On 23 July 2023, Banco de la República (the Central Bank of Colombia) celebrated its 100th anniversary, having been established as the Central Bank of Colombia through Law 25 of 1923, according to the parameters defined by the Kemmerer Mission. On the occasion of such an important anniversary, Banco de la República (the Central Bank of Colombia) has been disseminating across various media a retrospective of its contribution to the country’s development through the effective fulfillment of the central banking and cultural functions entrusted by the Constitution and the Law. This was done, for example, in the March 2023 Report to Congress, which analyzed the role played by this institution in the management of inflation since the 1991 Constitution and its implications for the current situation.

In its discussions, the National Constituent Assembly gave special importance to price stability and considered that the institution responsible for this task should be enshrined in the Constitution and have the technical capacity and institutional autonomy necessary to achieve this objective. On this basis, Banco de la República (the Central Bank of Colombia) progressively incorporated the institutional advances of central banks in countries that have successfully controlled inflation. Subsequently, the Constitutional Court, in a 1999 ruling, ratified that the basic constitutional purpose of Banco de la República (the Central Bank of Colombia) is the protection of a sound currency, but also pointed out that, in its decisions, the Bank must consider other fundamental objectives of State intervention, such as economic growth and employment, to ensure an effective coordination with the general economic policy.

The National Constituent Assembly's motivation for including monetary management in the new Constitution was based on its conviction of the important benefits of low and stable inflation for society as a whole and for the proper functioning of the economic system. Such benefits are manifold, including the fact that low inflation facilitates the efficient use of productive resources, promotes economic growth, and increases the welfare of the population. It also reduces uncertainty about the expected profitability of investment, which stimulates investment and increases the confidence of economic agents. Low inflation avoids arbitrary redistribution of income and wealth, considering that people in lower-income levels tend to be the most affected by inflationary shocks. On the other hand, low inflation helps to create a good working environment and reduces employment level volatility. It also contributes to a more transparent and equitable tax system by avoiding the distortions brought about by inflation on the value of assets and income. Finally, from the monetary authority’s point of view, one of the most relevant benefits of low inflation is the credibility gained by economic agents in the inflation target, which makes it an effective nominal anchor on the price level. This, in turn, allows the exchange rate to fluctuate against other currencies and become the first defense mechanism against external shocks, such as abrupt changes in the prices of exported goods or in international financial conditions, thus mitigating the effects of such shocks on the economy as a whole.

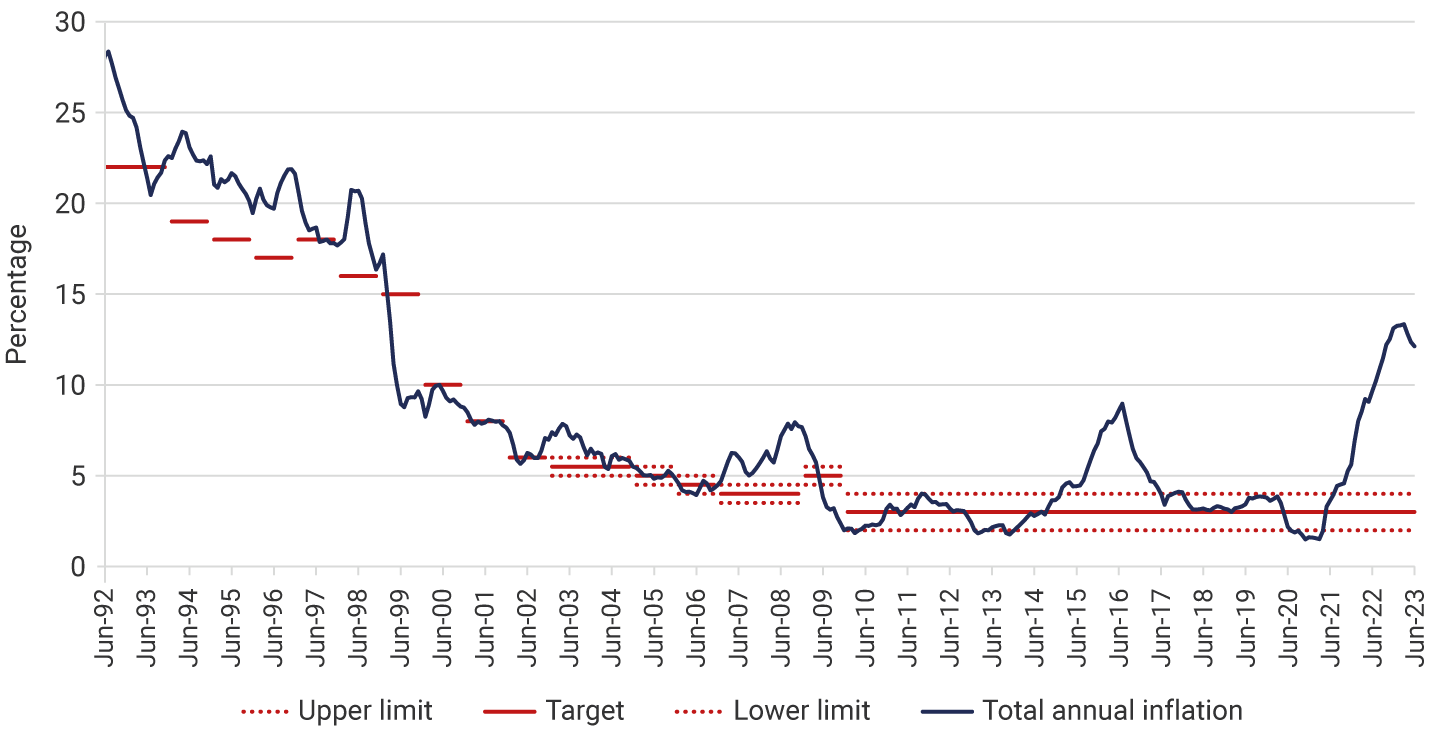

Upon receiving its mandate and per its autonomy, Banco de la República (the Central Bank of Colombia) began to announce specific annual inflation targets starting in 1992. Although in this first stage the proposed inflation targets were not precisely met, a downward trend in inflation was achieved, which took it from a level of 32.4% in 1990 to 16.7% in 1998 (Graph 1).

Graph 1. Total annual consumer inflation and its target

In 1999, annual inflation fell to 9.2% in the context of an economic contraction that affected several Latin American countries, partly as a result of the contagion from the Asian and Russian crises of 1997 and 1998, respectively. Shortly before the beginning of the 21st century, Banco de la República (the Central Bank of Colombia) announced the adoption of a new monetary policy regime called the Inflation Targeting Scheme and abandoned the currency bands it had been using since the early 1990s. This increased monetary policy autonomy by avoiding the inherent conflict of simultaneous inflation and exchange-rate targets. This enabled monetary policy to be managed countercyclically, which had not been possible to do before.

In its first years, the new monetary policy scheme sought to comply with the decreasing inflation targets established by the Board of Directors of Banco de la República (the Central Bank of Colombia) and at the same time stimulate the recovery of economic activity. This purpose was fully achieved. Inflation continued to decline progressively during the first half of the 2000s, in line with the proposed inflation targets, reaching a level of 4.5% in 2006. At the same time, economic activity recovered to 6.8% growth in 2006. Inflation rebounded to 5.7% in 2007 in a context of rapidly growing demand and GDP growth of 7.5% per year, exceeding potential output capacity. Beginning in 2010, the BDBR established the long-term annual 3.0% inflation target, which is still effective today. The credibility that the long-term target gained in subsequent years made it possible to successfully face the inflationary shock of 2015-2016 as a result of the sharp devaluation that followed the fall of oil prices and the El Niño phenomenon (Graph 1).

The tangible achievements made by Banco de la República (the Central Bank of Colombia) in managing inflation over the last two decades gave the BDBR the necessary elements to confidently face the difficult challenge of bringing the current high level of inflation back to its long-term target of 3.0%. Recent signs are encouraging. After peaking at 13.3% last March, annual inflation began to decline to 12.1% at the end of June. Monetary policy will continue to focus on achieving this objective while ensuring the sustainability of economic activity, as mandated by the Constitution. The forecasts of the technical staff, the expectations of economic analysts, and those derived from public debt markets coincide in that consumer price inflation will continue to decline during the remainder of 2023, and that this process will consolidate during 2024. The BDBR will remain attentive to the performance of inflation in the coming months and will monitor the risks that would arise from a new El Niño phenomenon, from exchange rate pressures, or from changes in the global context, in order to adopt the monetary policy stance it deems most appropriate in a timely manner.