Report of the Board of Directors to the Congress of Colombia, July 2023

Pursuant to Article 5 of Law 31 of 1992, the Board of Directors of Banco de la República (the Central Bank of Colombia) submits a report to the Honorable Congress of Colombia, informing about the performance of the economy and its outlook. This report is submitted twice a year, in March and July, within ten business days following the start date of the sessions of the Congress.

The effect of monetary policy decisions is beginning to be reflected in a fall in inflation and a gradual correction of inflation expectations, a process that will be further consolidated as these effects of monetary policy become fully apparent. This is suggested by the expectations of economic agents, who anticipate that the downward trend in inflation that began in April will continue in the coming months and will continue its convergence to the target in 2024.

See the report

See the report

International Macroeconomic Environment

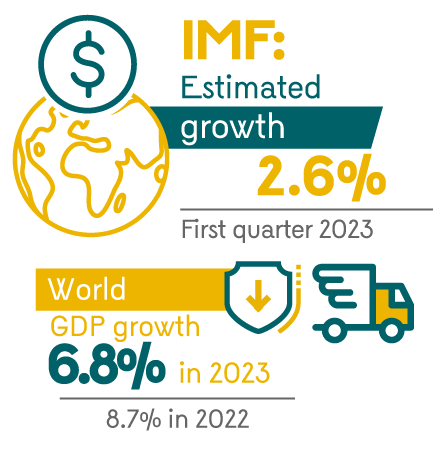

- The global economy expanded at an annual rate near 2.6% in the first quarter of 2023 due to improved consumer confidence, normalization in global supply chains, and favorable dynamics in service activities.

- For the remainder of the year, global growth is expected to slow down amid an uncertain economic climate characterized by geopolitical tensions, risks to financial stability, high indebtedness in many economies, and the effects of restrictive monetary policies in many countries, whose inflation rates continue to exceed their targets, despite the reductions achieved so far.

- The International Monetary Fund (IMF) expects the moderation of inflation to continue in the coming months, with average annual global inflation falling from 8.7% in 2022 to 6.8% in 2023.

Economic Activity in Colombia

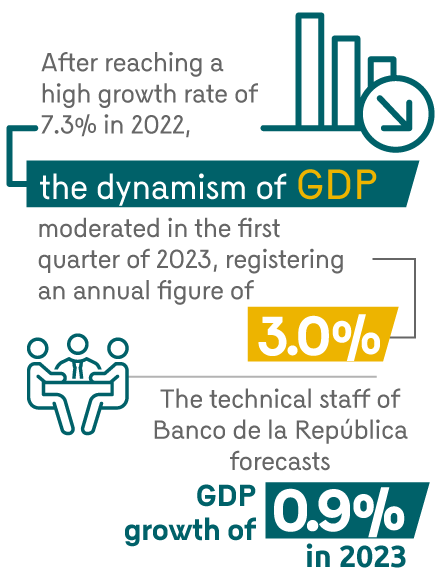

- After reaching a high growth rate of 7.3% in 2022, the dynamism of gross domestic product (GDP) moderated in the first quarter of 2023, registering an annual figure of 3.0%, driven by a positive net external demand, mainly due to a drop in imports, especially capital goods, affected by the slowdown in economic activity.

- Domestic demand contributed negatively to growth, which was reflected in the loss of dynamism of household consumption and the contraction of gross capital formation.

- The technical staff of Banco de la República forecasts GDP growth of 0.9% in 2023.

Employment

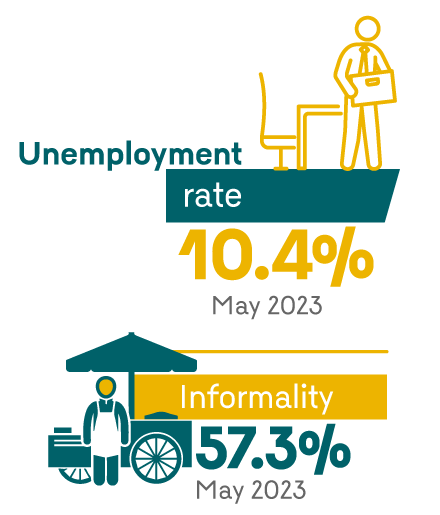

- The unemployment rate continued to decrease in annual terms during the first months of 2023, registering a level of 10.4% in the rolling quarter ending in May, below its historical average, mainly explained by the recovery of employment in rural areas.

- The informality rate stood at 57.3% in May 2023, 0.3 pp higher than that observed in December 2022, when it registered a level of 57%.

- By economic sector, the major contributions to the annual variation in national aggregate employment were made by commerce and lodging, manufacturing, and professional activities.

Inflation and Monetary Policy

- Consumer price inflation maintained an upward trend over the course of the previous year, reaching 13.1% at the end of 2022. During the first quarter of 2023, it stabilized at around an annual 13.3%. From April onwards, it began to show a downward trend, reaching an annual 12.1% in June, one percentage point below the level recorded in December 2022.

- The decreases in the inflation rate during the second quarter have been explained, among other factors, by the fall in food inflation; the downward adjustments in the international prices of some food, raw materials, and transportation costs; the appreciation of the exchange rate; and the reduction in producer price inflation, offset by the increase in fuel prices.

Balance of Payments

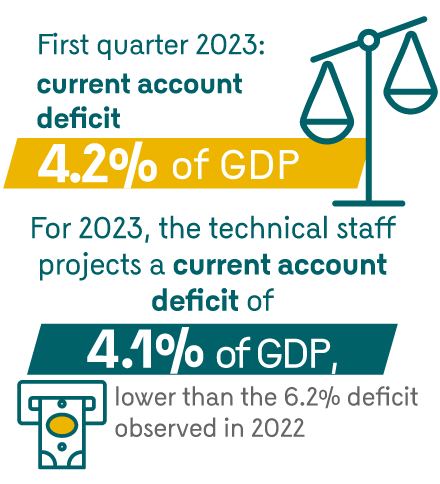

- In the first quarter of 2023, the current account deficit was 4.2% of GDP. This meant a reduction in the external imbalance of two percentage points of GDP compared to that recorded in the same quarter of 2022.

- This decline resulted primarily from the reduction of the trade deficit in goods and from the lower imbalance in trade in services.

- For 2023, the technical staff projects a current account deficit of 4.1% of GDP, lower than the 6.2% deficit observed in 2022.

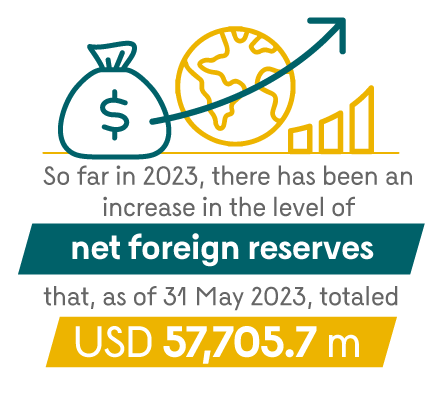

Foreign Reserves

- So far in 2023, there has been an increase in the level of net foreign reserves that, as of 31 May 2023, totaled USD 57,705.7 million (m), meaning an increase of USD 436.6 m compared to the amount recorded at the end of 2022. This is due to the positive profitability obtained in this period as a result of the higher yields received. The valuation of investments has also contributed to the increase in the level of reserves.

- These positive impacts on investments have been partially offset by the depreciation of other reserve currencies against the U.S. dollar, which has generated a negative exchange effect on the valuation of reserves.

Profits of Banco de la República

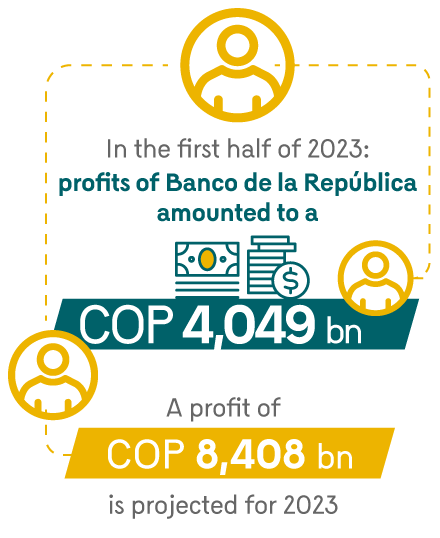

- In the first half of 2023, the profits of Banco de la República amounted to COP 4,049 billion resulting from revenues of COP 6,423 billion and expenses of COP 2,374 billion.

- Revenues were mainly due to the yield on foreign reserves and, to a lesser extent, to the yield on TES (bonds issued by the Colombian government and managed by Banco de la República) held by the Bank and expansionary repos. Expenses were mainly attributable to the remuneration of government deposits at the Bank and contraction deposits and to corporate expenses.

- A profit of COP 8,408 billion is projected for 2023, which is higher than that obtained in 2022 (COP 1,506 billion) and would come mainly from the yield on foreign reserves. The expected profitability on reserves would respond to high external interest rates.

Public Finances

- The fiscal deficit of the Central National Government (CNG) stood at 5.3% of GDP in 2022, which implied a correction of 1.7 pp compared to the deficit of 2021 (7.0% of GDP). With this result, the CNG was able to meet the deficit target set for the transition period in the fiscal rule (8.3%).

- This adjustment was possible due to the dynamism of the Colombian economy, which boosted tax collection, favorable terms of trade, and reduced spending pressures associated with the Covid-19 pandemic.