Financial Infrastructure and Payment Instruments Report 2024

During 2023, the local financial infrastructure operated normally, demonstrating its adequate functioning. Thanks to efficient management, the infrastructure provided stability and confidence to participants in the payment system and financial markets.

Financial Infrastructure in Colombia

Payment Infrastructure in Financial Markets

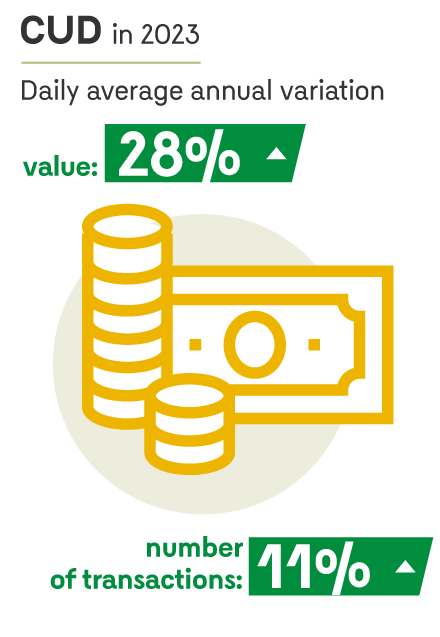

- In 2023, Banco de la República’s (the Central Bank of Colombia) large-value payment system (Deposit Accounts System or CUD in Spanish) showed greater dynamism. The value of settled transactions increased by 28% compared to the previous year and 11% in the number of transactions. This was due to increased activity in the public debt market (purchases/sales and sell/buy back transactions), expansion repos, and direct fund transfers among participants.

- Consistent with the activity in the CUD, there was greater dynamism in financial market infrastructures. The amounts cleared and settled at the Central Securities Depository (DCV in Spanish) increased by 18%, driven by the rise in repo and sell/buy back transactions. Likewise, the Central Counterparty Risk of Colombia (CRCC in Spanish) saw a 28% increase in managed transactions due to the consolidation of the temporary transfer of securities (TTS) of public debt in the fixed-income segment and the positive evolution of products with underlying Representative Market Exchange Rate (TRM in Spanish) (futures, NDFs, and options).

- Simulation exercises allowed to quantify the potential impact of some cyberattack scenarios on the CUD large-value payment system and making recommendations to help mitigate them.

- Banco de la República (Banrep) acknowledges the importance of managing risks associated with central counterparties (CCPs) that are not related to the defaults of clearing members. To identify areas for improvement in local practices, it monitors the practices of CCPs in other jurisdictions and compares them with those observed in the CRCC.

Retail-Value Payment Infrastructures

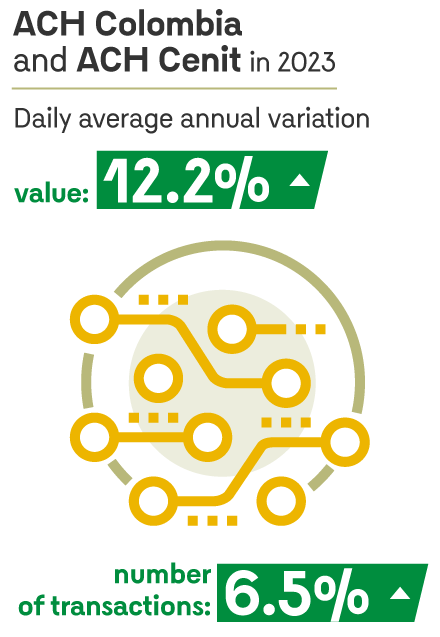

- The Automated Clearing Houses (ACH) in Colombia (ACH Colombia and ACH Cenit) experienced a 12.2% annual increase in value and a 6.5% rise in the number of transactions managed.

- In 2023, retail-value payment systems involved in the clearing and settlement of debit and credit card transactions increased their value and number of transactions by 15.1% and 21.6%, respectively.

- To help mitigate settlement, credit, and liquidity risks, participants of instant payment systems will be able to settle transactions in real time within the large-value payment system.

- According to the analysis carried out for ACH Colombia, the implementation of automatic debit services on deposit accounts provided by Banrep to financial market infrastructures offering settlement services in the CUD contributed to mitigating intraday liquidity risk for its participants.

Payment Instruments

- In the retail-value payment market, the use of electronic payment instruments, such as intra- and interbank transfers, increased in value by 12% and in number of transactions by 43%. In turn, debit and credit card transactions grew by 6.0% in value and 11% in number of transactions. Checks continued to show a 7.0% decrease in the value of transactions and a 20% decrease in the number of transactions, following the trend from previous years.

- In Colombia, the adoption rate of electronic funds transfers and debit and credit cards has increased over the last ten years. Electronic funds transfers have become the most widely used instrument due to the development of new payment schemes, such as the payment button, instant payments, and mobile wallets. The use of this instrument has supported the growth of e-commerce.

- The use of cash for daily purchases in Colombia has declined. In the last decade, it has decreased by 12.1%, although it remains the most widely used payment instrument in Colombia.

- According to Banrep’s (2023) survey on the perception of the use of payment instruments, cash remains the most commonly used for daily transactions among Colombians.

Trends and Innovations in Payments

- As part of Banrep's monitoring of new payment settlement solutions, some international projects aimed at understanding the use of wholesale central bank digital currency (wCBDC) are described. It should be noted that recently published a document discussing the relevance of issuing a central bank digital currency in Colombia (available at banrep.gov.co: Pertinencia y riesgos de emitir una moneda digital de banco central en Colombia - Relevance and Risks of Issuing a Central Bank Digital Currency in Colombia, available only in Spanish).

- The regional integration of financial markets (stock exchange markets) among Colombia, Chile, and Peru will require infrastructures to overcome legal, operational, technological, and regulatory challenges to ensure that clearing and settlement processes are safe and efficient.

Boxes

Box 1: Cyberattacks in the CUD Large-Value Payment System and its Systemic Impact

Box 2: Practices of Central Counterparties for Managing Risks Not Associated with Member Defaults

Box 3: Instant Payments and their Interbank Settlement

In Focus

In Focus 1: Entre-Cuentas: The new Instant Payment Service by Redebán