A recent paper published in Ensayos sobre Política Económica (ESPE) a journal of >Banco de la República (the Central Bank of Colombia), examines the constraints faced by Colombian smallholder farmers in accessing credit. Among other findings, the paper presents the results of a study done by Camilo Bohórquez, Margarita Gáfaro, Karelys Guzmán, and Alex Pérez analyzing the effects of climate risk on credit access using small-scale potato producers as a case study.

In Colombia, agriculture is highly dependent on weather conditions. In the absence of a robust insurance market, credit serves as a tool to mitigate the effects of weather fluctuations on farmers' income and costs. However, uncertainty regarding future climate conditions makes access to credit more difficult. On the one hand, climate risk discourages farmers from applying for loans due to concerns over their ability to repay. On the other hand, financial institutions tend to perceive these farmers as too risky, particularly those exposed to greater climate variability, reducing their willingness to extend credit.

The authors use data from the credit operations of the Agricultural Sector Financing Fund (Finagro in Spanish) along with municipal rainfall information calculated from the Climate Hazard Group (CHIRPS) data provided by the University of California, Santa Barbara. These data are used to estimate the effect of climate risk on credit disbursements to smallholder potato farmers in Colombia.

The results of the study confirm that climate uncertainty, measured by using the variation coefficient of municipal daily rainfall reduces credit disbursements. Furthermore, results show that this decline in credit access in the face of greater climatic uncertainty is more pronounced in areas farther from urban centers and in loans not backed by the Agricultural Guarantee Fund (FAG in Spanish).

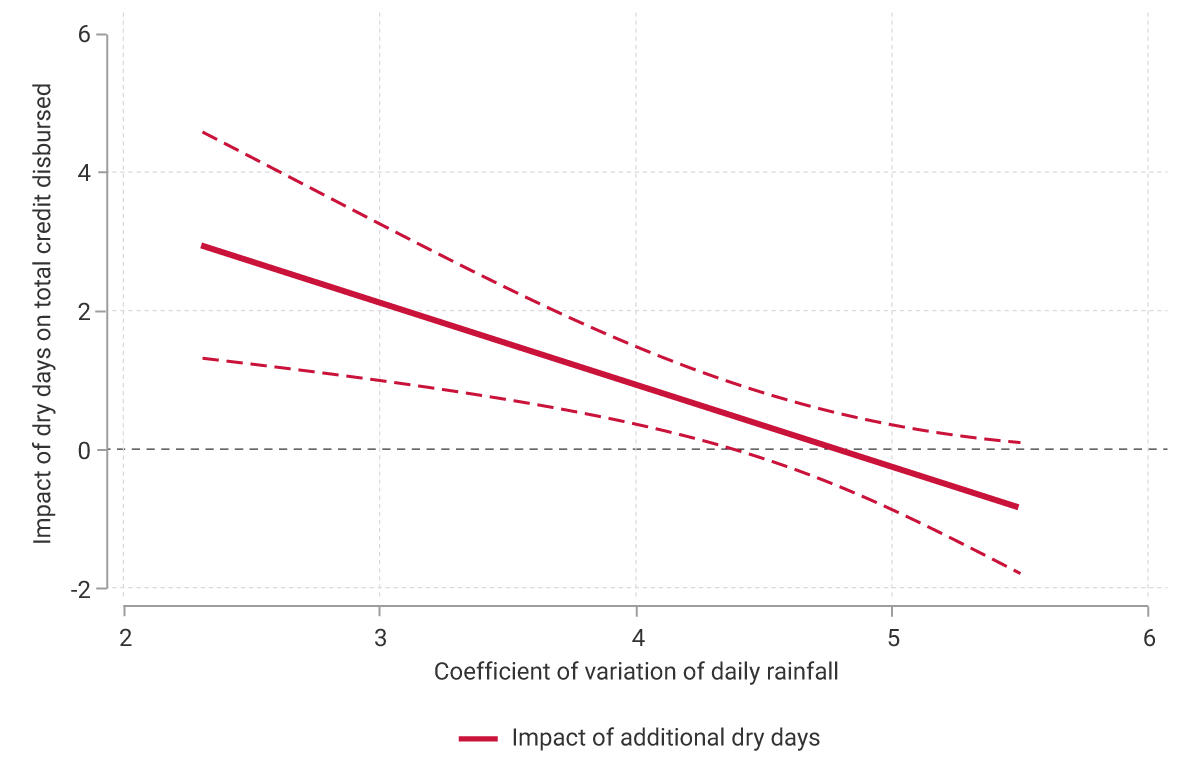

Graph 1 provides a more specific feature of these results. It exhibits the effect of one additional dry day on total credit disbursements per municipality, depending on the municipality’s historical climate variability, as measured by the rainfall variation coefficient. In municipalities with low historical rainfall variability, additional dry days are, in fact, associated with higher credit disbursements. However, this effect weakens and becomes insignificant as climate variability increases. This evidence is consistent with the idea that credit serves to mitigate the effects of droughts, but its effectiveness diminishes when climate risk is high. In other words, under high climate risk, credit ceases to function as an effective mechanism to alleviate income losses caused by prolonged dry spells.

The study focuses on potato producers, which allows for a more precise identification of the effects analyzed. However, results suggest the existence of credit access constraints associated with climate risk, which could extend to other crops. Increases in rainfall variability resulting from climate change could exacerbate these constraints. Recognizing this challenge and adopting measures to address it should be a priority in climate change adaptation policies.

In this context, the development of the insurance market is an effective way to protect producers from climate risk. In particular, international experience shows that weather-indexed insurance can be an effective instrument. However, its implementation has faced significant challenges, especially due to liquidity constraints and limitations in the availability of climate data. The literature suggests that these obstacles can be overcome by improving the accuracy of climate data, redesigning insurance contracts to ensure more timely payouts, conducting financial education campaigns, and providing temporary subsidies to facilitate the initial adoption of insurance.