Economic-knowledge: Benchmark interest rate

The main tool of the Board of Directors to guide the country’s monetary policy is the benchmark interest rate, also known as the Reference rate or policy interest rate. It is known as the “Benchmark” rate because it is the actual rate at which the Central Bank directly intervenes in the money market to provide or extract liquidity from the system. It is of reference because it serves for calculating other interest rates, and it is of monetary policy because, through it, the monetary authority defines its political stance to guide inflation towards its target (3.0% annually).

The modifications in the level of the benchmark interest rate aim to influence short-term growth and the variation of consumer prices. This happens through different transmission channels, which can be defined simply as the chain of events that start with a change of the Central Bank’s interest rate and, with some delay, affect the interest rates of the market at different terms, the exchange rate, and the inflation expectation. These variables, in turn, influence the variation in the level of prices.

In practice

In practical terms, the benchmark interest rate corresponds to the minimum interest rate Banco de la República charges the financial entities for the liquidity it provides them, generally on an overnight basis, through repo operations. In addition, it serves as a reference to establish the maximum interest rate at which the Central Bank pays them for receiving the money they have as surplus.

Changes in the benchmark interest rate established by Banco de la República’s Board of Directors are almost immediately transmitted to the short-term interest rates at which financial intermediaries borrow money. For example, the overnight benchmark interbank rate (IBR overnight) and the Interbank interest rate (TIB in Spanish). Then, after a while, they transmit to the level of Deposit and placement interest rates of the financial system. This means that the benchmark interest rate affects the costs at which financial entities borrow money among themselves (IBR and TIB), and it influences both the payment for our deposits (Deposit interest rate) and the cost of the loans we request (Lending interest rate).

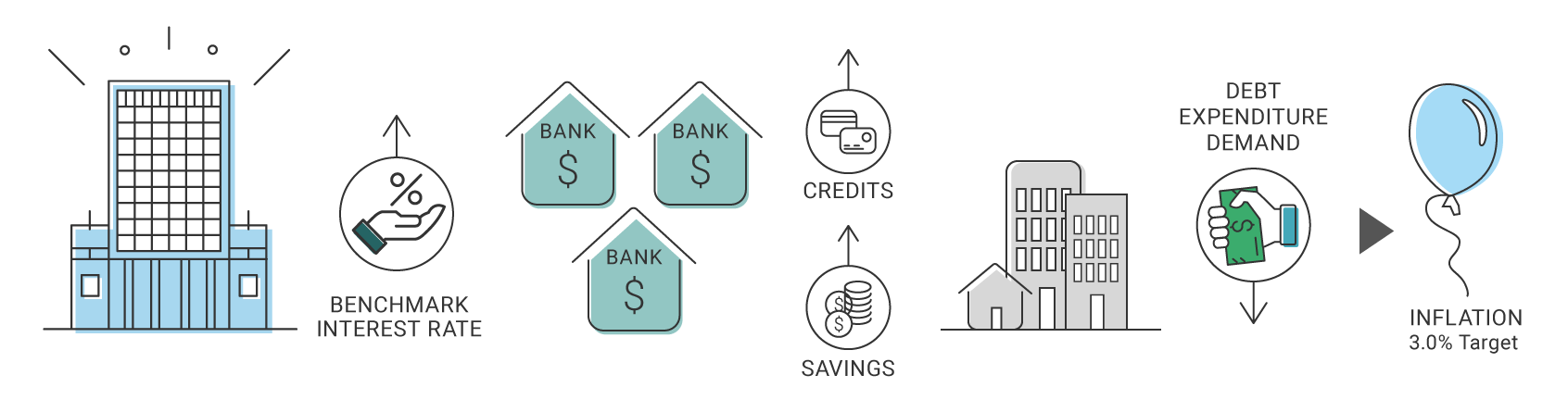

In other words, and as an example, if an increase of the benchmark interest rate makes it more expensive for a financial entity to borrow resources, either from Banco de la República or the rest of the financial system, that entity would have incentives for attracting more resources to the public. To this end, it would increase the interest rates at which it pays our deposits, motivating us to save. Likewise, this would increase the interest rate at which it charges the credits, decreasing people’s expenditure and, therefore, the economy’s demand. Furthermore, if this level of demand is coherent with the country's production capacity, it is possible to control pressures on inflation. Consequently, it contributes to meeting the objective of maintaining inflation and its expectations around the 3.0% annual target.

Lastly, it is worth reminding that the inflation targeting strategy, adopted almost two decades ago by Banco de la República, aims to explicitly communicate that all its decisions (including those related to the benchmark interest rate) are focused on keeping inflation low and stable, in order to anchor the inflation expectations to the target. Therefore, the Central Bank’s credibility remains a crucial asset that must be preserved for full compliance.

Let’s brush up!

| What is a repo? |

|---|

It is an operation in which an asset is sold (such as securities) in exchange for an amount of money, agreeing to repurchase it in the future. In this sense, it is similar to a money loan with a guarantee (the asset). The repo operations are the primary mechanism through which Banco de la República provides liquidity to the economy. They aim to adjust the money supply to ensure that the rates at which financial entities borrow each other money are close to the Banco de la República’s benchmark interest rate. |