Report of the Board of Directors to the Congress of Colombia, February 2025

Pursuant to Article 5 of Law 31 of 1992, the Board of Directors of Banco de la República (the Central Bank of Colombia) submits a report to the Honorable Congress of Colombia, informing about the performance of the economy and its outlook. This report is submitted twice a year, in March and July, within ten business days following the start date of the sessions of the Congress.

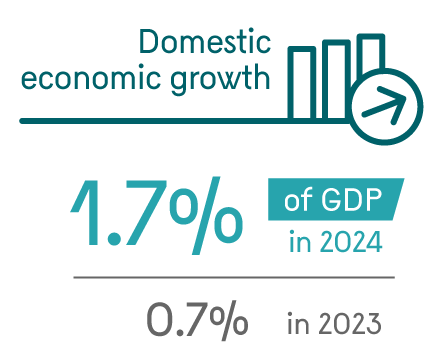

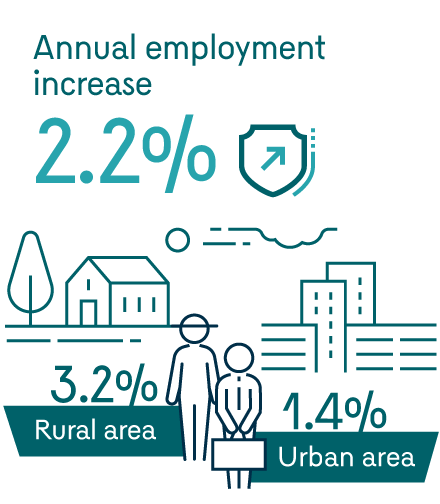

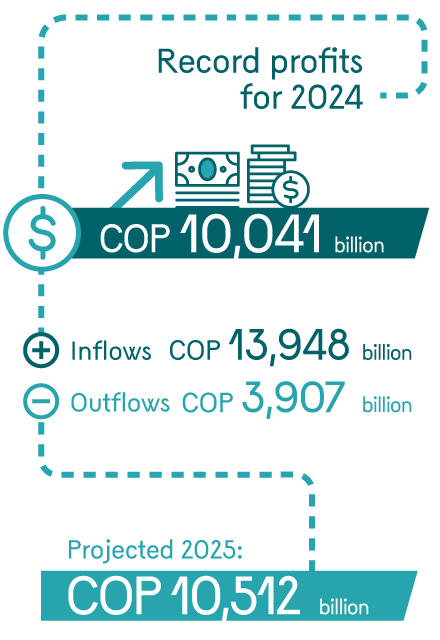

In 2024, the macroeconomic adjustment process continued, characterized by a sustained reduction in inflation that began in 2023 and a decline in the current account deficit of the balance of payments. This adjustment took place in the context of a contractionary monetary policy, with a gradual reduction in the monetary policy interest rate. GDP grew by 1.7%, driven by investment and consumption, while employment increased by 2.2%. Foreign reserves remained at adequate levels, and Banco de la República recorded a profit of COP 10,041 billion, benefiting from the returns on foreign reserves.

See te Report (only in Spanish)

See te Report (only in Spanish)

Macroeconomic environment

- The International Monetary Fund (IMF) and the World Bank estimate that the global economy grew by 3.2% in 2024, a rate similar to that observed in 2023 (3.3%). This occurred in a context of moderating inflation and declining monetary policy interest rates in most countries.

- Global inflation moderated over the course of 2024. However, inflation rebounded toward the end of the year in some advanced economies, mainly due to rising energy costs.

- In Latin America, inflation trends were mixed. While some economies experienced sustained price stability, in most cases, inflation remained above the targets set by their respective central banks.

- Monetary policy interest rates in most Latin American economies continued to decline, reflecting a moderation in inflation and inflation expectations. However, some countries in the region recently raised interest rates in response to renewed inflationary pressures.

- Oil production increased in 2024, leading to a 3% decrease in oil prices, with Brent crude averaging around USD 80 per barrel. However, geopolitical tensions prevented a more pronounced decline.

- The U.S. dollar appreciated against most currencies, driven by expectations that the Federal Reserve (Fed) would implement more gradual policy rate cuts.

- In 2025, global economic growth is projected to be similar to that of 2024, supported by declining inflation, wage recovery, sustained employment growth, and a less restrictive monetary policy stance. However, geopolitical tensions and U.S. trade policies introduce uncertainty.

- More gradual reductions in the Fed’s interest rate are expected, with the possibility of pauses if inflationary pressures resurface. In Latin America, central banks are expected to continue cutting interest rates, although monetary policy may remain contractionary where inflation has not yet reached target levels.

Domestic economic activity

- Colombia’s GDP grew by 1.7% in 2024, reflecting a moderate recovery compared to the previous year. This occurred in an environment of lower interest rates, improved domestic demand, and an increase in remittances and exports.

- Private consumption and fixed capital investment—particularly in infrastructure projects such as the Bogotá metro—contributed to economic growth. However, investment in housing declined.

- Agricultural and services sectors led economic growth, while mining and manufacturing contracted.

- The loan portfolio experienced low nominal growth, though some segments showed signs of recovery toward the end of the year.

- For 2025, economic activity is expected to continue recovering, approaching its productive capacity and aligning with the convergence of inflation toward its target.

Employment

- Employment grew by 2.2% in 2024, resulting in the creation of 508,000 jobs. This expansion was driven by rural areas, where employment increased by 3.2%, surpassing the 1.4% growth in urban areas.

- The commerce, accommodation, manufacturing, public administration, health, and education sectors were the primary contributors to job creation.

- Wage employment grew by 2.7%, exceeding pre-pandemic levels, while non-wage employment increased by 1.8%, leading to a decline in informality to 55.6%.

- The national unemployment rate fell by 0.6 percentage points, reaching 9.7%, with a more pronounced reduction in rural areas.

- For 2025, the unemployment rate is expected to remain stable, supported by a positive economic outlook.

Inflation and Monetary Policy

- Headline inflation in Colombia fell significantly from 9.3% in 2023 to 5.2% in 2024, primarily due to a restrictive monetary policy that moderated domestic demand and contributed to a reduction in the current account deficit.

- Core inflation (excluding food and regulated products) declined from 8.4% to 5.2%, reflecting the effectiveness of contractionary monetary policy.

- Inflation of goods dropped sharply, from 7.1% to 0.6%, due in part to the resolution of logistical disruptions and the appreciation of the peso. In contrast, services inflation declined more moderately, from 9% to 7%, influenced by indexation to past inflation and the increase in the minimum wage.

- Prices of food decreased from 5.0% to 3.3%, driven by lower pressures on processed food prices, benefiting from reduced costs of imported raw materials and a favorable exchange rate.

- Prices of regulated items dropped to 7.3%, following smaller adjustments in gasoline prices (after the required increases in 2023) and lower electricity and public service tariff increases, except for gas prices, which continued to rise.

- Inflation is expected to continue converging toward the 3% target in 2025, with headline inflation projected to close the year at around 4.1%, continuing its downward path into 2026. However, new risks have emerged, including a recent rise in producer costs, a significant increase in the minimum wage, and a rebound in inflation expectations.

Balance of payments

- Colombia’s current account deficit narrowed to 1.7% of GDP between January and September 2024, down from 2.5% in the same period in 2023. This improvement was driven by higher remittance inflows, an improved services trade balance, and lower factor income outflows.

- Remittances reached a record USD 11,848 million, with the United States and Spain as the main sources of these inflows.

- A decline in the profits of foreign direct investment (FDI) companies, particularly in the oil and coal sectors, also contributed to reducing external imbalances.

- The trade deficit widened due to a greater imbalance in the trade of goods within a context of lower commodity prices. However, this was partially offset by strong agricultural and industrial exports. Additionally, the good performance of service exports, supported by higher international tourist arrivals, helped contain a larger trade imbalance.

- The financial account recorded net capital inflows equivalent to 1.1% of GDP, lower than the 2.5% recorded in 2023, primarily due to a decline in foreign direct investment in mining, transportation, and oil. This was partially offset by growth in financial and business services investment.

- The current account deficit is estimated to have closed 2024 at 1.8% of GDP, with a projected widening to 2.5% in 2025, in line with higher expected economic growth and stronger domestic demand.

Public finances

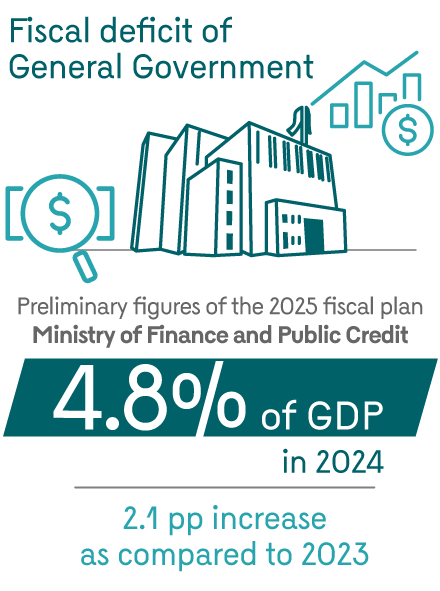

- According to preliminary figures from the 2025 Financial Plan (PF-25) presented by the Ministry of Finance and Public Credit (MHCP), Colombia’s General Government deficit reached 4.8% of GDP in 2024, marking a 2.1 percentage-point increase compared to 2023. This deterioration was mainly driven by a worsening in the balances of the Central National Government (GNC) (2.6 pp) and the Social Security subsector (0.4 pp), partially offset by a 0.8 pp improvement in Regional and Local Government balances.

- The reduction in the deficit position of the Fuel Price Stabilization Fund (FEPC for its acronym in Spanish) was notable, following gasoline price adjustments, which closed the gap between the reference price and local market prices. However, fiscal pressures persist due to ongoing subsidies for ACPM (diesel fuel).

- The total and primary deficits of the Central Government stood at 6.8% and 2.4% of GDP, respectively, driven by a decline in tax revenue—particularly from income and external taxes—alongside increased government spending.

- The net debt of the Central Government increased to 60% of GDP, exceeding previous forecasts.

- For 2025, a total and primary deficit of 5.1% and 0.2% of GDP is projected, with tax revenue expected to grow by 22.6%.

- Compliance with the fiscal rule and the stabilization of public finances will be critical in 2025, given the potential impact of fiscal slippage on the country’s risk premiums. Failure to meet fiscal targets could raise interest rates for both the Government and the broader economy. Maintaining credibility in fiscal policy will be key to preventing macroeconomic adjustments from exerting additional pressure on interest rates.

International Reserves

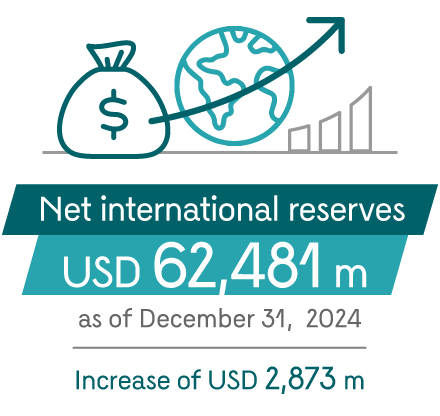

- As of December 31, 2024, Colombia’s net international reserves stood at USD 62,481 million, reflecting an increase of USD 2,873 million during the year.

- This growth was primarily driven by returns on reserves, which reached 3.65%, benefiting from higher global interest rates, and Banco de la República's reserve accumulation program, which added USD 1,479.4 million to reserves.

- According to the IMF’s reserve adequacy methodology, Colombia maintains a reserve ratio of 1.29. This falls within the adequate range (1.0 – 1.5), indicating that Colombia’s reserves are sufficient to withstand extreme external shocks and balance of payments risks.

Profits obtained by Banco de la República

- The Bank's profits reached a record COP 10,041 billion in 2024, resulting from revenues of COP 13,948 billion and expenses of COP 3,907 billion.

- Profits increased by COP 815 billion compared to 2023, primarily due to lower expenses, although partially offset by a decline in revenues.

- For 2025, profits are projected at COP 10,512 billion, supported by the high expected profitability of foreign reserves. However, this projection is subject to uncertainty related to reserve performance and monetary base growth.

Boxes

Rox 3: Finalización del programa de acumulación de reservas internacionales anunciado en 2023

Box 4: Características del nuevo sistema de pagos inmediatos Bre-B