Report of the Board of Directors to the Congress of Colombia, July 2024

Pursuant to Article 5 of Law 31 of 1992, the Board of Directors of Banco de la República (the Central Bank of Colombia) submits a report to the Honorable Congress of Colombia, informing about the performance of the economy and its outlook. This report is submitted twice a year, in March and July, within ten business days following the start date of the sessions of the Congress.

In the first quarter of 2024, the figures of the National Administrative Department of Statistics (DANE in Spanish) showed that the economy achieved annual growth of 0.9%. Although this result was moderate, it confirmed the economy's recovery path. Monetary policy has played a critical role in containing inflationary pressures. This has allowed inflation to trend downwards, continuing into the first half of 2024. Net foreign reserves totaled USD 60,901 million as of 30 June 2024, a slight increase over the course of the year. For 2024, the profit of Banco de la República (the Central Bank of Colombia) is projected at COP 8,795 billion.

International macroeconomic environment

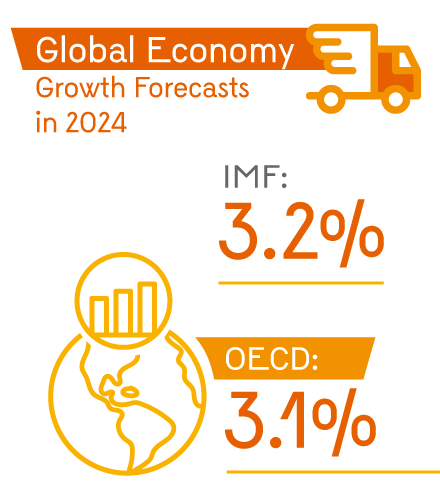

- The global economy would continue to grow in 2024 at a rate slightly higher than 3.0%, according to forecasts from the International Monetary Fund (3.2%) and the Organization for Economic Cooperation and Development (3.1%).

- This dynamic is lower than the pre-pandemic historical average due to the long-term consequences of COVID-19, Russia’s invasion of Ukraine, and growing geoeconomic fragmentation, among other reasons.

- Various advanced and emerging economies, particularly the United States and some Asian countries, have seen favorable growth due to strong aggregate demands, dynamic private consumption, and high public spending. Meanwhile, inflation has been on a downward trend, but with values exceeding the goals of its central banks.

- In several developing countries, inflationary pressures have been significant due to the transfer of high international food, energy, and fertilizer costs and higher-than-expected currency declines. These factors have affected growth in these economies amid tight monetary policies.

Economic activity in Colombia

- In the first quarter of 2024, DANE figures showed that the economy achieved annual growth of 0.9%. Although the result was moderate, it confirmed the economy's recovery path after the annual contraction in the third quarter of 2023 (-0.7%), followed by 0.4% annual growth in the last quarter of the previous year.

- On the expenditure side, the annual growth seen in the first quarter of 2024 was driven by net external demand, given an annual drop in imports (-13.3%) and an annual increase in exports (2.4%).

- On the supply side, the agriculture sector, public administration, health and education services, and arts and entertainment activities grew the most annually.

- The tight monetary policy and higher tax rates that characterized the 2023 adjustment continued to impact the economy's aggregate spending, which was also affected by low levels of business and consumer confidence.

- During the second quarter, the economy would have continued to increase its growth rate, driven by the good performance of the agriculture sector and the dynamics of some services related to public administration, health, education, and entertainment.

- Banco de la República’s (Banrep) technical staff expects that in the second half of the year, the economy will continue to gradually improve its dynamics to achieve growth of around 1.8% throughout 2024 and approach its potential growth in 2025.

Employment

- Early 2024 saw unemployment rate increases driven by deteriorating employment, after which this indicator has remained relatively stable. Thus, between December 2023 and May 2024, the unemployment rate for the domestic aggregate rose 0.2 percentage points (pp) to reach 10.5% in May.

- The number of employed people remained relatively stable for the domestic aggregate, with levels close to 22.9 million (m) jobs.

- The reduction in salaried employment, coupled with recent growth in the non-salaried segment, explains the increased informality rate. This rate stood at 56.2% in May 2024, one percentage point higher than in December 2023.

Inflation and Monetary Policy

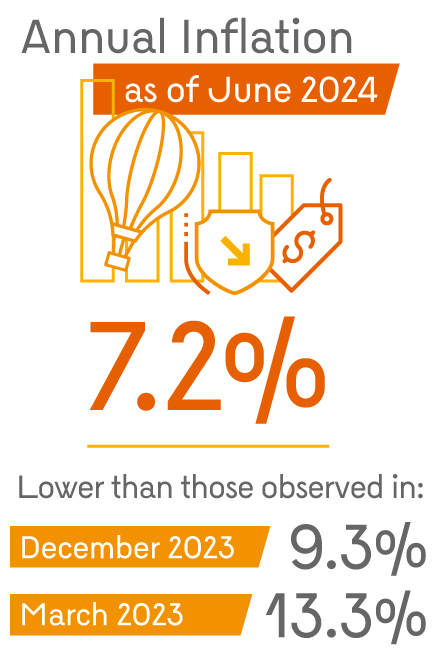

- Headline inflation in June was 7.2%, lower than that seen in December (9.3%) and well below the high level reached in March 2023 (13.3%).

- The downward trend in inflation has primarily resulted from tight monetary policy carried out by the Board of Directors of Banco de la República (BDBR) through progressive increases in the benchmark interest rate initiated as of September 2021.

- The BDBR’s decision to undertake a monetary policy easing cycle as of last December was based on the downward trend that annual inflation had been exhibiting since April 2023 and evidence that tight monetary policy was meeting its goal of reducing excess spending in the economy.

- A cumulative 2.5 percentage point policy interest rate cut was completed by July 2024, bringing it to 10.75%.

Balance of payments

- As a share of quarterly gross domestic product (GDP), the current account deficit of the balance of payments decreased from 3.7% of GDP in the first quarter of 2023 to 1.9% in the first quarter of this year.

- The decrease in the current account deficit balance was explained by the favorable variation in factor income, the services trade balance, and net income from current transfers.

- By 2024, the technical staff projects a current account deficit close to 2.8% of GDP, moderately higher than the 2.5% deficit observed in 2023 and significantly lower than the 6.1% deficit of GDP recorded in 2022. The smaller current account deficit makes the Colombian economy less vulnerable to negative external shocks.

Public finance

- The 2024 Medium-Term Fiscal Framework (MTFF-24), presented by the Ministry of Finance in mid-June, shows that the General Government produced a 2.7% deficit of GDP in 2023, which means a reduction of 3.6 pp vis-a-vis 2022.

- This adjustment is explained by the improvement in the balances of the social security sub-sector, of the rest of the central level to which the Fuel Price Stabilization Fund (FEPC in Spanish) belongs, and of the Central National Government (CNG). The surplus of the FEPC, which closed at 0.4% of GDP in 2023, stands out in contrast to the 1.3% deficit registered a year earlier.

- The adjustment of the CNG’s public finances in 2023 was supported by the boost in tax collection derived from the reforms approved in 2021 and 2022, as well as by the good dynamics of economic and oil activity in those years. According to the MTFF-24, in 2023, the CNG's fiscal deficit and net debt reached 4.3% and 53.8% of GDP, respectively.

- MTFF-24’s fiscal deficit forecasts are consistent with compliance with the fiscal rule. However, as stated by the Independent Fiscal Rule Committee (CARF in Spanish), there are risks around collection and spending expectations.

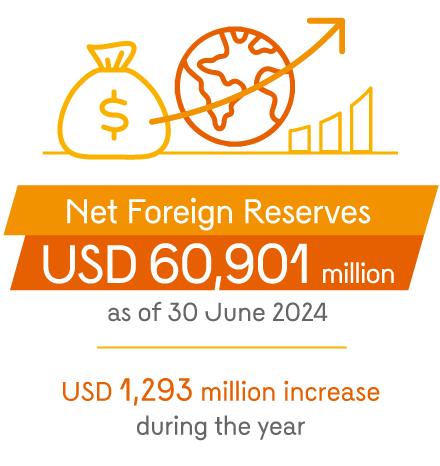

Foreign reserves

- Net foreign reserves totaled USD 60,901 m as of 30 June 2024, an increase of USD 1,293 m over the course of the year. This increase is primarily due to the program to accumulate international reserves announced by the BDBR in December 2023.

- The return on the foreign reserves for the year, excluding the foreign exchange component, amounts to 1.43% (USD 864 m). This result is mainly explained by higher interest rates, which have positively impacted the return on foreign reserves.

- An economy is considered to maintain adequate reserve levels if, among other indicators, the ratio of the reserves to the appropriate level is between 1.0 and 1.5. With information available as of June 2024, the ARA calculated for Colombia by the IMF was 1.24.

Profits of Banco de la República

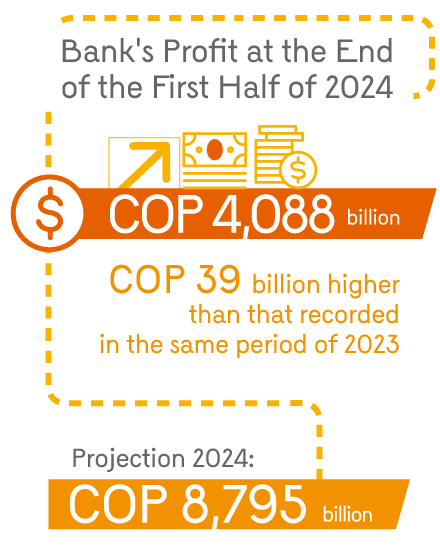

- Banco de la República's profit at the end of the first half of 2024 amounted to COP 4,088 billion (b), as a result of revenues of COP 5,903 b and expenses of COP 1,815 b. This profit was COP 39 b higher than that recorded in the same period of 2023.

- Revenues during this period were mainly due to the yield on foreign reserves, which amounted to COP 3,770 b, with an increase of COP 237 b compared to that received in the first half of the previous year. Expenses originated mainly from the remuneration on national government deposits in Banrep, which amounted to COP 683 b with a reduction of COP 812 b compared to the first half of 2023, mainly due to the lower average balances held in Banrep.

- For 2024, a profit of COP 8,795 b is projected, COP 431 b lower than that observed in 2023. This estimate has a high degree of uncertainty, taking into account the risks associated with the evolution of foreign reserves yield and the growth and sources of expansion of the monetary base.

Boxes

Law 2381 of 2024, “Whereby the Comprehensive Social Protection System for Old Age Disability, and Death (Sistema de Protección Social Integral para la Vejez, Invalidez y Muerte, in Spanish) of common origin is established, and other provisions are issued,” creates the Reserve Fund of the Contributory Pillar (Fondo de Ahorro del Pilar Contributivo, in Spanish), hereinafter the Fund, and assigns its administration to Banco de la República (Banrep). This box highlights the main issues involved in the designation of Banrep as the Fund’s administrator within the framework of its constitutional functions:

Box 2: Determinants of the Speed of Adjustment of the MPR

Box 3: Primary Liquidity Supply by Banco de la República, 2023-2024