Flexible Credit Line by the International Monetary Fund

What is the Flexible Credit Line (FCL)?

The FCL is an instrument created by the International Monetary Fund (IMF) and designed to provide early and flexible financing to countries with very strong economic fundamentals and sound institutional economic policy frameworks. It is a temporaryi and preventive credit line that facilitates access to immediate liquidity to mitigate the impacts derived from extreme adverse events of external origin for the beneficiary countries.

This credit line has three basic characteristics that differentiate it from other IMF credit facilities: i) it is contingent, that is, its purpose is to cover the materialization of extreme external risks; ii) it grants immediate access to resources at any time; and iii) it is a non-conditional instrument, which means that access is determined by the country's previous macroeconomic conditions and does not entail subsequent economic policy commitments when making use of the instrument.

To access the instrument, applicant countries must meet certain qualification criteria, the fulfillment of which is validated by the IMF. These criteria are:

- A sustainable external position

- A capital account dominated by private flows

- A history of accessing international markets on favorable terms

- A relatively comfortable level of reserves at the time of requesting a precautionary FCL

- Sound public finances (including a sustainable public debt position)

- Low and stable inflation in the context of a sound monetary and foreign exchange policy framework

- The absence of bank solvency problems that pose a systemic threat to the stability of the banking system

- Effective supervision of the financial sector, and

- Integrity and transparency of information.

The FCL operates as a renewable credit line that, at the country's discretion, may be used initially for one or two years, and for which eligibility is assessed after the first year. It has no access cap and access is determined in relation to the size of the country's quota in the IMFii, which may be increased during the term of the agreement, provided that the country meets the qualification criteria. The resources of this line are intended exclusively to address critical balance of payments situations.

An important benefit of the FCL lies in the signal it sends to the market about the prudent management of the economy and its capacity to respond to crisis situations, reducing its vulnerability to speculative attacks. Thus, the FCL acts as an endorsement of excellence in the eyes of the international community, since access to it confirms the existence of a robust economic policy framework. It also contributes to lowering external financing costs and complements the accumulation of foreign reserves as a more economical alternative to accumulating and sterilizing reserves.

The agreement complements the availability of the country's external liquidity, provides insurance against external risks, and maintains agents' confidence in the economy. External risks associated with a high level of uncertainty due to geopolitical factors and the tightening of international financial conditions highlight the importance of maintaining adequate levels of external liquidity.

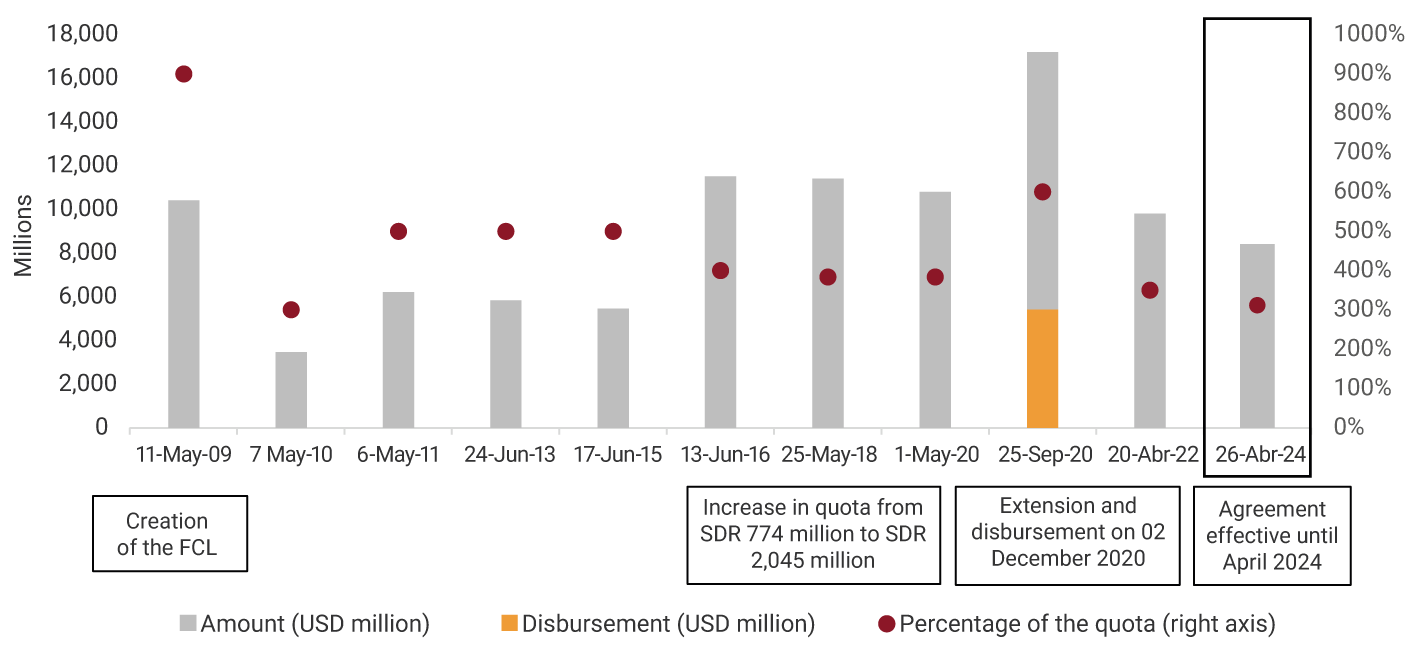

Colombia's access to the FCL

Colombia has had access to this credit line since its creation in 2009 to present date. It is worth highlighting some characteristics of the country's access to the FCL, which can be seen in Graph 1 (the bars in the graph represent the amount in millions of dollars of the FCL at the time of its application and the red dots correspond to its equivalent in terms of the percentage of Colombia's quota at the Fund). First, over the years, the country has varied the amount requested depending on the shocks and risks it has had to face. Thus, access has ranged between 300% and 900% of the country's quota for the whole period in which Colombia has had the instrument. In this context, it is important to note that, in the last approved agreement, the Colombian authorities reduced their access to the instrument, in line with an expected decrease in external vulnerabilities, the reduction in risks associated with the pandemic, and the authorities' commitment to gradually reduce access to the facility as external risks decrease.

Second, since its first access in 2009, Colombia has granted full precautionary status to the instrument and continues to do so. However, it is worth mentioning that, in September 2020, the FCL was granted partial precautionary status under the agreement approved in 2020 after the country made a disbursement at the end of the year due to high uncertainty regarding the COVID-19 situation (see yellow bar in Graph 1). Prior to this event, an extension of the line's access had been approved under the same agreement. The subsequent agreement, which is currently in force, was requested and approved in 2022 for a period of two years and for an amount equivalent to 300% of the country's quota at the IMF (about USD 8,100 million). This last agreement is considered as a precautionary line by the Colombian authorities.

Third, it is important to note that, in February 2016, the country's quota was increased from SDR 774 million to SDR 2,044.5 million under the IMF's Fourteenth General Review of Quotasiii. This increase meant that, although an increase in access to the instrument was requested that year (in dollars), there was a reduction in access in terms of the percentage of the quota.

Graph 1. Colombia's historical access to the FCL

Source: Banco de la República (the Central Bank of Colombia) and IMF (official communiqués)

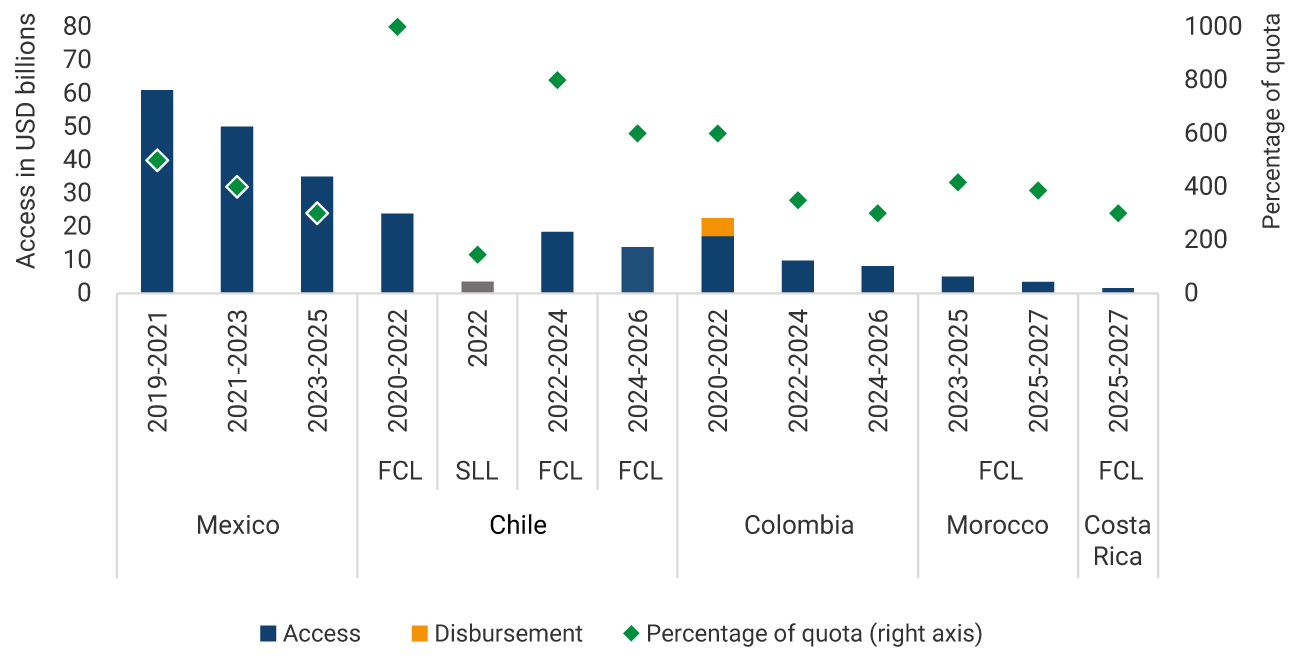

Other countries’ access to the FCL

Currently, four other countries have access to the FCL: Mexico, Chile, Morocco and Costa Rica (Graph 2):

- Mexico: this credit line has been in force since its creation in 2009.

- Chile and Peru resorted to this instrument since the beginning of the pandemic in 2020. In 2022, Chile cancelled its instrument to replace it with a short-term liquidity line (SLL), but then decided to reapply for the FCL for a two-year period (2022-2024). In 2024, the IMF approved a new agreement for the country for a two-year period (2024-2026). On the other hand, Perú allowed the agreement it had for two years (del 2022 al 2024) to expire on 26 May 2024, and decided not to request its renovation. Therefore, it currently has no access to the instrument.

- Morocco acceded to this instrument for the first time in early 2023, and requested a new agreement for a two-year period in 2025.

- In 2025, Costa Rica requested a two-year agreement under the FCL for the first time.

Graph 2. Recent FCL Agreements

Source: Banco de la República (the Central Bank of Colombia) and IMF (official communiqués)

Information published by the Central Bank of Colombia and the IMF on the FCL

Banco de la República's press release on the current agreement

Information on the disbursement can be found in the following links:

- Fact sheet del FMI describiendo la LCF

- Colombia Draws on IMF Flexible Credit Line to Address the COVID-19 Pandemic

- IMF Approves Augmentation of the Flexible Credit Line for Colombia to USD 17.2 billion

- Press release: renewal of the Flexible Credit Line for Colombia (9 april 2020)

Boxes in the Reports to Congress:

1 ↑ Its access is considered to depend on the evolution of international conditions and the country's vulnerability to external shocks..

2 ↑ Colombia's quota at the IMF corresponds to SDR 2044.5 million, equivalent to USD 26,895.5 million (using the SDR/USD rate of 10 November 2023).

3 ↑ The IMF Board of Governors conducts general reviews of quotas on a regular basis (generally every five years). According to information from the IMF, a general review of quotas addresses two main issues: the size of the overall increase and the distribution of the increase among member countries. A general review of quotas allows the IMF to assess the adequacy of quotas in light of members' balance of payments financing needs and its own ability to help meet those needs. On the other hand, a general review makes it possible to increase the quotas of member countries in line with changes in their relative position in the global economy. Information available at IMF Quotas.