Sovereign Wealth Fund Management

What is a sovereign wealth fund?

A sovereign wealth fund is a state-owned investment fund through which assets are managed by investing them. Its resources generally come from surplus revenues from natural resources or commodities, the accumulation of foreign reserves, and savings from fiscal rules, among others. It aims to stabilize the economy, promote intergenerational savings, and/or finance social and infrastructure projects.

The Norwegian Government Pension Fund Global is the world's leading sovereign wealth fund, recognized for the size of its managed portfolio, broad diversification of financial instruments, and high transparency indices. The Latin American region includes the Mexican Petroleum Fund (Mexico), the Economic and Social Stabilization Fund (Chile), and the Savings and Stabilization Fund (Colombia).

The General Royalties System and the Savings and Stabilization Fund

In 2011, the General Royalties System (SGR in Spanish) was created in Colombia to determine the distribution, objectives, administration, execution, control, and destination of revenues from the exploitation of non-renewable natural resources. To comply with the objectives and purposes of the SGR, certain funds were created, one of which is the Savings and Stabilization Fund (FAE in Spanish). It was specified that its resources and returns would be allocated to the FAE Trust and managed by Banco de la República (the Central Bank of Colombia). In addition, it was established that territorial entities (regions, departments, municipalities, and districts) would be participants of the FAE, headed by the departments. The regulations governing FAE include Articles 360 and 361 of the Political Constitution of Colombia, Law 2056 of 2020 and its Regulatory Decree 1821 of 2020.

What are the objectives of the FAE Trust?

The FAE is a fund that promotes fiscal and macroeconomic stability by saving the allocation of a portion of the SGR revenues. This fund not only reinforces the stability of public spending financed by royalties; it also supports a counter-cyclical economic policy, promoting the development of regional projects without abrupt adjustments to changing economic conditions.

Therefore, the investment policy of the FAE Trust’s resources aims to maximize the profitability of the resources, incorporating risk and return objectives for a period consistent with the nature of the resources, seeking to diversify the portfolio. Thus, the FAE Trust is the portfolio managed by Banco de la República (the Central Bank of Colombia) with diversification in terms of instruments, sectors, maturities and credit ratings.

FAE Savings and Dissaving

In accordance with the Political Constitution, the SGR allocates to the FAE a remaining percentage of its budgeted revenues to savings for investment stabilization and 45% of surplus revenues from increased collections with respect to the biennial royalties budget.

On the other hand, a withdrawal from the FAE is triggered by a 20% decrease in the annual current revenues of the SGR in a fiscal year, or by successive annual reductions adding up to this decrease, or specifically by the guarantee for Peace Allocations by the SGR.

FAE Trust Governance

In terms of governance, the FAE Trust has an Investment Committee, which is responsible for determining and overseeing the investment policy by which Banco de la República (the Central Bank of Colombia) manages the FAE’s resources. It comprises the Minister of Finance and Public Credit, who chairs the Committee; the Minister of Mines and Energy; and the Director of the National Planning Department (DNP in Spanish), or their respective delegates. The Governor of Banco de la República (the Central Bank of Colombia), the auditor, and the representatives of the territorial entities attend as permanent guests, with voice but without vote. In addition, Banco de la República (the Central Bank of Colombia) acts as Secretary to the Committee.

Investment Policy and Management Practices

The investment policy defines the general criteria and limits for the selection of investments and describes the investment strategy based on the relationship between risk and return. It also details the procedures to be followed when investments exceed or fall short of established limits, includes performance assessment procedures, and establishes risk management and administration guidelines.

The FAE's asset management is governed by the principles of a prudent investor, considering diversification and the balance between risk and return to maximize profitability. Investment decisions and management are evaluated jointly as part of an overall investment strategy, rather than on the performance of individual investments.

Reporting

Banco de la República (the Central Bank of Colombia) prepares reports detailing the performance and sector composition of invested resources, assessing the associated risk levels, and verifying compliance with investment guidelines.

Results in 2024

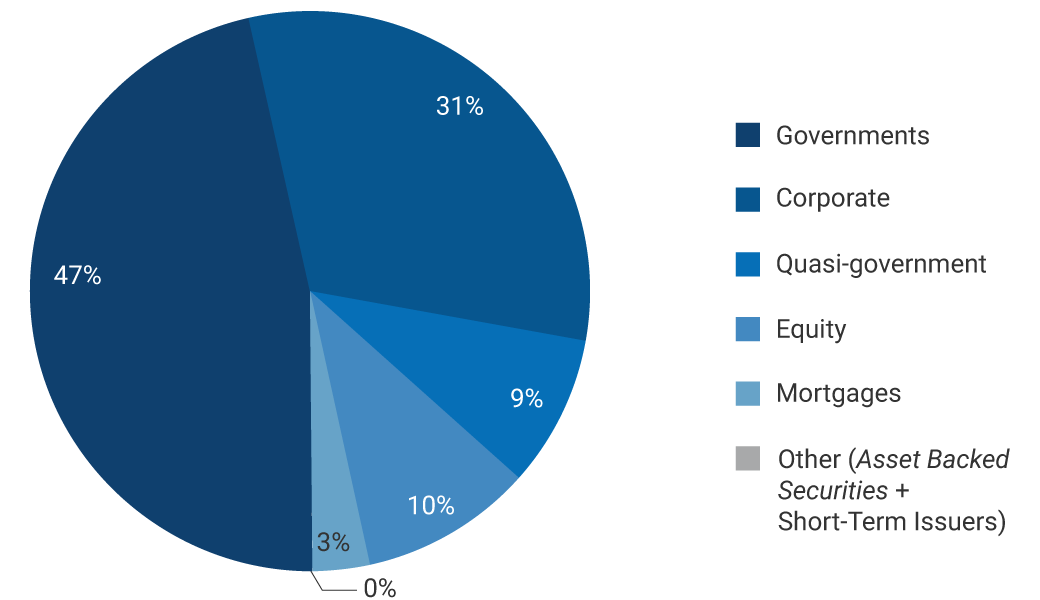

Graph 1. Composition of the investment portfolio by sector (information as of 31 December 2024)

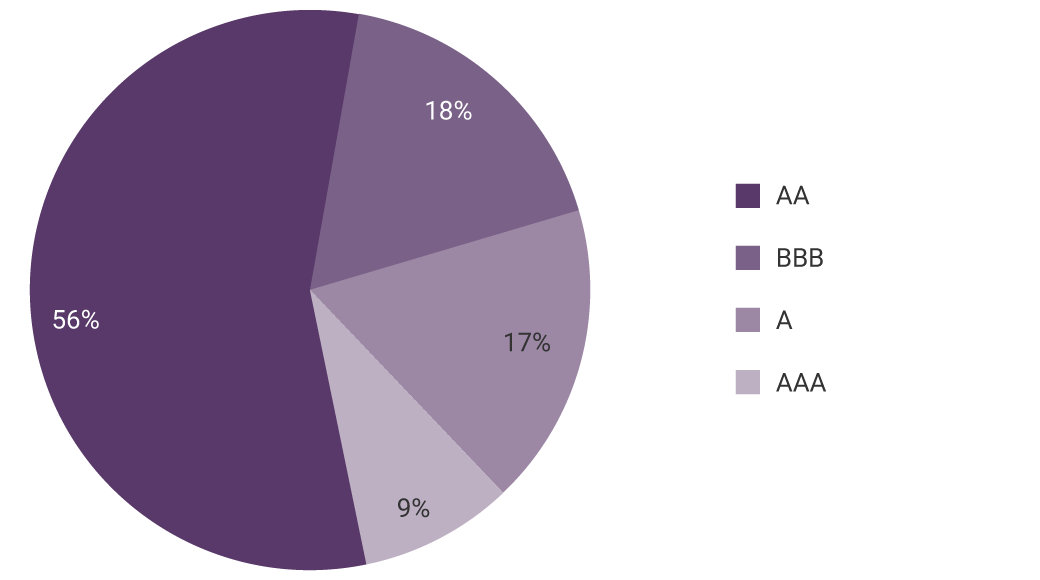

Graph 2. Distribution of investments by credit rating (information as of 31 December 2024)

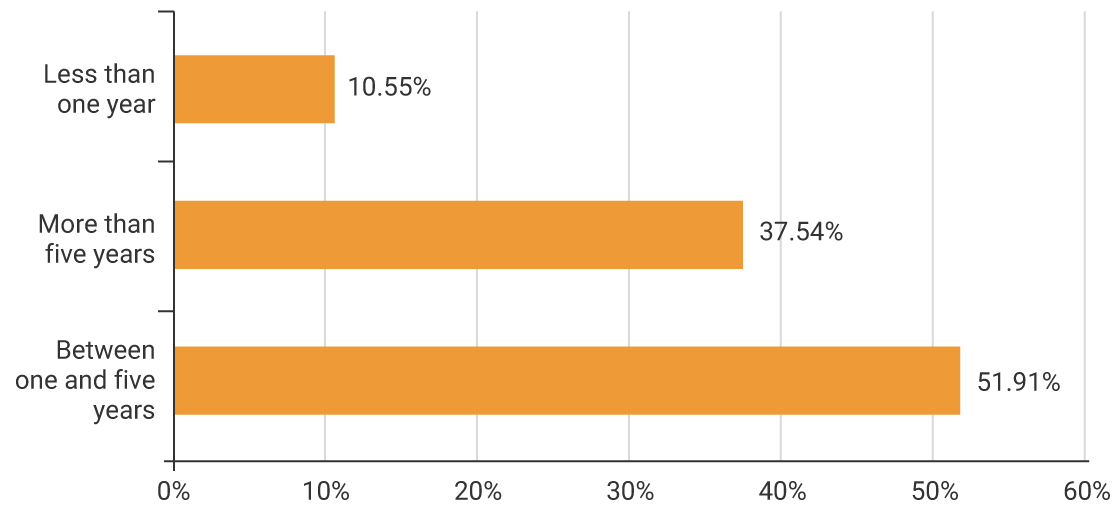

Graph 3. Composition of the investment portfolio by maturity (information as of December 2024)