Economic-knowledge: Why is it important to control inflation?

In the two previous editions of Economic-knowledge inflation was defined as the generalized and sustained increase in prices of the most representative goods and services consumed by a country's households. It was also explained that its causes might be due to factors related to demand or supply of those products. Moreover, we understood the key role that inflation expectations play in price formation, especially in the current inflation targeting scheme adopted by Banco de la República (the Central Bank of Colombia).

Having understood the above, this article will analyze the importance of controlling inflation and why economic authorities around the world have among their main monetary policy goals to keep inflation at low and stable levels.

Let’s refresh our memory

|

When a moderate increase in the prices of the most consumed goods and services in the country is aligned with a corresponding increase in our income, it should not cause any problem for our pockets, and the economy would not be affected either. However, in practice, this desirable alignment does not always happen.

If prices start to rise above the magnitude of income growth, we will clearly and naturally start noticing that our money is no longer enough to buy the same basket of goods and services as before. This is known as the loss of the purchasing power of money; in other words, our money is losing its purchasing power1.

This situation involves a series of adverse consequences for the consumer, social costs, distortions, and uncertainties in all economies that, if not controlled on time by the economic authorities, could end up getting out of control and causing much more serious problems, including those associated with hyperinflation2.

To understand a little more about the importance of having low and stable inflation, let’s consider the case of an ordinary Colombian person who has signed a labor contract and whose salary would be fixed for at least a year. If during this period prices start rising more than expected before signing the contract (high inflation), surely the monthly salary this person gets will not be enough to buy the same amount of goods and services as before3.

Since price increase is generalized throughout the economy, this example does not distinguish between income levels or social classes, because the additional relative value paid by a low-income citizen for a certain good or service may be very similar to that paid by a high-income citizen.

Even though this situation affects the real income of society as a whole, its impact is more harmful to lower-income families since almost all of their resources come from wages or other types of informal income, which are consumed almost immediately. This means that their savings capacity is minimal or nearly nil. Therefore, this reduces the family’s ability to protect themselves from inflation through a savings or investment product that gives them a higher interest rate than the inflation rate. However, lower-income households are not only affected by inflation given their limitation for saving, but also because their consumption is essential or basic, and they cannot substitute expensive consumption for a cheaper one. In other words, low-income families are not able to substitute goods or services, which are already cheap, for cheaper ones.

The opposite occurs for the high-income population, whose consumption pattern can be adjusted in response to increases in prices of goods and services. For example, if the wealthy population purchases luxury vehicles, when faced with a rise in the price of this type of vehicle, they could adjust their consumption without affecting their income by buying a less expensive car. For this reason, it is very common to hear that inflation is similar to a regressive “tax”, which affects lower-income people to a greater extent, but without forgetting that the real income of the entire population is affected; therefore, it is important to control inflation.

When faced with high inflation, it is natural that there will be a higher uncertainty about the real prices in the future; for this reason, consumers will have incentives to purchase products rapidly when they perceive that prices may increase in the following days. This could lead to products running out rapidly as they become scarcer, and prices could continue increasing due to the imbalance between supply and demand.

Companies also tend to face high uncertainty against high inflation. In general, companies end up postponing their financing plans to expand their operations as their financial costs increase, which usually rise in these periods. This is not only because of the monetary policy's timely response4 to control inflation (increasing policy interest rate), but also because the higher costs associated with the increased risks and higher uncertainty that the financial system usually faces in these periods are transferred to the credits granted to companies.

However, companies may also face the so-called transaction costs and menu costs5, due to instability and the high levels of consumer inflation. The menu costs are related to the value that companies must assume to modify their prices with relative frequency due to the rapid change in consumer prices, and all associated damages, including changes in packaging, labels, new price registers, etc.

Other situations that companies could face with a high and very variable inflation are increases in wage costs, which erode their profits and tend to hinder salary negotiations between employers and workers. Similarly, many prices in the economy are indexed (that is, attached) to the observed inflation. This means that excessive inflation could generate a persistent cycle of unwanted price increases in an important proportion of the basic consumer basket, especially in the areas of rents, education, certain utilities, and in some transportation and personal services that are directly or indirectly updated with the observed inflation.

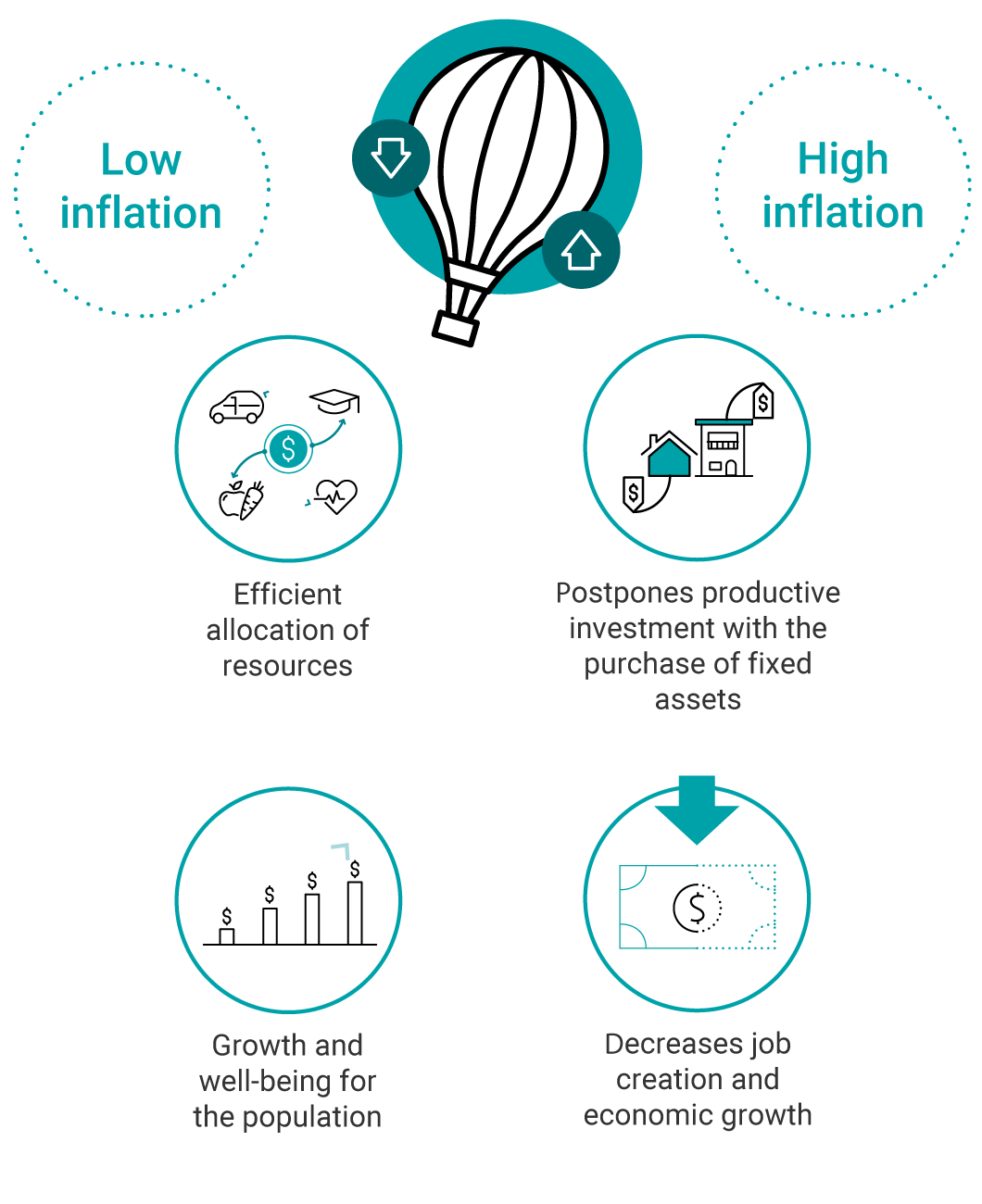

Lastly, controlling inflation is important for the countries’ economies since, in a low and stable inflation environment, all produced resources are allocated more efficiently, thus ensuring a higher growth and well-being for the population in general. On the contrary, if inflation is high, the companies and households could protect themselves from the increase in prices by buying fixed assets (such as a house or a warehouse), thus postponing a productive investment. This would not be the optimal thing because it decreases job creation and the country’s economic growth. In addition, the economic authorities of a country with moderate and stable inflation find it easier to adopt optimal economic policies to promote social and productive development.

To conclude, the excessive growth of prices causes direct distortions to the economy’s dynamics. Particularly, it hinders long-term economic growth and affects competitiveness in markets, employment, consumption, saving, and investment, among other important aspects.

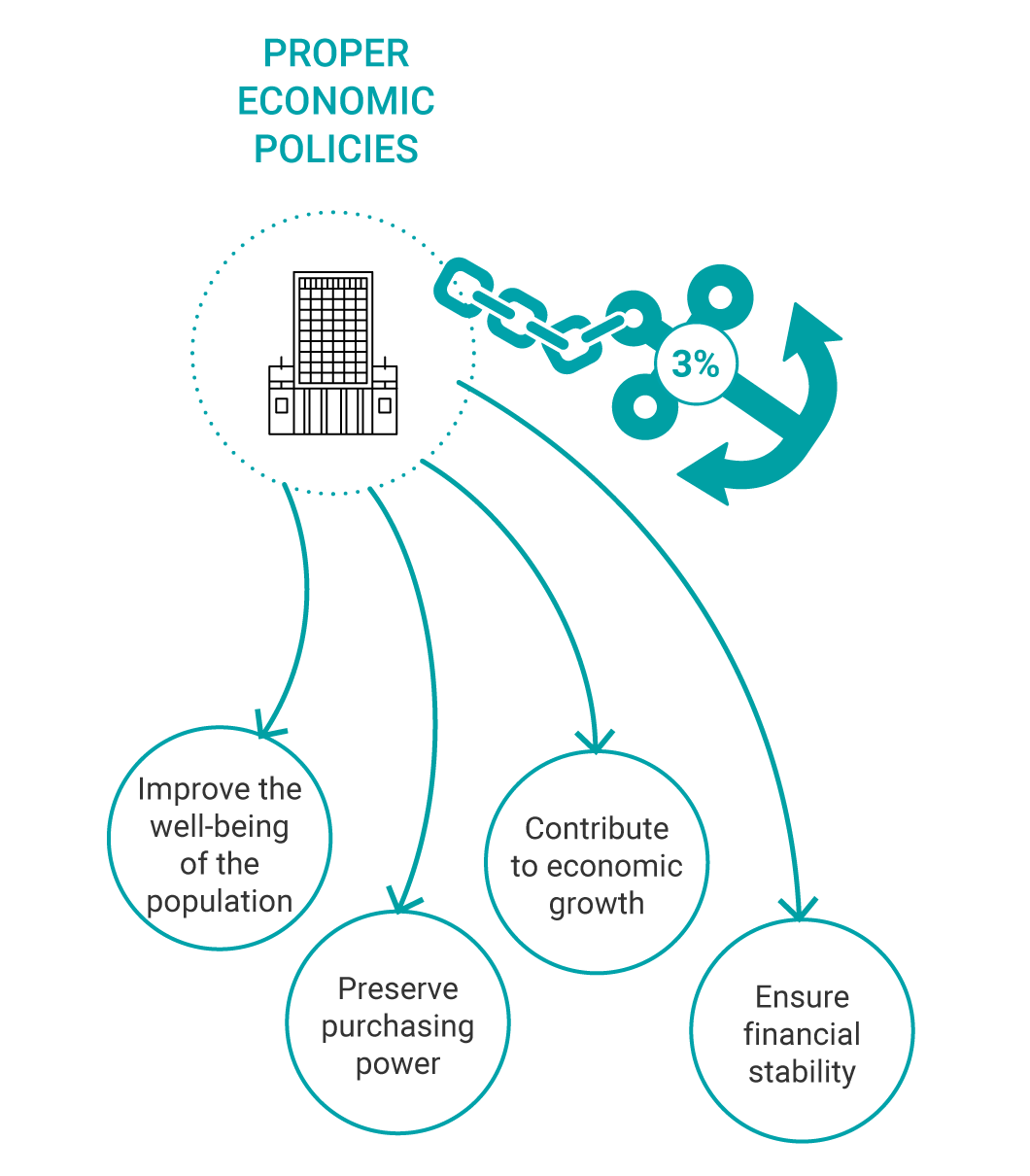

Faced with the described panorama and with an even broader perspective on the damage caused by high and uncontrolled inflation, Banco de la República has as a main and constitutional function to improve the general well-being of Colombian people, procuring the purchasing power of money, inducing a sustained economic growth, and ensuring financial stability, as well as the proper functioning of the payment systems.

1 In addition, the Political Constitution of Colombia established in Article 373 that “the State, through Banco de la República, shall oversee the maintenance of the purchasing power of the currency…” which is directly achieved by keeping inflation at a low and stable level.

2 Hyperinflation is the excessive and uncontrolled growth of prices in an economy. Although there is no consensus on the exact percentage of inflation to be considered hyperinflation, some analysts estimate that it occurs when the generalized increase in prices exceeds the monthly 50.0%.

3 In technical terms, your real wage would be decreasing.

4 We recommend reviewing the credit channel on Transmission Channels of Monetary Policy, in ECONOMIC-KNOWLEDGE, where we show the monetary policy’s response to the inflation increases.

5 They are known as Menu costs, quoting the commercial costs’ metaphor that restaurants must assume when having to frequently change and print their businesses’ menus. They are also known as logistic costs.