Economic-knowledge: Monetary Policy Transmission Channels

When Banco de la República’s (the Central Bank of Colombia) Board of Directors makes a decision on the level of the benchmark interest rate, ordinary people may ask: does it really affect me? or how does this rate control inflation? Although the answers to such questions may seem complicated, they are not. You just need to identify the ways in which the effect of a change in the Central Bank’s interest rate has an impact on the growth rate of prices. In this publication, we will identify four of those main routes, known as monetary policy transmission channels.

A Little Context

| To understand the transmission channels, we must consider three main aspects: | |

|---|---|

| 1. | The main objective of Banco de la República, as dictated by the 1991 Constitution is “to ensure the maintenance of the purchasing power of the currency.” In order to comply with this mandate, Banco de la República is responsible for formulating and executing the monetary policy [Economic-knowledge on Monetary Policy]. Its objective is to keep inflation low and stable and to promote sustained economic growth. |

| 2. | The Board of Directors’ main available tool for influencing the variation of consumer prices is the benchmark interest rate [Economic-knowledge on Benchmark Interest Rate]. This is the minimum rate at which the Central Bank is willing to charge financial institutions for the liquidity it provides, usually on an overnight basis. |

| 3. | In addition to the liquidity that Banco de la República offers to the market, financial intermediaries can also lend to each other, and they do so at similar rates to the benchmark interest rate. These are known as short-term interest rates1/ and the Central Bank’s operational objective is to align these rates with the benchmark interest rate so that financial institutions are indifferent to borrowing from other institutions or from Banco de la República. |

Transmission Channels

When the Board of Directors makes a decision on the level of the benchmark interest rate, a chain of events begins. These, with some delays and through different routes, end up influencing the economy’s aggregate demand and the variation in the price level. These events are known as the monetary policy transmission channels.

To understand the different channels, from now on, we are going to suppose that the decision made by the Board of Directors is an increase in the benchmark interest rate as a consequence of an inflation forecast that exceeds the long-term goal (3.0%) for reasons other than transitory supply factors.

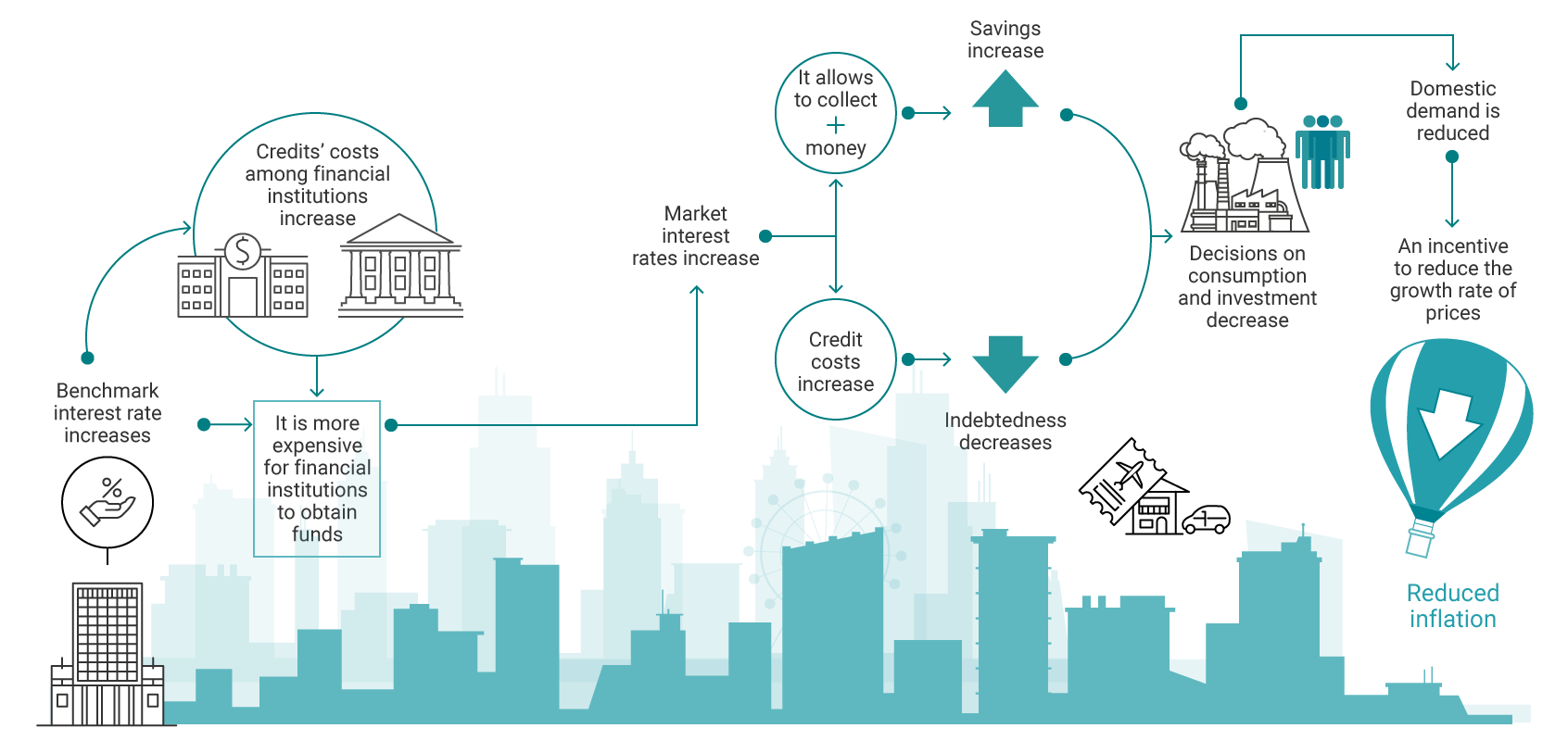

Interest Rate and Credit Interest Rate Channels

As noted above, the increase in the benchmark interest rate is almost immediately transmitted to the short-term interest rate. Consequently, borrowing costs between financial institutions would also increase. Since it is now more expensive for financial institutions to obtain funds from Banco de la República or in the interbank market, it is expected that the first decision made to obtain more liquidity will be to increase the interest rates at different terms at which our deposits or financial instruments are remunerated. This will be in order to collect more money from clients and not have to ask for (now more expensive) funds. In this situation, economic agents (like us) will have incentives to increase their deposits, which contributes to decreasing their consumption and investment decisions, meaning there would be less spending (domestic demand) in the economy. The expected effect of this channel is that, due to the lower demand in the economy, some sellers of goods or services will lower prices to promote their sales, thus reducing through this route the growth rate of prices.

The next channel is related to credit interest rates. Through this route, when a financial institution starts to give more money to its clients for deposits and also pay more interest for the liquidity requested to the Central Bank or the financial institutions, logically, it will also increase the interest rates for different types of credits offered (such as consumer credit, credit cards, mortgage credit, or commercial credits). Faced with higher credit interest rates, companies would end up postponing their investment plans, and households would reduce their borrowing plans to finance the purchase of goods and services. In this way, expenses on investments and consumption would fall (domestic demand), and, therefore, inflation would tend to decrease.

Interest Rate and Credit Interest Rate Channel: graphic example

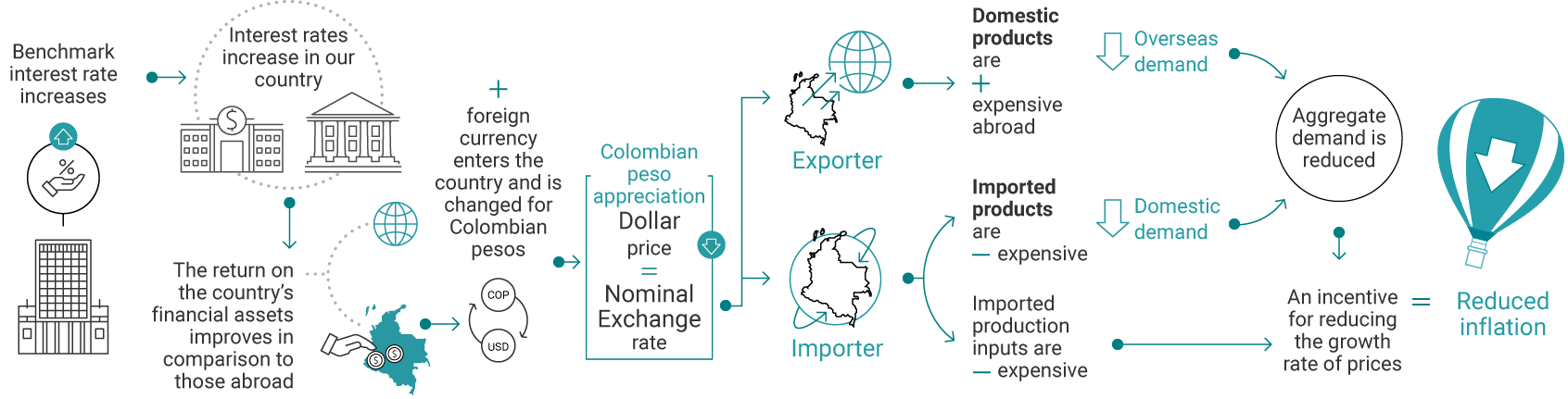

Exchange Rate Channel

Following our example, it is clear that, when the Board of Directors increases its benchmark interest rate, it leads to an increase in market interest rates. This could in turn contribute to an improvement in the relative return on financial assets of the country, compared to those abroad. Therefore, this would make it more appealing to invest in Colombia, which means foreign currency (dollars) would enter the country and would then be exchanged for Colombian pesos. As the number (supply) of dollars available in the Colombian foreign exchange market increases, the dollar price tends to decrease, resulting in an appreciation of the Colombian peso (a decrease in the nominal exchange rate). In this new situation, there are different effects, depending on the sector being analyzed: exporter or importer.

- Exporter: as the exchange rate is reduced, domestic products become more expensive for foreigners than before, making them pay more dollars to purchase those products. This situation leads to a decrease in overseas demand for our exported goods and services, causing the aggregate demand to decrease and, therefore, a reduction in inflationary pressures.

- Importer: if there is a reduction in the exchange rate (appreciation), imported products would be cheaper than before since importers would pay fewer Colombian pesos for each dollar paid for their purchases. Similarly, domestic products using imported inputs in their production process would also benefit from a cheaper exchange rate. This situation would lower the price of these products and, consequently, inflation.

Overall, the impact of this channel on short-term growth and consumer inflation will depend on the rate of the country’s total demand for exported and imported goods and services. Thus, if the latter are significant, the pass-through of exchange rate adjustments to inflation will be greater2/.

Exchange Rate Channel: graphic example

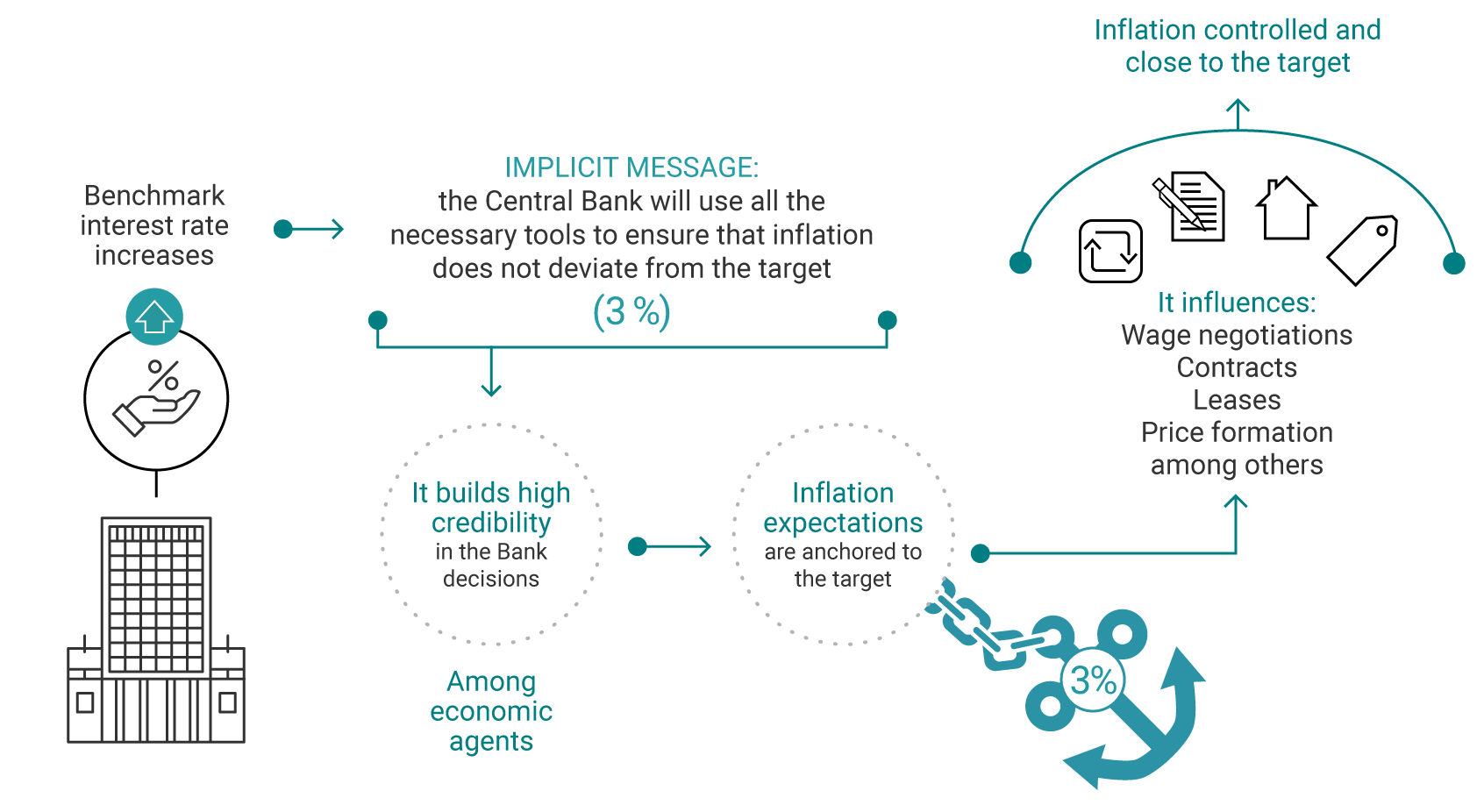

Expectation Channel

In the current monetary policy scheme, known as inflation targeting, the credibility of economic agents that the monetary policy actions of Banco de la República will, indeed, lead to inflation to its 3.0% target is very important. This is because inflation expectations play a crucial role in price formation, wage, contract, and lease negotiations, partly due to the fact that many of these negotiations are linked to inflation (this is known as indexation).

When inflation expectations are consolidated, it is very likely that they will influence economic agents’ behavior and, therefore, the growth rate of prices, which should be close to the target set by Banco de la República. In our example, when the Board of Directors increases the benchmark interest rate, it is sending a clear message to economic agents: the Central Bank will use all the tools and make all the necessary decisions, so that inflation does not deviate from the 3.0% target. Thus, if the credibility in the Central Bank’s actions is high, inflation expectations will be anchored in the target set by the Board of Directors of Banco de la República.

Expectations Channel: graphic channel

_______

1/ For example, the overnight benchmark interbank rate (IBR in Spanish) and the interbank interest rate (TIB in Spanish).

2/ what is technically known as pass through pass through.