Economic-knowledge: What is the Output Gap?

In order to explain the second objective of Banco de la República’s (the Central Bank of Colombia) monetary policy (“[…] and to ensure that the economy can grow at the maximum level of its capabilities”), in the last Economic-knowledge1 edition, we provided a simple explanation of the Gross Domestic Product (GDP), its definition by components; the difference between valuing production with current or constant prices (Nominal GDP or Real GDP, respectively); and some additional considerations in terms of adjustments to better capture information provided by this economic activity’s indicator.

With this basic information, in this Economic-knowledge edition, we will explain two key concepts that allow us to better understand the second objective of monetary policy: the estimations of potential output and of the output gap, as well as its implications and importance for the country’s macroeconomic management.

When approaching any economic report of the Central Bank2, we are faced with certain information that seems complicated, but when we understand the information (as we will in these lines), it is no longer complicated. For example: “[…] economy is producing above its capacity […],” “[…] there is idle capacity in the economy […],” “[…] the negative output gap justifies the expansionary stance of monetary policy […],” “[…] the economy is converging towards its potential […]” or “[…] there is excess installed capacity […].”

Although an ordinary person would think that this information is very technical and far from reality, the truth is that it is important for everybody to understand it in order to comprehend, among other things, the rationality of the Board of Directors’ decisions for the benefit of the monetary policy objectives in Colombia3.

In order to give the reader context, let’s start this explanation with an everyday example that will help us understand the concepts of potential output and output gap.

We all remember our great cyclists Nairo Quintana, Lucho Herrera, Fabio Parra, and Egan Bernal, and we are very aware of their achievements in international cycling competitions. Considering those challenging competitions for the body, let’s imagine that to reach the finish line, they must maintain a stable performance at a certain pace according to their capabilities, and not going too fast or too slow. They just need to find that balance to move as fast as they can without overloading their body or losing the Peloton at the front of the competition.

In this example, certain questions may emerge: what would happen if cyclists, at the start of the race, got on their bikes and went at full speed? The natural answer is that, after a few kilometers, their bodies would be exhausted, and they should either: 1) substantially slow down or 2) stop because their bodies would not respond. In contrast, a second question could emerge: what would happen if our competitors started very slowly (as in the last stage of the Tour de France) and continued that way every day? The obvious answer is that they would lose the competition and would not benefit from their capabilities. Each cyclist could make it to the finish line, but they would do it too late and miss opportunities.

Well, in this example the potential is that level at which a professional cyclist can compete if he/she efficiently uses all his/her resources (muscular, pulmonary, concentration, hydration, equipment etc.) in such a way that there are no overloads that would cause him/her to drastically reduce his/her speed, nor would he/she advance at a very slow pace that would cause him/her to miss the chance to win the race.

The previous example may be used to understand the definition of Potential GDP, which corresponds to the maximum amount of final goods and services an economy can produce operating at full capacity. That is, using completely and efficiently the factors of production it has available (such as capital, land, and labor).

This definition makes us think that the Potential GDP is obtained by using all of the economy’s productive capacity. Therefore, if the country produces at such a level, theoretically, there would not be a sort of overheating of the economy that could cause, for example, inflationary outbreaks due to the persistent increases of demand. In fact, we, economists, recognize potential GDP as the non-inflationary value of GDP, that is, the value of output at which pressures on prices are not caused above a certain level. In other words, it is the production level at which prices do not have pressures above or below a certain target level expected by the monetary authorities in the long term.

Concerning the definition described above, it is important to clarify that the value of potential GDP is not observable data, since there is no economic authority or statistical department calculating the data and publishing it as an official value. Instead, it is a reference value to be estimated, and each analyst, researcher, or think tank may have their own estimations according to the available information, parameters, and methodologies they use. Neither could it be assured that an estimation technique is ideal or exact because everything will depend on the available information and the dynamics of the economy itself, among other aspects. However, the experience of those behind the models and the improvement of the techniques used allow having more confidence between one estimation and another.

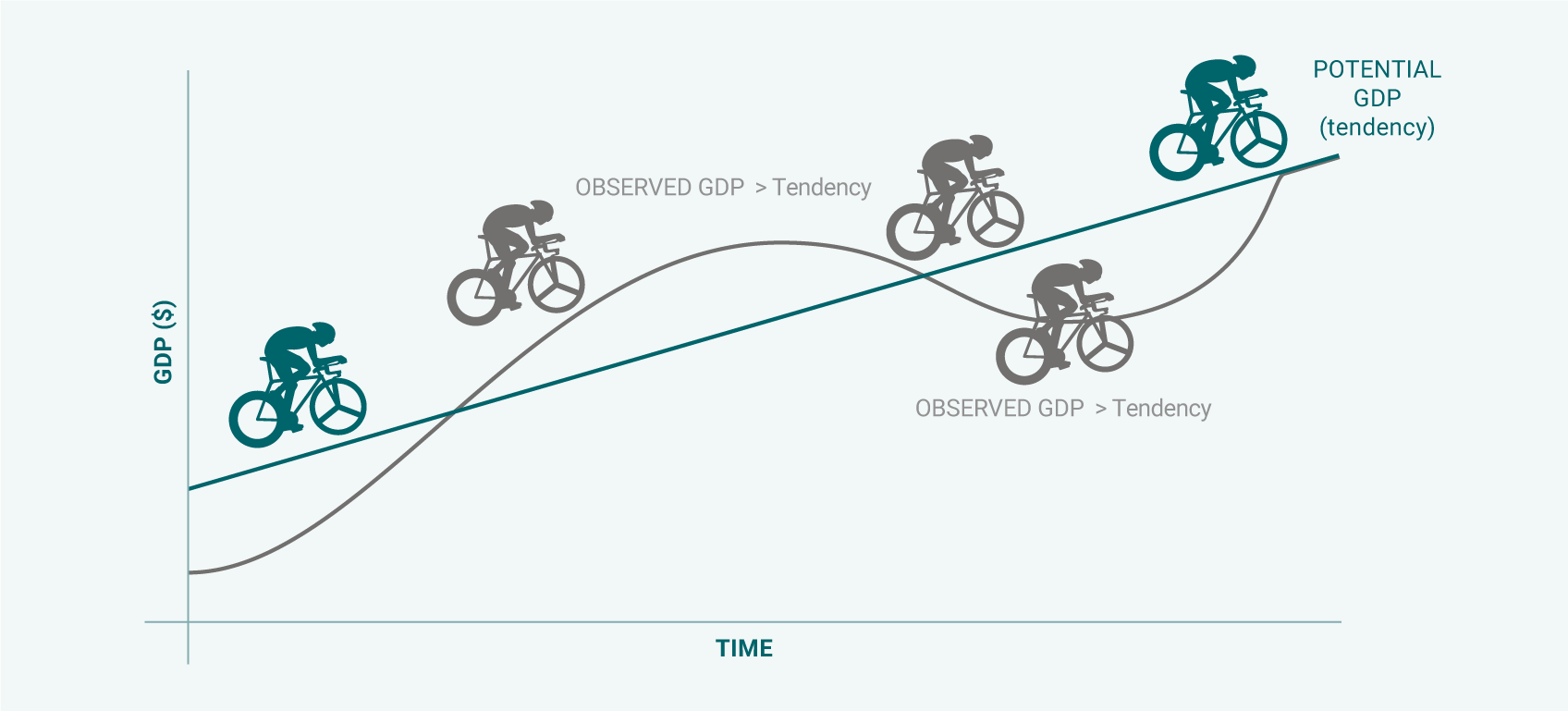

Having clarified the concept of potential GDP, we can now define the output gap. In order to understand it, let’s use the example of our cyclists again and think of the output gap as the difference between the speed at which they actually cycle and what we had defined as their potential (or trend) pace. If the speed at which they ride is higher than what we estimated their capacity to be, the difference would be positive, i.e., the pace exceeds their potential. If, however, they ride at a very slow speed, significantly below their capacity, the gap would be negative.

We can analyze the output gap in an economy similarly, yet we must be cautious of the precision and technical thoroughness used for measuring it. Thus, we say the output gap is positive when the economy is producing above its capacities (its potential), but the output gap is understood as negative if it produces below its capacities. This gap can be expressed in output values, as a percentage deviation from potential GDP, or in growth percentages of potential GDP. Therefore, if the rate is positive, it means the gap is positive, but if it is negative, the opposite is true4.

An economy could be operating above its capability (positive gap) and take the risk of overheating when, for example, there is a high demand which leads companies and workers to produce above their capacities. However, this will not be sustainable over time because it leads to a natural depletion and causes increases in production costs, which will end up resulting in a price increase. Hence, if the demand dynamics is too intense and persistent over time, it could exert pressures to increase inflation, which would be contrary to the main purpose of the monetary authority (in our case, Banco de la República)5.

In other words, the fact that the economy operates above its sustainable level matches the risk of inflation being above the inflation targeting defined by the Board of Directors of Banco de la República (3.0%). In this case, along with additional considerations and analyses, a probable monetary policy decision could be to increase the benchmark interest rate in order to decrease the incentives for liquidity in the economy, stabilizing expenditure and production around its potential level. All of these aim for inflation to converge towards the target.

In the opposite case, a negative gap could indicate that the economy is operating below its capacity and that the factors of production are underused in the country, partly due to low demand. In other words, there would be factors of production that would not be used efficiently. This situation could suggest that there are no inflationary pressures on the demand side. Even if inflation and its expectations are controlled (the first objective of monetary policy assured), the monetary authority could encourage demand by reducing its benchmark interest rate.

In the case of both the positive and negative gaps, it is normal to think that the situation is inefficient, since it is ideal to operate at potential and not above or below it. Nevertheless, the economy’s dynamic causes these fluctuations, and it is the responsibility of economic authorities to guide the economy so that it converges to operate at the maximum of its capacities (second objective of monetary policy).

It is worth noting that the output gap, similarly to potential GDP, is estimated and is neither observed nor officially published by an economic or statistical authority. To estimate it, the authorities can use all the available information, such as surveys, labor market and foreign trade indicators, and gross capital formation, among others.

On the other hand, it is important to understand the two types of messages usually produced by Banco de la República and which could be confused or misunderstood by public opinion: levels and growth rates of these variables.

When we refer to levels (measured in trillions of real value of Colombian pesos)6, f the observed GDP is higher than the estimation of potential GDP, we face a positive output gap. Whereas, if the potential GDP is above the observed GDP, we would have a negative gap, as we previously explained. For its part, the growth rates of both variables would be helpful to understand the convergences in the future. For example, if we face a situation in which we have a negative output gap, establishing the growth rates of both variables is crucial to know whether this gap is expanding or, in the best-case scenario, closing (converging the observed GDP to its potential).

In other words, if the economy is producing below its capacity (negative gap) but growing faster than the estimation of its potential, the gap is closing. And that excess installed capacity will be used so that the economy can operate at its maximum capacity in the future. On the contrary, if we have a positive output gap (level of observed GDP above its capacity) with a growth rate of the observed GDP lower than the potential GDP, this indicates that the economy is converging to operate at total capacity, so the demand’s inflationary pressures would be dissolving.

To conclude, let’s review these typical expressions of the reports again to validate if the explanation provided in this Economic-knowledge edition was effective to understand these messages. “[…] the economy is producing above its capacity […],” “[…] there is idle capacity in the economy […],” “[…] the negative output gap justifies the expansive stance of the monetary policy […],” “[…] the economy is converging towards its potential […]” or “[…] there are exceeds on the installed capacity […].”

To consider

- The Political Constitution of 1991, in its Article 373, defined the constitutional mandate: “[…] The State, through Banco de la República, shall oversee the maintenance of the purchasing power of the currency […].” For its part, Ruling C-481 of July 7, 1999, adds that: “[…] Banco de la República’s activity to maintain the purchasing power of the currency must be executed in coordination with the general economic policy […].”

- The first use of the value of potential GDP is that it allows us to estimate the gaps between the observed value of GDP and its potential, to have a measure of the possible inflationary pressures at the moment of the analysis.

- The second use of the potential GDP is that its forward projection indicates the value to which the observed GDP should converge once the shocks that have occurred in the economy are dissipated.

--

1 Economic-knowledge:“The Gross Domestic Product, GDP".

2 Similar to the report of the Board of Directors of Banco de la República, the Monetary Policy Report represents the technical team of the Central Bank or even the minutes of the Board of Directors meetings.

3 Economic-knowledge: “Monetary Policy".

4 For those reading this article interested in deepening the gap estimation, we can say that it can be divided into two parts: the historical and the forecast. The first is calculated as the difference between the observed and the potential (trend) GDP resulting from the 4GM model. In contrast, the second is calculated as the difference between the GDP estimation of the technical equipment and the potential (trend) GDP resulting from the 4GM model.

5 Economic-knowledge: “Why is it important to control inflation?”.

6 Economic-knowledge: “The Gross Domestic Product, GDP)".