Labor Market Report - Employment Stability and the Impact of Increased Training Costs on Demand for Apprentices

The Labor Market Report (RML in Spanish) series is a quarterly publication by the Labor Market Analysis Group (GAMLA, in Spanish) of Banco de la República (the Central Bank of Colombia), a group created in 2017. Opinions and possible errors are the author’s sole responsibility, and its contents do not compromise Banco de la República nor its Board of Directors.

Data from the official Colombian Household Survey (GEIH in Spanish) suggest that, after a recovery period in the second half of 2024, national employment exhibits an annual 1.2% increase, reaching levels close to 23.1 million employed individuals in the quarter ending in November 2024.

See the report (Only in Spanish)

See the report (Only in Spanish)

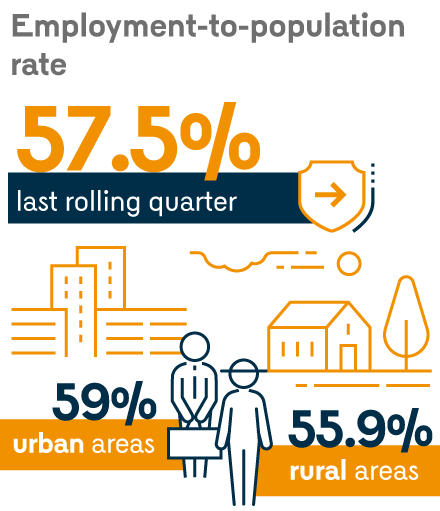

Given the increase in the working-age population, the employment-to-population rate (ER) remained stable in the recent period, standing at 57.5% in the last rolling quarter, with a notable difference between urban areas (59%) and other municipalities and rural areas (55.9%).

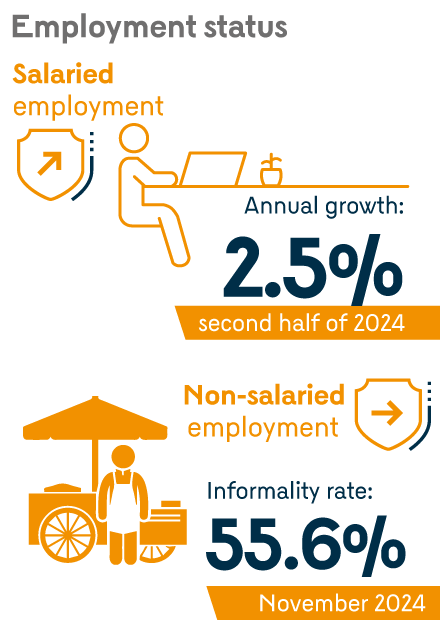

In terms of employment status, salaried employment showed recovery in the second half of 2024, with an annual 2.5% growth, while non-salaried employment remained stable during this period, leading to a reduction in the informality rate, which fell to 55.6% in November 2024. This evidence suggests a possible reconfiguration of employment, favoring higher-quality jobs. Other labor demand indicators, such as job vacancies, showed a negative trend over the past year; however, they remain slightly above pre-pandemic levels. Similarly, hiring expectations remain stable and still positive.

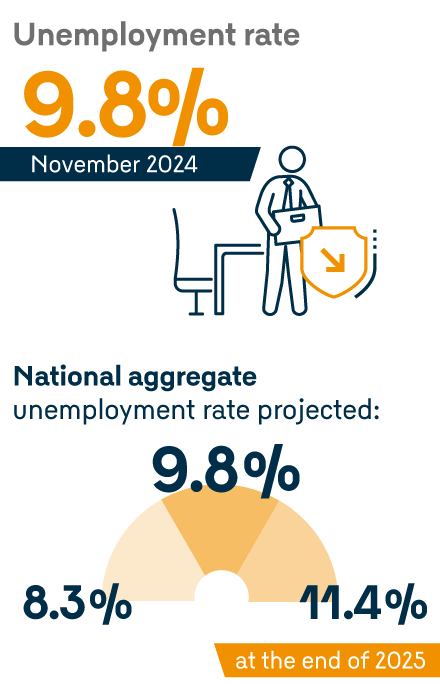

Meanwhile, the labor force participation rate (LFPR) has remained relatively stable over the past year; however, the most recent quarter saw a decline in labor supply across all sectors. This decrease in participation coincided with an increase in real monthly wages. In line with the lower labor force participation, there were reductions in the unemployment rate (UR) in recent months, particularly in other municipalities and rural areas. Nationally, the UR fell to 9.8% in the quarter ending in November. UR forecasts for 2025 suggest relative stability. Specifically, the urban UR is expected to stand between 8.5% and 11.6% at the end of 2025, with the most likely value being 10%. Meanwhile, the national aggregate UR is projected to be between 8.3% and 11.4%, with 9.8% being the most likely figure. These forecasts collectively reflect the observed and expected dynamics in economic activity. Additionally, it is anticipated that the UR gap will continue to narrow throughout 2025, with a non-accelerating inflation rate of unemployment (NAIRU) averaging 10.5%, which suggests an average of -0.5 percentage points (pp), slightly more negative than estimated in the previous Report, but in line with labor market stability.

As usual, this report is divided into two sections. The first one provides a detailed analysis of the recent labor market events summarized above. The second section presents an analysis of the effects of the increase in training costs on apprentice demand in Colombia during 2014, the year in which these costs increased from 75% to 100% of a minimum wage (MW). The analysis shows that this increase negatively and significantly affected apprentice demand, particularly for companies not required to hire them.