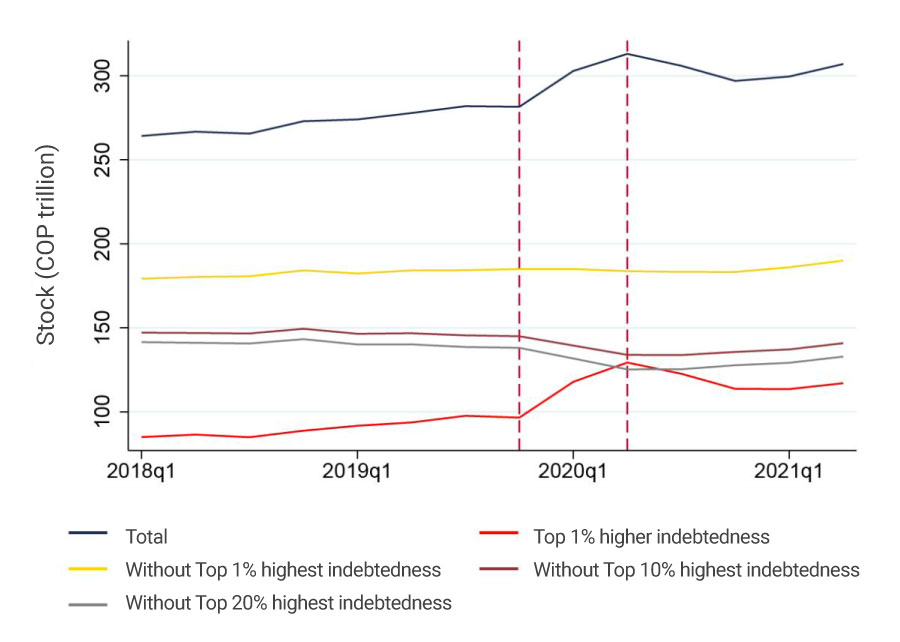

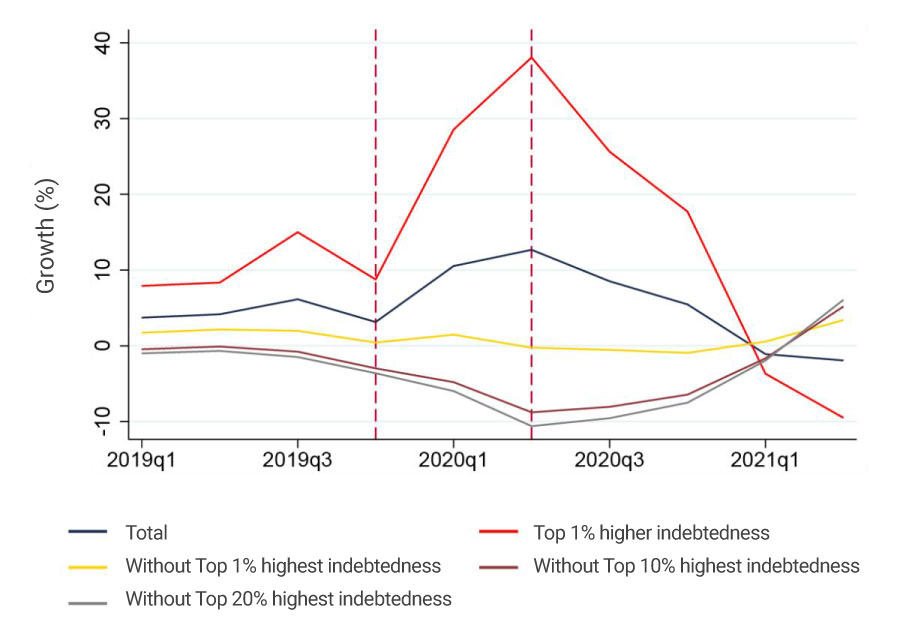

Banco de la República's Financial Stability Report of the first semester of 2021 showed that during the first six months of 2020 (in a recessionary context derived from the global pandemic) total commercial credit from Colombian financial institutions to firms increased significantly. This phenomenon is illustrated by the blue lines in Graph 1, panels A and B. Starting in the second half of 2020, the stock of commercial loans began to decline. This raised concerns about the availability of credit to firms in the current context of economic recovery.

The analysis of the data reveals that this performance of the stock of commercial loans may have been caused by the search for liquidity by a few large firms at the beginning of the pandemic in an effort to smooth the drop in their revenues. These firms drew down their pre-established credit lines and began repaying their debt beginning in the third quarter of 2020. Therefore, in order to understand the recent flow of credit to the productive sector of the economy, it is relevant to analyze the distribution of commercial loanschanges among firms, especially among those that borrowed at the beginning of the pandemic and those that did not.

To this end, commercial loan disbursements by credit institutions to each firm between December 2019 and June 2020 (period of the beginning of the pandemic) were calculated using the credit registry from the Office of the Financial Superintendent of Colombia. This calculation reveals that a total of 84,625 companies increased their commercial debt by some magnitude during this period. However, the top 1% of firms that had the largest increase in debt during that period1, account for practically all of the increase as well as the subsequent reduction in the total stock of commercial loans as illustrated by the red lines in Graph 1, panels A and B.

Excluding the top 1% of firms with the highest growth in commercial debt and analyzing the rest of the companies2 the yellow lines in Graph 1, Panels A and B, are obtained. As can be seen, commercial loans to this non-top 1% of firms are relatively stable and, as of the fourth quarter of 2020, show a mild acceleration. If, instead of the top 1%, the top 10% or top 20% of firms that took on the most debt in that period are excluded,3, the violet and gray lines, respectively, are obtained. In this case, there is a drop in commercial loans in the first half of 2020 and a vigorous recovery thereafter with annual nominal growth of over 5.0% in June 2021, in line with increased economic activity.

In summary, the commercial credit cycle observed since the beginning of the health emergency exhibits an important temporal heterogeneity in the flow of commercial loans. At the beginning of the pandemic, loans flowed mainly to a small number of companies with large disbursements, while loans have flowed to the rest of firms since the end of 2020.

Graph 1. Commercial Credit

Panel A. Stock of Loans

Panel B. Nominal Annual Growth

Source: Calculations by Banco de la República, based on the credit registry from the Office of the Financial Superintendent of Colombia.

1 The top 1% group that drew down their access to credit the most is made up of 846 firms, 809 of which are large firms, and these accounted for 41.3% of the commercial l as of June 2020. A company is classified in this group if its disbursements in the December 2019-June 2020 period exceed COP 5.9 billion.

2The group excluding the top 1% that accessed the most credit in the first half of 2020 is composed of 426,621 companies.

3 The group excluding the top 10% that accessed the most credit in the first half of 2020 is composed of 419,004 firms with disbursements of less than COP 349.1 million in the same period. The group excluding the 20% that accessed the most credit in the first half of 2020 is composed of 410,541 firms with disbursements of less than COP 119.5 million in the same period.