Monetary policy decisions require taking into account the multiplicity of factors that affect price levels and their increase, considering that the interest rate can only influence some of them. Likewise, such decisions must also contemplate the time horizon in which the benefits for society are to be maximized and frame the dilemma between price stability and economic growth that monetary policy may face in the short term in this context. Both issues are highly relevant for the monetary policy design and give rise to frequent public debates. Therefore, the Technical Remarks recently published by two members of the Board of Directors of Banco de la República (the Central Bank of Colombia) (only in Spanish) —Bibiana Taboada and Mauricio Villamizar— is of particular interest.

This Blog focuses on the first issue mentioned above and discusses whether the Bank should take measures in the face of inflationary shocks fundamentally caused by supply shortages, and if so, which would be the most appropriate. Supply shocks caused by weather events, landslides, and road blockades have been recurrent in Colombia. By increasing the firms’ production costs, they tend to induce price increases. These shocks can also arise from external factors such as wars and geopolitical tensions, affecting the country through different links and business activities.

The impact of supply shocks on prices in the economy can vary widely. When these shocks are quickly diluted and their effects are concentrated in a few industries or regions, the prices of the products affected temporarily increase compared to the others, which generates changes in relative prices. In these cases, interest rate adjustments have limited effects, given that monetary policy has no impact on the supply of particular sectors, nor can it be transmitted in a targeted manner to affect demand in specific areas of economic activity

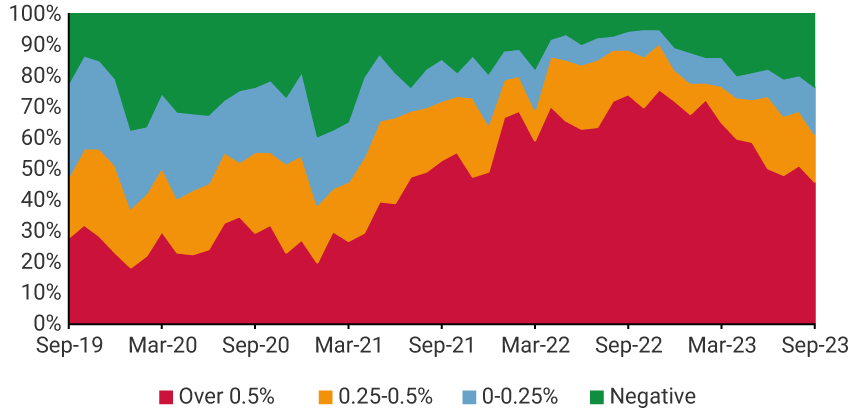

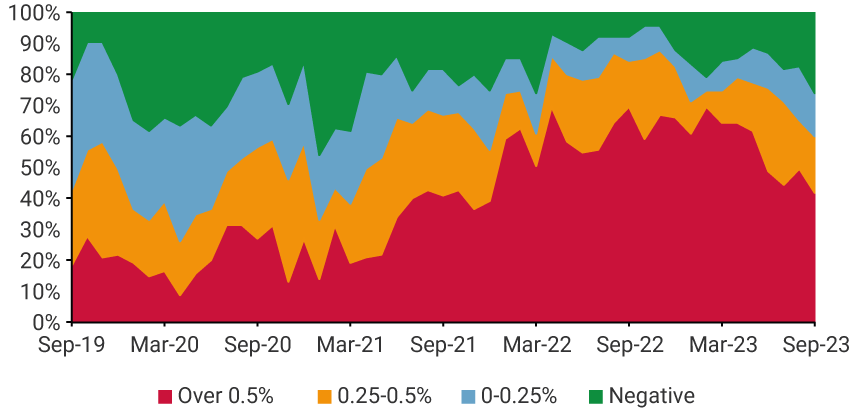

However, when there are multiple supply shocks that accumulate and persist over time, generalized price increases occur and the changes in relative prices originated in the supply shocks tend to dilute. This situation illustrates what has happened in Colombia over the past four years. The country has experienced shocks that have impacted production costs through various channels: a pandemic, the effects of expansive external fiscal policies, disruptions in supply chains, road blockades and disruptions, adverse weather events such as La Niña and El Niño, and the loss of the investment grade by two credit rating agencies, among others. This situation, unprecedented in the country's recent economic history, has not only increased the prices of some specific goods, but has also affected the entire basket of goods included in the consumer price index, as shown in Graph 1. Even if the origin of current inflation were solely due to these supply shocks (which is not the case), their broad effect on the economy merits consideration and action by monetary policy authorities.

Graph 1. Percentage of family basket items according to their monthly growth rates for the consumer price index (CPI) and for the CPI excluding food and regulated items

When shocks such as those mentioned above accumulate and last over time, they permeate the entire economy through price indexation processes and high inflation expectations, which act as adaptation or defense mechanisms for society in the face of high and volatile prices. As a result, the so-called "second-round" effects arise. These occur when, for example, producers pass on higher input costs to the final prices of their products, or when workers demand high wage adjustments to maintain the purchasing power of their income. In these cases, inflationary pressures become more acute, and what was originally a supply shock translates into expectations of higher prices for all stakeholders in the economy. This situation is known as a generalized nominal de-anchoring. Under these conditions, monetary policy must act to restore inflation expectations and control price increases.

Frente a estas circunstancias, la credibilidad que los diferentes actores de la economía tengan en la capacidad del Banco para hacer reIn these circumstances, the credibility of the different economic stakeholders in the Bank's ability to bring inflation back to its target becomes crucial. This is so because strong credibility will induce economic agents to adjust their inflation expectations in line with the target, which will reduce the effort required from monetary policy. On the contrary, if agents do not see the convergence of inflation to the target as feasible, monetary policy will have to make a greater effort for the different stakeholders in the economy to believe again that prices will remain stable, that is, to achieve the re-anchoring of inflation expectations.

Thus, while the nature of the shocks does matter, so does their magnitude and persistence, as well as the context in which they occur. The level of credibility that the Bank is able to acquire and maintain is equally important, since the magnitude of rate adjustments required to keep inflation expectations in line with the target depends on it.