In recent years, remittance inflows from workers to Colombia have been increasing at rates that exceed the figures for economic activity growth. As a result, their share of GDP reached an all-time high of 2.8% in 2024, up from just 1.1% a decade ago.

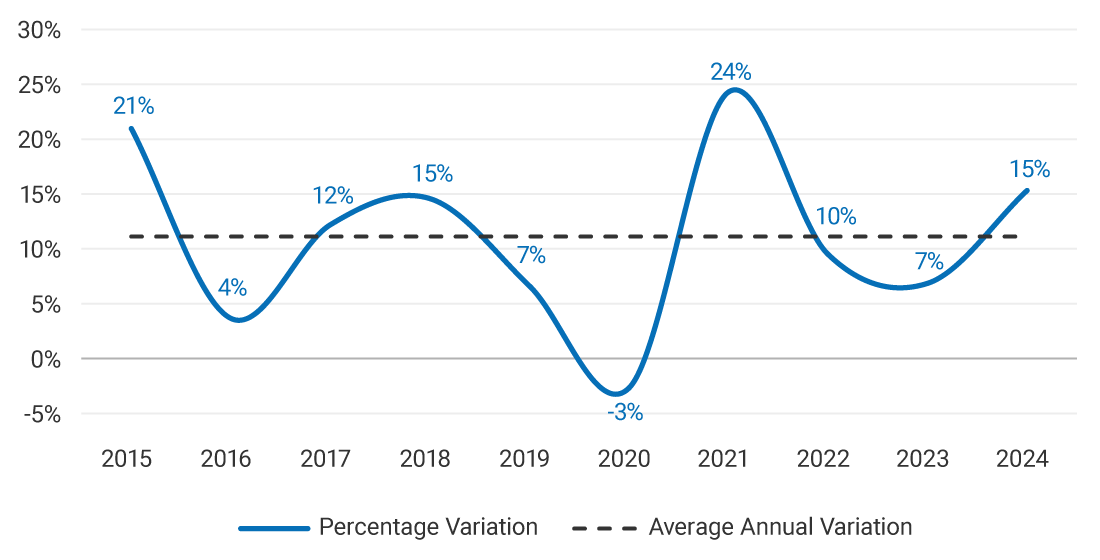

As documented in a previous blog, after a 3.0% contraction in remittances in 2020 due to the global economic crisis derived from the pandemic, there was a remarkable rebound in 2021, with a 24% growth, largely driven by the support provided by the governments of host countries to households to navigate the crisis (Graph 1). Subsequently, remittances continued to grow at an average annual rate close to 10%, and, by 2023, remittances to the country surpassed USD $10 billion for the first time.

Graph 1. Annual Variation in Dollar Value of Remittance Inflows

Source: Banco de la República (the Central Bank of Colombia)

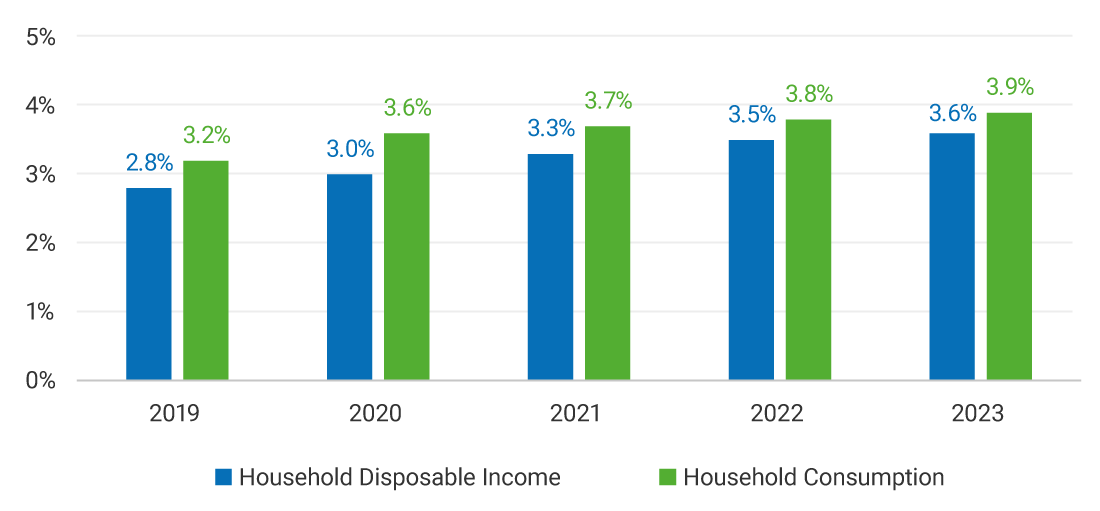

Graph 2. Remittances as a Proportion of Household Income and Consumption

Source: National Administrative Department of Statistics (DANE in Spanish)

The sustained growth of remittances from workers to Colombia has made them an increasingly important support for Colombian families, reaching 3.6% of disposable income and 3.9% of household consumption in 2023 (Graph 2). This assistance is particularly significant as it constitutes income that is not subject to the fluctuations of the local economy, thus allowing households to cushion difficulties during unemployment or other contingencies. Besides contributing to living expenses, remittances are also used for important purposes such as children’s education or investment in housing, whether for family use or to generate an additional revenue.

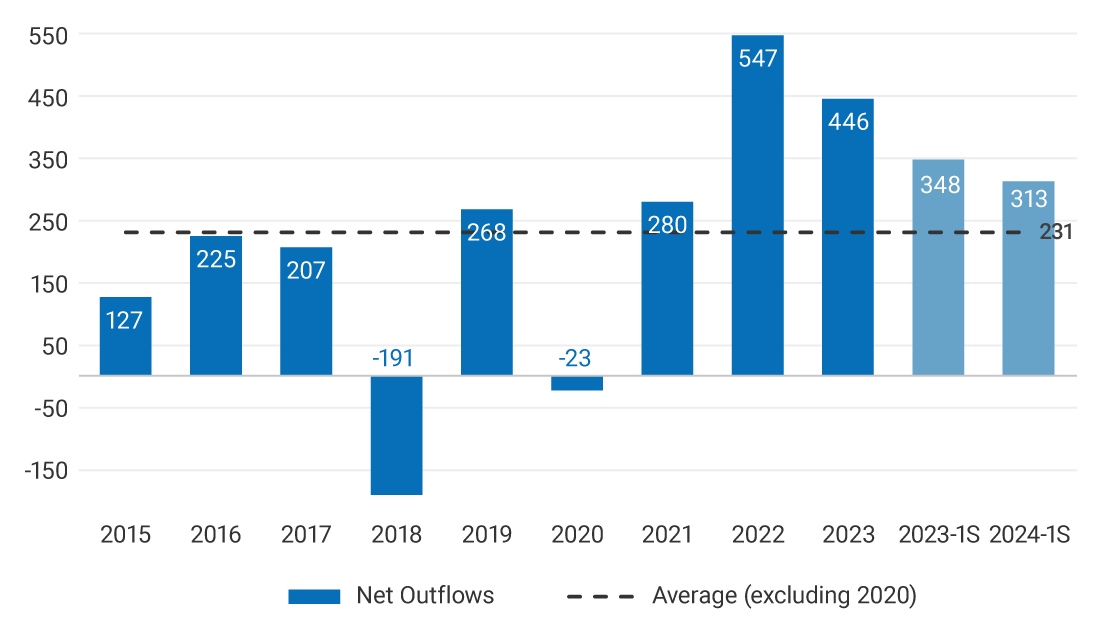

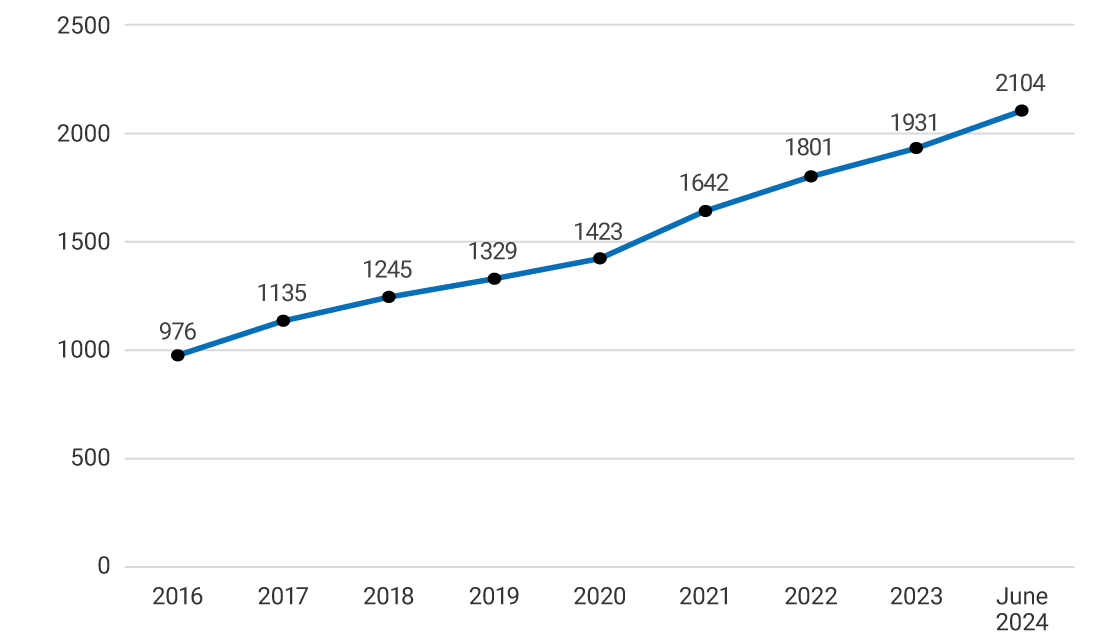

Various international studies, as well as those focused on Colombia, have shown that worker remittances result from a migratory process in which the migrant maintains a connection with their country of origin. Hence the importance of highlighting the increase in the Colombian population residing abroad, driven by significant migratory flows over the last decade, which have intensified particularly in the last three years (Graph 3). The growth of the Colombian population abroad has been reflected in the increase of family remittances, which exceeded USD $1 billion monthly for the first time in June 2024. This, in turn, has led to a substantial increase in the number of people receiving these aids in Colombia: from just under 1 million in 2016, this figure rose to 2.1 million Colombians in June 2024 (Graph 4).

Graph 3. Emigration from Colombia (thousands of people)

Note: The "net departures of Colombians abroad" is an indicator related to the flow of people emigrating from Colombia.

Source: Migración Colombia

Gráfico 4. Número de personas receptoras (en miles)

Note: Data corresponds to December of each year, except for 2024, which corresponds to June.

Source: Banco de la República (the Central Bank of Colombia)

Colombian emigrants are primarily located in the United States and Spain. In 2020, according to UN figures, 45% of the Colombian population residing abroad (excluding those living in Venezuela) was in the United States, while 25% were in Spain. This highlights the importance of illustrating the economic situation of the Colombian population in these countries, as remittances not only depend on the number of emigrants but also on their income, occupations, and job opportunities in host countries.

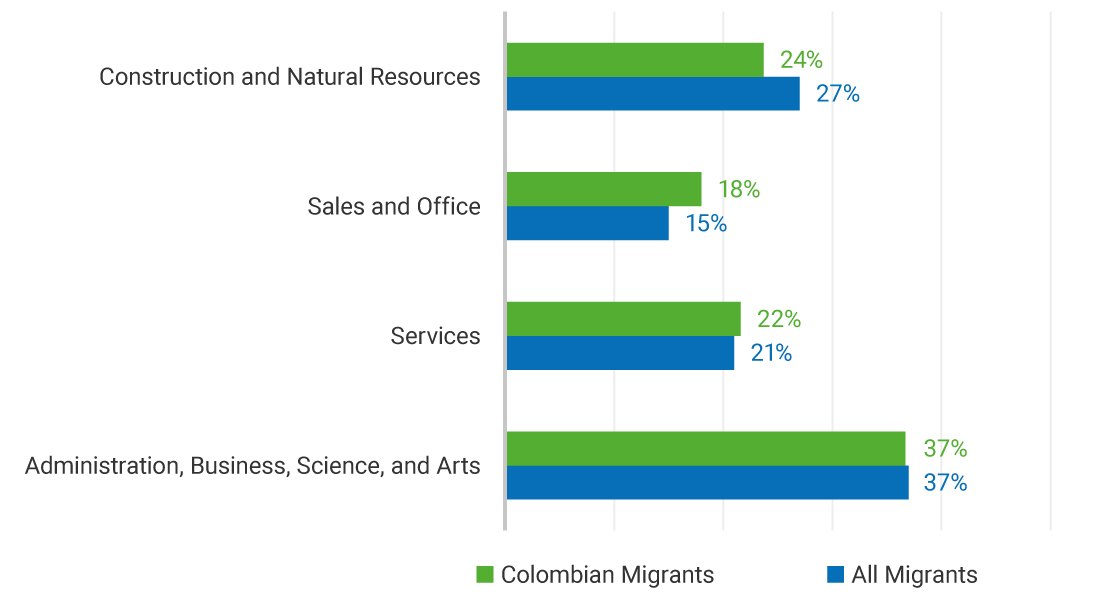

In this regard, it is noteworthy that the employment of Colombians in the United States in service-related activities (including “sales and office”) is significant and exceeds that of the average migrant (Graph 5). This represents an important benefit for Colombian migrants to that country, considering that the service sector generates over 75% of the U.S. GDP and has a lower unemployment rate than the national average. This enhances job opportunities for this population.

Graph 5. Migrants Employed as a Percentage of the U.S. Labor Force by Economic Sector

Source: U.S. Census Bureau data.

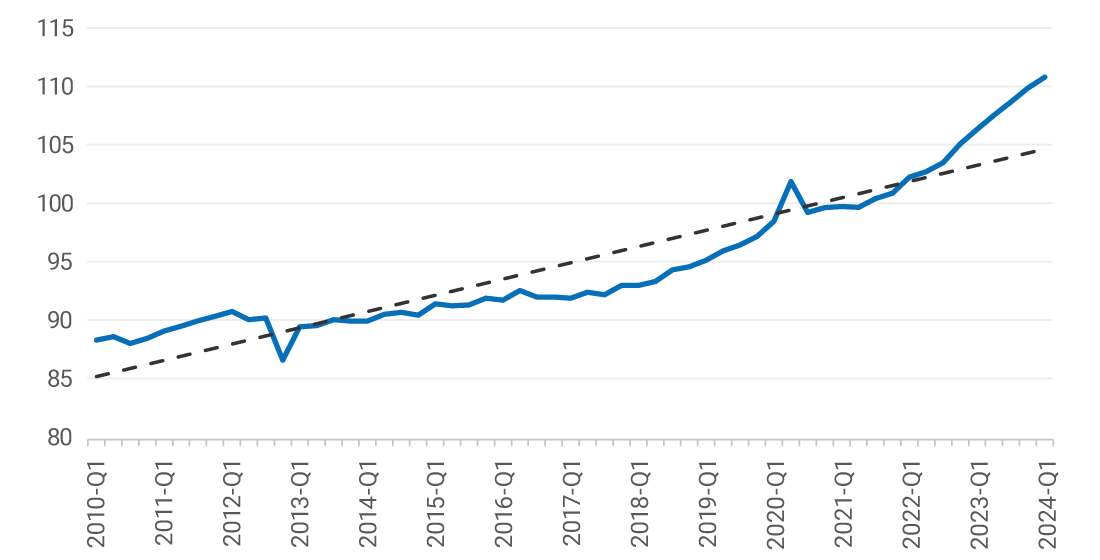

In Spain, the labor income indicator has been increasing over the last decade, with a positive trend accentuated since early 2022 (Graph 6). Additionally, the unemployment rate weighted by the autonomous communities where most Colombians reside, such as Madrid and Catalonia, is lower than the national average. This represents an additional benefit for the Colombian population living in that country in terms of a higher likelihood of obtaining well-paying jobs.

Graph 6. Real Wage Cost per Effective Working Hour for Spain (Index 2020=100)

Source: National Statistics Institute (INE in Spanish) Spain.

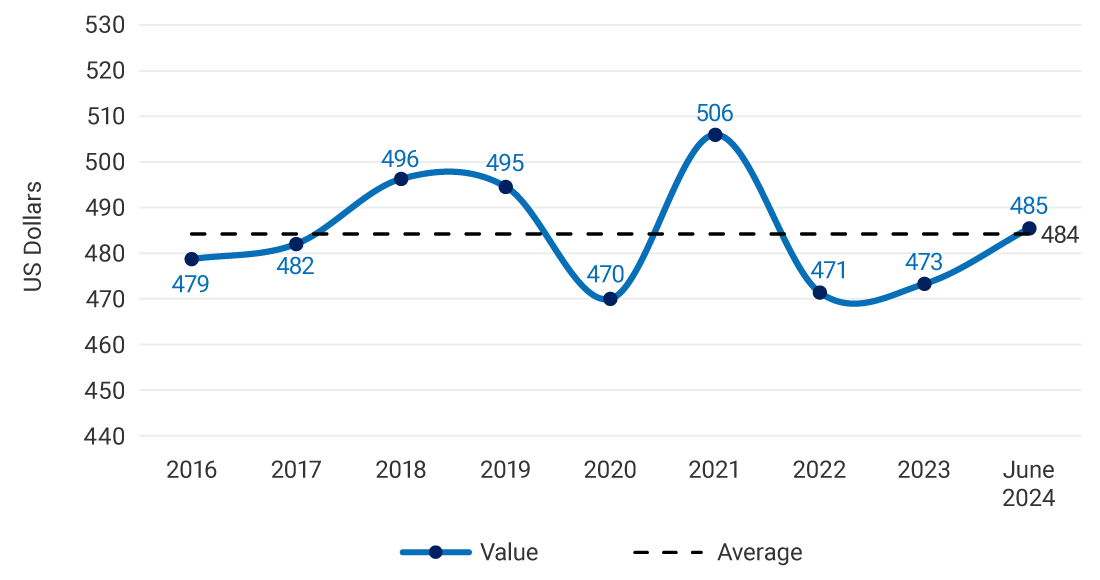

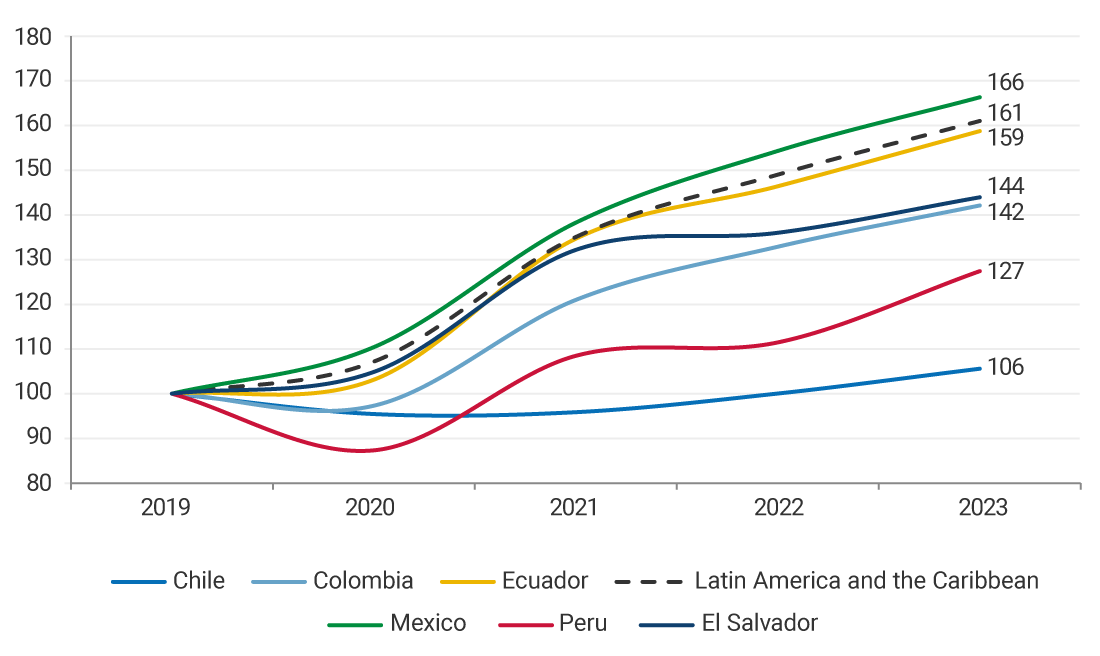

The average monthly value of remittances per recipient in current dollars has remained close to its historical amount, fluctuating between $470 and $506 (Graph 7). Moreover, the recent growth of remittances has been a widespread phenomenon in the region. Compared to pre-pandemic levels, remittances to Colombia grew by 42%, while in Latin America and the Caribbean, they increased by 61% (Graph 8). The increases in remittances to Mexico (66%), Ecuador (59%), and El Salvador (44%) were higher than those directed to Colombia.

Graph 7: Average Monthly Remittance Amount per Recipient

Source: Banco de la República (the Central Bank of Colombia)

Graph 8. Remittance Growth Index (2019=100)

Source: World Bank

In conclusion, the increase in remittances to Colombia has allowed for a greater share of this revenue in disposable income and household consumption. This growth is common to several countries in the region and, particularly for Colombia, is primarily explained by the increase in Colombian migration abroad and the job opportunities for migrant population in foreign countries, especially in the United States and Spain, which are their main destination countries.