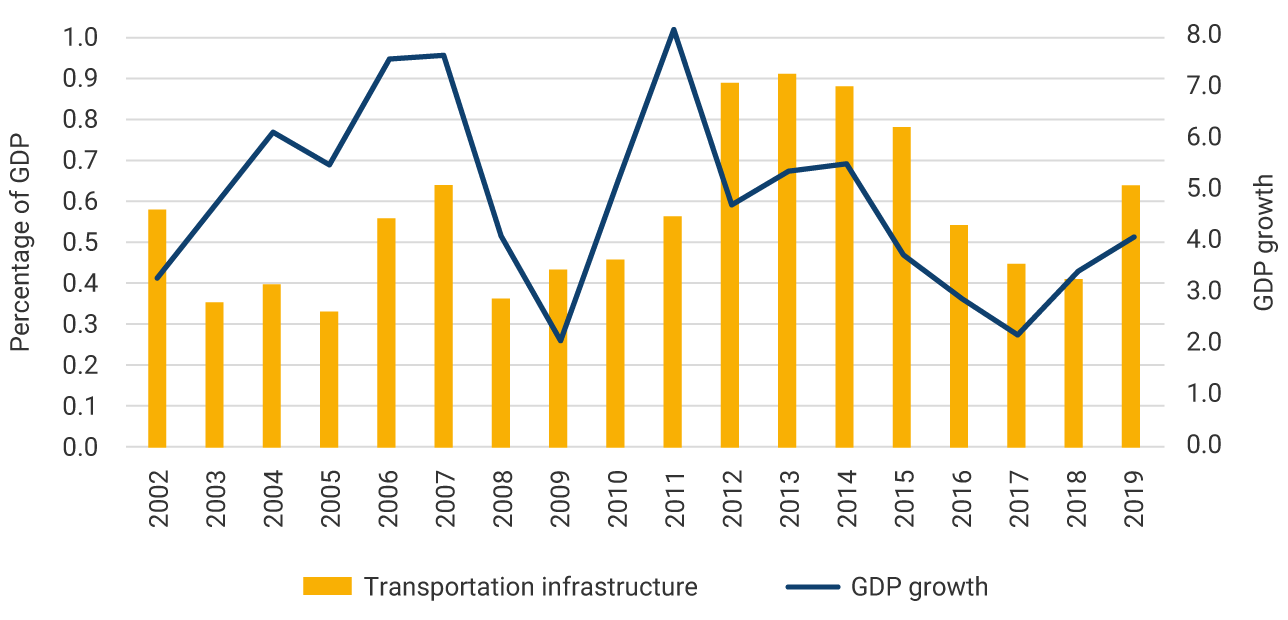

In addition to its long-term stagnation, CNG spending on GCF exhibits a clear procyclical behavior (Graph 3). Thus, during 1998-2004, in the context of a GDP contraction of 4.2% in 1999, followed by a slow recovery, government investment fell from 2.2% of GDP in 1997 to a minimum of 1.0% of GDP in 2004. Years later, when economic growth slowed from 5.1% in 2013 to 1.4% in 2017 as a result of the oil price drop, investment declined significantly from 3.2% of GDP in 2013 to 1.5% of GDP in 2018. In contrast, between 2005 and 2013, when the economy benefited from favorable terms of trade due to high oil prices (temporarily interrupted by the 2009 international financial crisis), government investment progressively increased to reach a peak of 3.2% of GDP in 2013.

Graph 3. GDP growth (percentage) vs CNG investment (percentage of GDP)

Source: Ministry of Finance and Public Credit.

The study published last May by Banco de la República shows that investment in transport infrastructure follows a pattern of stagnation and procyclicality very similar to that of the CNG’s total investment, although its level is considerably lower, fluctuating around 0.5% of GDP.

The reasons for the procyclical behavior of public investment in Colombia are rooted in the institutional framework governing budget allocation. Under this framework, the budgetary process in Colombia for allocating National Government spending has a high degree of inflexibility. This is noted by the Comisión de Gasto y de Inversión Pública (Public Spending and Investment Commission) (2018)(only in Spanish), which identifies several causes. First, earmarked revenues (i.e., revenues that by law are reserved only for certain items) and the floors, limits, or minimum percentages of spending for specific purposes established by the Constitution or by the law. These mechanisms are used to guarantee resources to certain sectors in order to shield them from unanticipated revenue volatility. Secondly, there is a constitutional provision that creates a floor or minimum limit for “social spending”1 by establishing that its percentage share in the budget for the fiscal year shall not decrease in relation to the corresponding share of the previous year. Given the broad definition of social spending, the provision implies the relative reduction of other essential items such as public and infrastructure investments, which then become residual spending and are adjusted to fit budgetary restrictions.

This Commission noted other common practices that accentuate the bias against investment in capital goods. For example, the pressure to maintain strict control over the growth of personal services spending induces entities to record payroll expenses through service contracts under investment. This distorts tax accounting and, in the case of investment, makes it appear higher than it actually is.

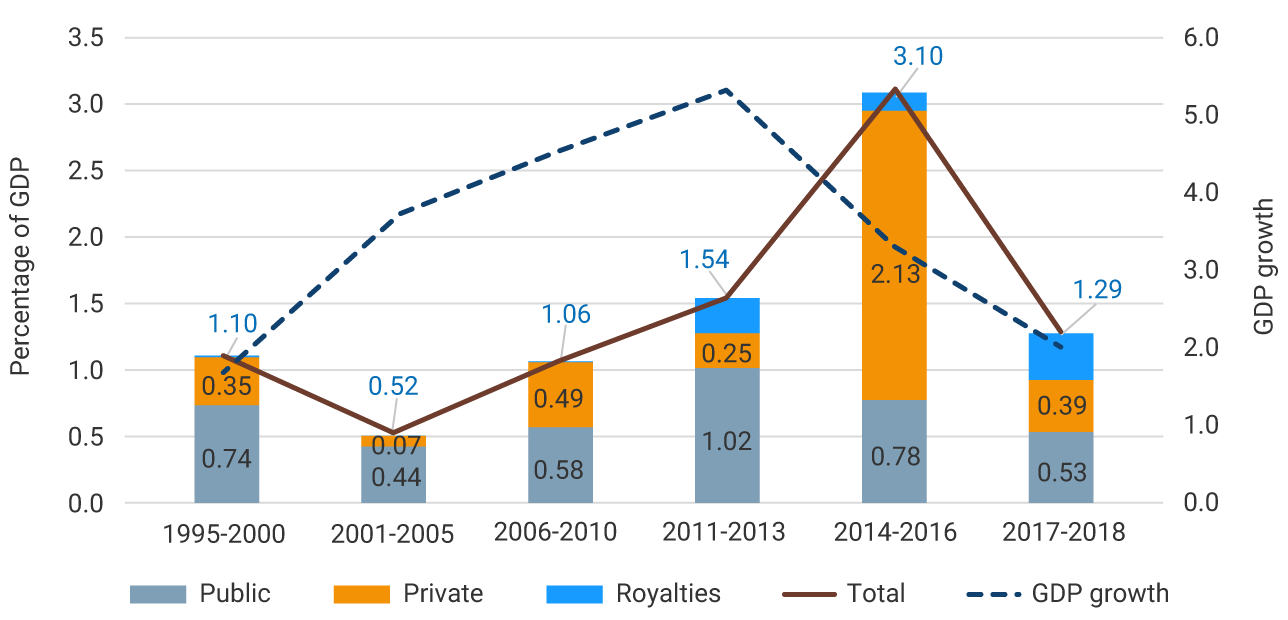

Linking private capital to the financing of public infrastructure projects opens up the possibility of boosting this investment and mitigating its procyclicality. In this field, the Colombian Government has accumulated long experience in using concessions that have allowed it to escape to a certain extent from the budgetary restrictions for the construction of road infrastructure and other types of projects at the national and territorial levels. Much of the learning accumulated with the concession scheme was embodied in Law 1508 of 2012, which created a modern legal framework to develop initiatives known as Public Private Partnerships (PPP). Under this regulation, investment in transport infrastructure increased from an average of 1.1% of GDP in the 2006-2010 period to 1.5% during 2011-2013 and 3.1% for the 2014-2016 period, which interrupted the traditional procyclical behavior (Graph 4). The 4G road program was crucial to achieving this result. However, the dynamism was not maintained, and investment in transport infrastructure fell to 1.3% of GDP in 2017-2018. For 2021, the Government launched the so-called 5G plan with 12 projects that will contribute to economic reactivation.

Finally, royalties are another source of financing for public investment in infrastructure at the territorial level, which depends on oil production and exports. From this point of view, royalties complement the National Government's budgetary efforts but add another procyclicality factor to investment by making it dependent on the performance of oil activity.

Graph 4. Investment in transport infrastructure (percentage of GDP)

Source: Mejía and Delgado (2020).

[1] Article 41 of the Organic Budget Statute states that public social spending is that aimed at solving unsatisfied basic needs in health, education, environmental sanitation, drinking water, housing, and others aimed at the general welfare and improvement of the quality of life of the population, programmed both in operation and investment.