As a complement to the Blog published on 07 November 2023, this new entry continues with the review of the Technical Remarks prepared by two members of the Board of Directors of Banco de la República (the Central Bank of Colombia) (only in Spanish) —Bibiana Taboada and Mauricio Villamizar. The second issue addressed in the Remarks refers to the mandate of Banco de la República, which is crucial for the design of monetary policy. With respect to this mandate, the Constitutional Court, in a 1999 ruling, determined that the Bank's obligation to preserve the purchasing power of the currency must consider other economic objectives, such as growth and employment. These objectives are closely related since short-term inflationary costs have an impact on production and employment costs in the medium and long term.

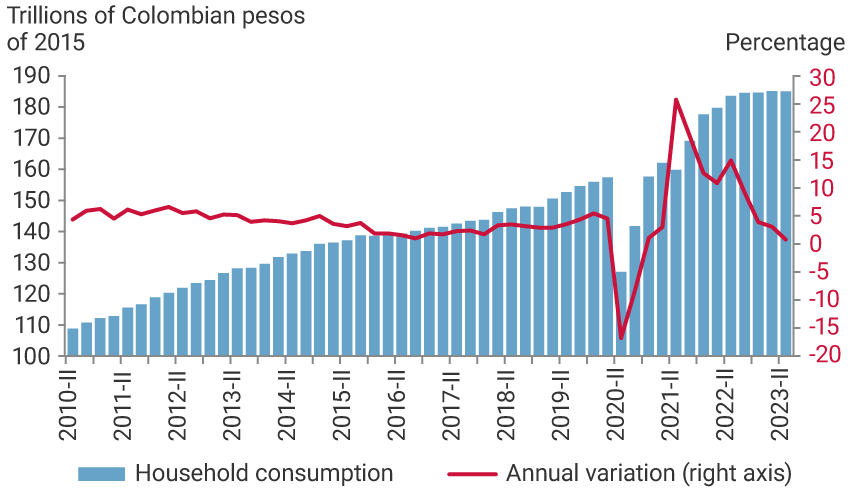

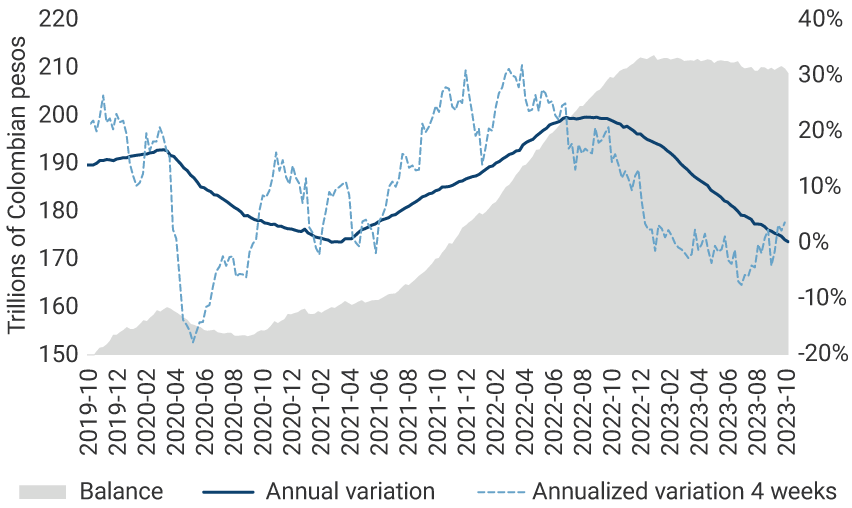

To complete the analysis, it is important to begin by defining the main objective of monetary policy, which is to maintain the currency's purchasing power while trying to achieve the highest possible sustainable growth and mitigate the volatility of economic cycles. In this regard, it is important to emphasize that growth beyond what is sustainable can lead to overheating of the economy, which in turn leads to a greater risk of future crises and a reduction of production in the long term. What happened in Colombia after the pandemic, especially in 2022, fits this pattern, since production exceeded its natural output level (according to estimates by the technical staff at the Central Bank), thus generating an imbalance between aggregate supply and demand that resulted in a historically high output gap. This was mainly due to the high level of household consumption, as can be seen in Graph 1, which exhibits the dynamics of household expenditure in the left panel and the balance and growth of the consumer portfolio in the right panel.

Graph 1. Household consumption expenditure and evolution of the consumer portfolio

Household final consumption expenditure

(quarterly and annual variation)

Source: National Administrative Department of Statistics (DANE in Spanish), calculations by Banco de la República.

Gross consumer portfolio

Balance, annual variation and annualized variation 4 weeks

Source: Banco de la República, calculations based on information from Form 281 of the Financial Superintendency of Colombia.

The recent experience of the Colombian economy in terms of growth and inflation reaffirms that, for economic growth and employment objectives to be compatible with the inflation target, a sustainable growth that contributes to preserving price stability is required. Economies with high and prolonged inflation rates experience high costs in terms of growth and equity, face difficulties in long-term financing, have distortions in the allocation of resources, and generate unfavorable redistributions for the lower-income classes of the population. In contrast, when inflation is low, future prices are more predictable, which is reflected in lower real interest rates that facilitate the development and permanence of long-term financing markets and favor more efficient resource allocation.

However, especially when so-called supply shocks occur in the short term (see the blog published on 07 November 2023), tensions may arise between price stability and growth objectives, or between short-run and long-run growth objectives. A useful concept to measure this tension is the "sacrifice ratio," understood as the magnitude of short-run output that must be sacrificed to reduce inflation and generate sustainable growth in the long run. This concept can also be interpreted as the additional inflation that must be allowed to achieve higher growth in the short run at the cost of lower growth in the future. The latter interpretation can better illustrate the complexity of the debate, especially when different time horizons are considered.

Therefore, the relevant question is the following: Is it better to achieve higher growth today and, in return, allow for more persistent and higher inflation and lower growth in the future? To answer this question adequately, at least three components that influence this decision must be considered. The first one has to do with the credibility of monetary policy, which, as explained in the previous Blog, increases its effectiveness, thus reducing the sacrifice ratio. Indeed, when monetary policy is credible, agents' price expectations are consistent with the inflation target, which allows for smaller interest rate adjustments and lower short-term growth costs. The second one concerns the relevant time horizon for which society's resources should be maximized. For central banks, the horizon of these objectives generally exceeds government mandates because they highly value society’s welfare in the future. Under these circumstances, more rapid (and sometimes painful in the short term) adjustments are possible, leading to a stable growth path. And the third is the consideration of the long lags that monetary policy has on output (9-12 months) and inflation (12-18 months) to reach its full effect. This makes it necessary to constantly review the results that are within the reach of monetary policy at different time horizons and differentiate them from those that already respond to policies adopted in the past.

Al final, las decisiones de política monetaria están encaminadas a lograr la estabilidad de precios y un nivel de crecimiento económico In the end, monetary policy decisions aim to achieve price stability and a sustainable level of economic growth in the long term, which in turn translates into the highest possible wellbeing for Colombians. In line with this objective, interest rate adjustments are calibrated according to the credibility that the Bank manages to maintain, on which the magnitude of the required monetary adjustment and the corresponding sacrifice ratio depend. When there is a significant deviation of inflation from the target, which the Bank has set at 3.0% with a range of plus or minus one percentage point, the timing of convergence towards that target also allows to adjust decisions considering the lag with which monetary policy acts.