Banco de la República explains the terms under which it manages gold and other assets of the country’s foreign reserves

In light of recent news on gold sales from the foreign reserves, Banco de la República (the Central Bank of Colombia) informs that:

- According to its legal mandate, Banco de la República administers the Nation’s foreign reserves based on the criteria of liquidity, security, and return. In pursuance of this mandate, the foreign reserves portfolio is determined by considering the relationship between the expected return of different assets and their volatility.

- Whenever interest rates on the country's foreign reserves are low, the portfolio has less ability to absorb potential negative price movements from more volatile assets. In this scenario, it is appropriate to sell assets whose prices are highly volatile such as gold.

- The foreign reserves management policy is based on rules and periodic adjustments to the portfolio, which have enabled the Nation to obtain important revenues from its reserves in a context of interest rate cuts in foreign markets. The Central Bank has also announced that these exceptional conditions may not last.

- In this process, Banco de la República does not assume speculative positions on individual asset prices, it builds a diversified portfolio that meets the management criteria explained above.

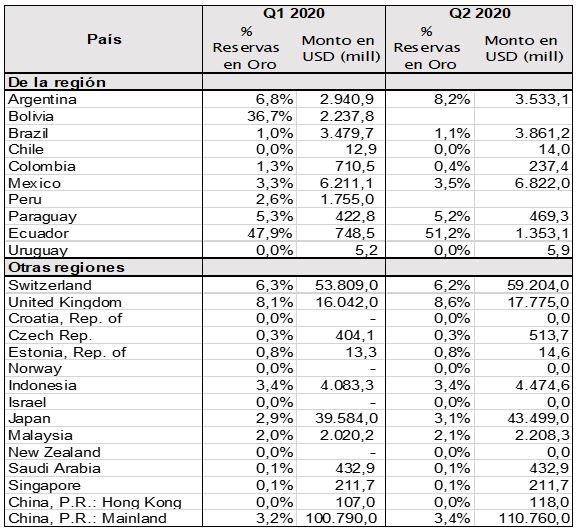

- The participation of gold in the foreign reserves is minimal. With the sales made between 27 May and 26 June 2020, it decreased further, from 1.40% of the total to 0.45%. The average sale price was US$1,727/ounce.

- Gold sales are made through over-the-counter operations with international counterparts in the metals market with a credit rating of at least A-, taking the best quote.

- The price of gold has risen during 2020. It started the year at US$ 1,517/ounce; its maximum was on 6 August at US$ 2,063/ounce. From there, it has returned up to US$ 1,939/ounce. This shows the high price volatility of this asset.

- In the following hours, the technical staff at the Central Bank will respond in writing to any concerns sent to us at comunicaciones@banrep.gov.co