As of June 2021, the National Administrative Department of Statistics (DANE in Spanish) and Banco de la República (the Central Bank of Colombia) began to jointly disclose the national accounts by institutional sector (CNSI in Spanish), which will henceforth be published quarterly and with a lag of less than three months. DANE prepares the National Accounts, which record all economic transactions from the point of view of production, revenue, final demand, and the calculation of the non-financial net lending, understood as the imbalance between savings and investment. Banco de la República (Banrep) is in charge of preparing the financial accounts based on information on financial assets and liabilities and calculates the financial net lending, which is the counterpart of the real net lending, corresponding to the imbalance between savings and investment calculated by DANE1. The joint work between the two entities guarantees the macroeconomic coherence and consistency of the results, which offers a valuable tool for the analysis and monitoring of the Colombian economy.

The possibilities offered by the quarterly and coordinated publication of the National Accounts by DANE and the financial accounts of Banco de la República constitute a great advance in the Colombian statistical system. The new National Accounts by Institutional Sector (CNSI) will make it possible to monitor the economic balances and their interrelation and will become an important source of information that will undoubtedly allow for a deeper understanding of the Colombian economy. The figures already published illustrate their relevance for the macroeconomic analysis of recent years.

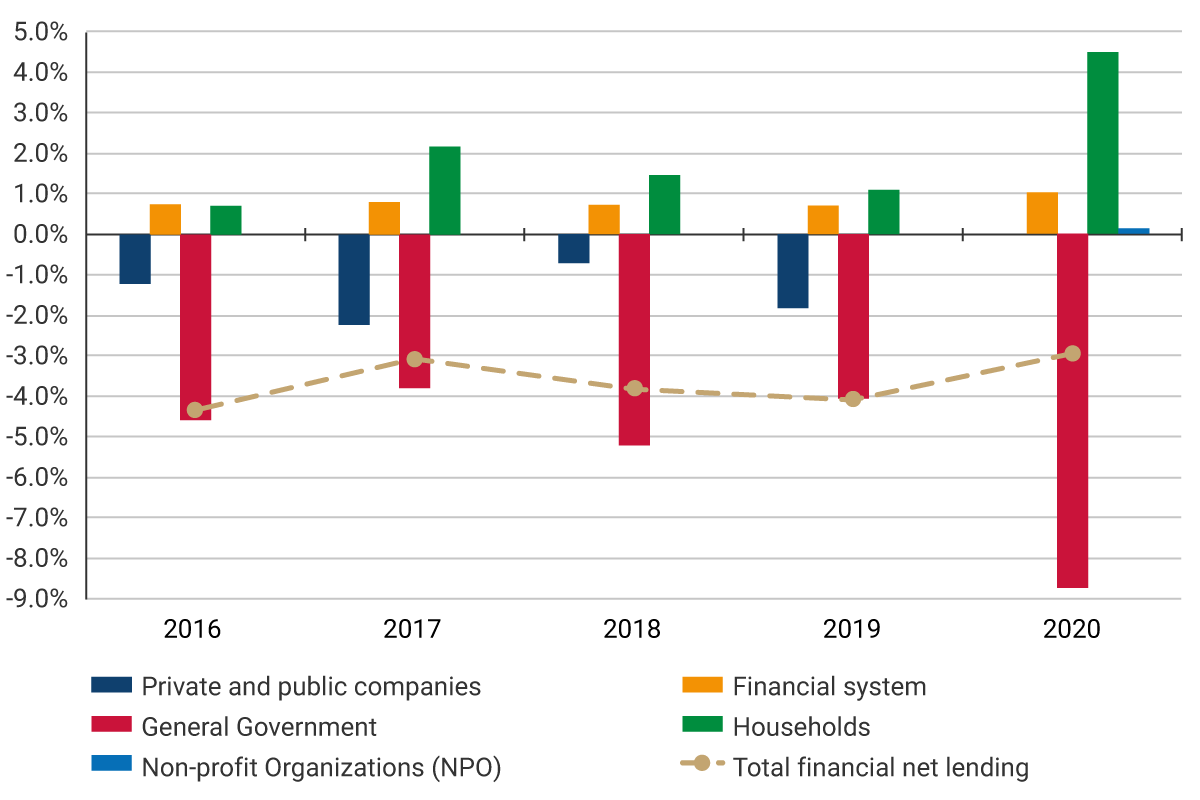

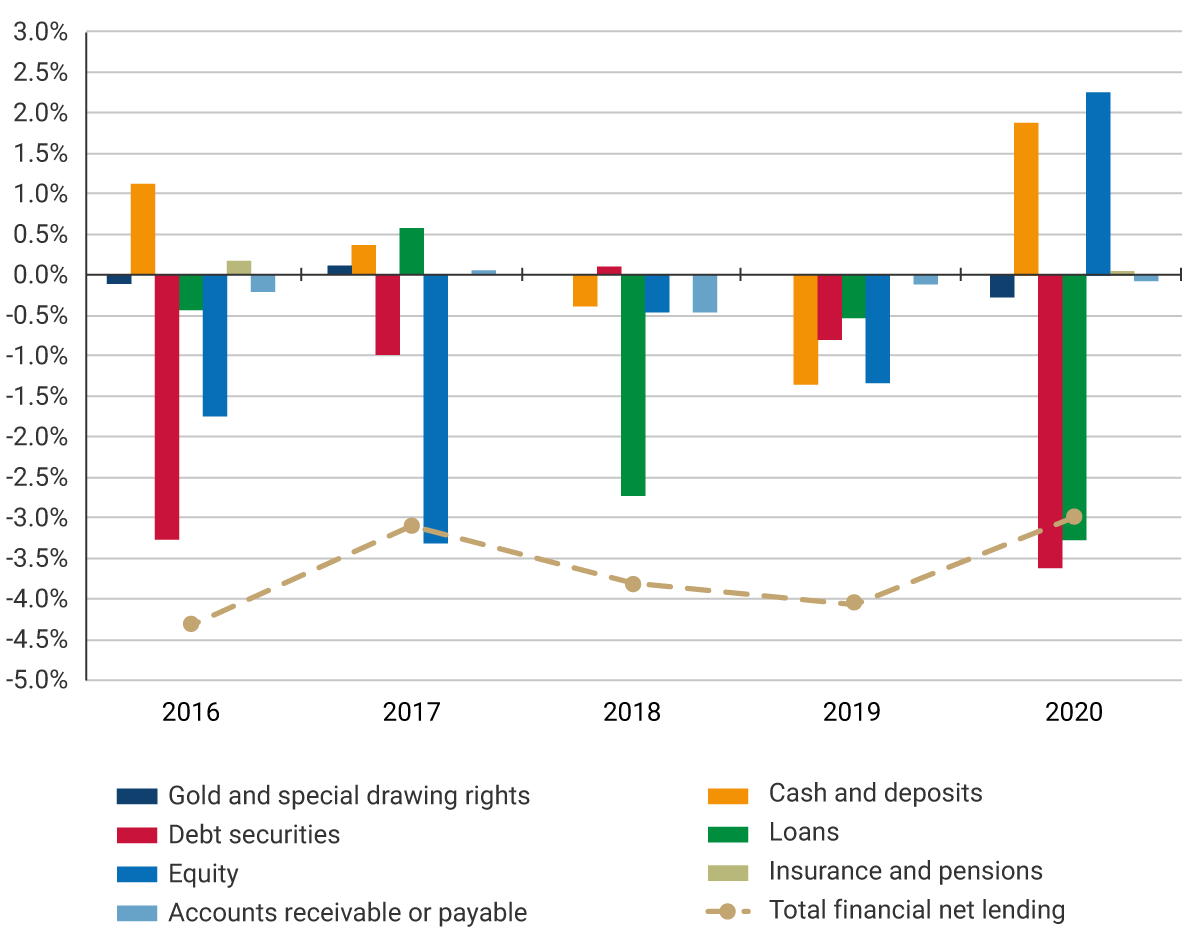

Graph 1 shows that in the 2016-2020 period, the Colombian economy was in deficit in its relations with the rest of the world, with annual financial net lending fluctuating between 3.0% and 4.3% of Gross Domestic Product (GDP). The general government2 was the sector with the largest deficit, followed by private and public companies, while households and the financial system were in surplus. The financing needs of the Colombian economy as a whole were covered with resources from the rest of the world in the form of equity, debt securities, and loans, as shown in Graph 2.

The COVID-19 pandemic significantly affected the balance sheets of the economy and its sectors. In 2020, the economy showed a deficit of 3.0% of GDP, lower than the deficit recorded in 2019, as shown by total financial net lending. This result was due to higher surpluses generated by households and the financial system (5.3% of GDP), which more than offset the increase in the general government deficit to 8.7% of GDP at the end of 2020 (Graph 1).

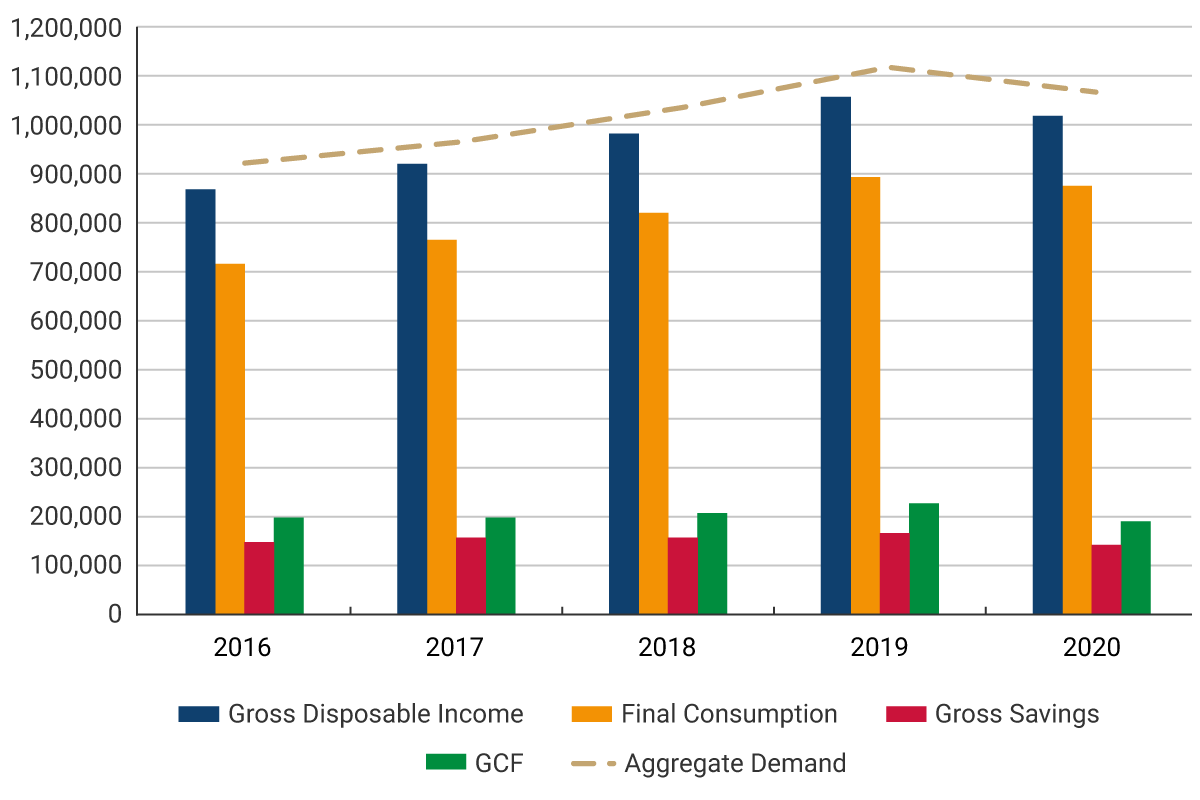

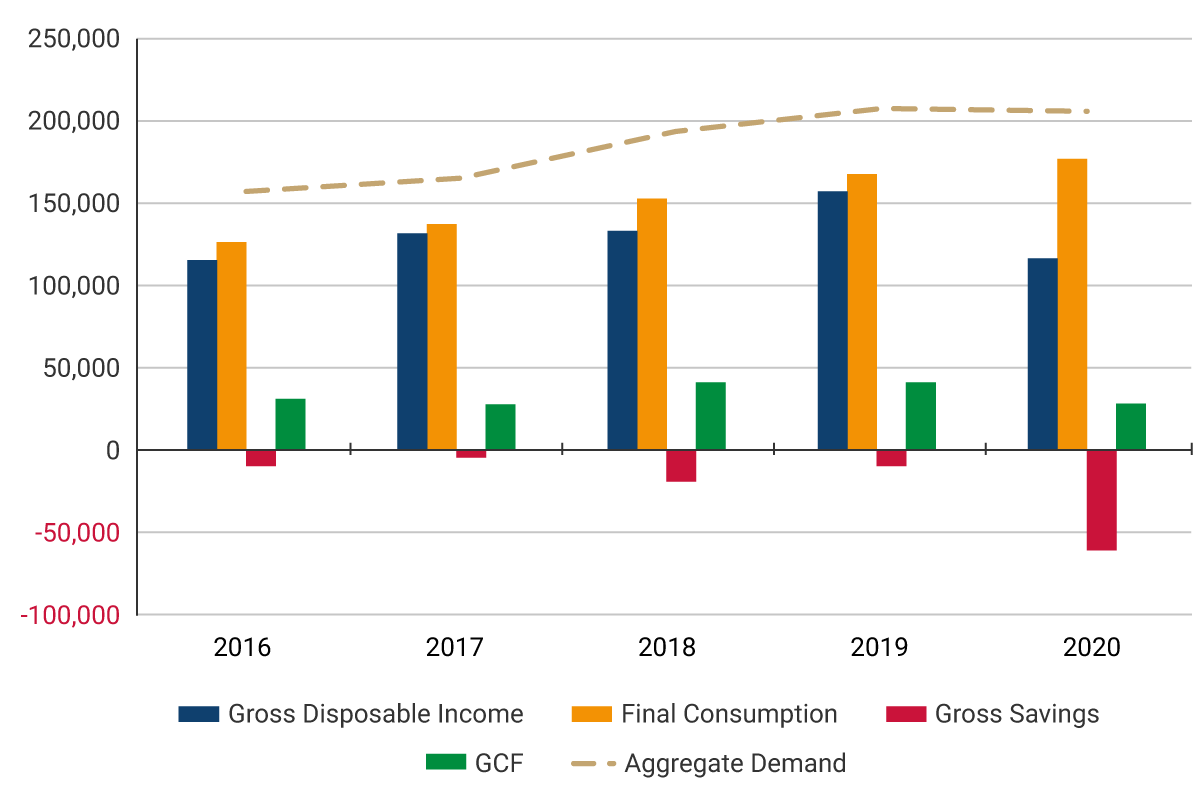

To better understand this result, Graph 3 presents in three panels the origin of the balance sheets of the total economy, households, and general government. Starting with the top panel, as a consequence of the pandemic, the economy as a whole showed a widespread fall in both disposable income and aggregate demand (final consumption plus gross capital formation (GCF)) in 2020, after these items had grown persistently since 2016. The reduction in aggregate demand was more pronounced than the fall in disposable income, which was reflected in a smaller overall deficit of the economy with the rest of the world.

The middle panel shows the evolution and performance of the components of the Colombian household balance sheet. In 2020, there was a substantial increase in the level of household savings, which is explained by a reduction in current consumption, greater than the fall in disposable income. The latter was maintained thanks to the increase in transfers, especially those received from the general government.

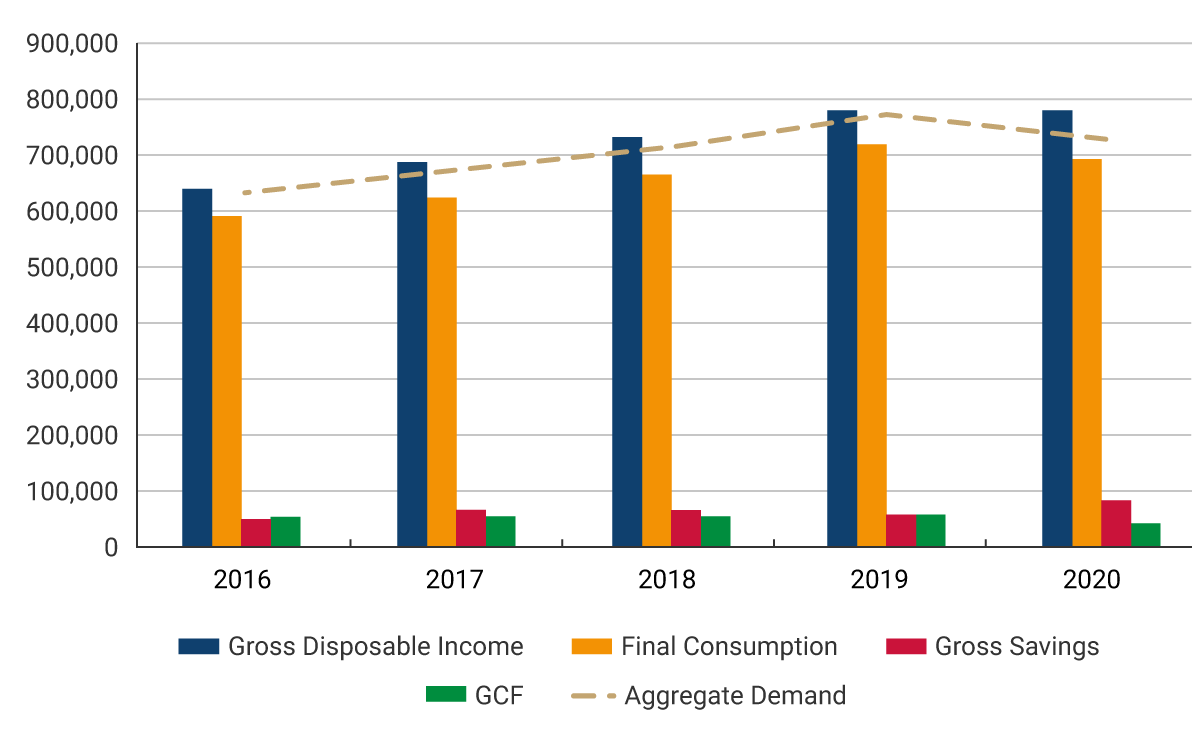

The lower panel shows how the general government’s disposable income was significantly reduced (due to the fall in tax revenues and the increase in transfers to households), which, together with higher final consumption expenditure, implied greater dissaving by this sector. In terms of financing, this implied a sharp increase in public debt, which was reflected in significant capital inflows from the rest of the world through loans and debt securities.

Graph 3. Colombia’s Non-Financial Net Lending: By components of Nominal Revenues and Expenditures 2016 – 2020. Billions of Colombian pesos

Source: DANE, National Accounts of Institutional Sectors

1 There are statistical discrepancies between the current account deficit of the balance of payments, the real net lending calculated by DANE, and the financial net lending calculated by Banco de la República due to the use of different sources of information.

2 Which is made up of the central national government, local and departmental governments, and social security.