Among the sources of external financing of the Colombian economy, in addition to foreign direct investment (FDI), the country also receives other significant resources known as portfolio flows. These flows are a major source of financing for the Government and for private companies. Portfolio investments are made mainly in public debt instruments (bonds issued by the Colombian government and managed by Banco de la República, TES) and, to a lesser extent, in company stocks and corporate bonds. Economic agents participating in these markets include non-resident and resident investors and comprise investment funds, pension funds, commercial banks, and private investors.

Unlike FDI, which targets the real sector of the economy and is motivated by its long-term returns, portfolio flows respond to external and internal financial conditions that determine the relative profitability of investing abroad or domestically. The external conditions include short- and long-term interest rates in international financial markets and the risk appetite of external investors, which is related to the global financial cycle. Internal variables include the local monetary policy interest rate, TES yields, country risk, devaluation expectations, and stock indexes, among others. Portfolio investments have substantial benefits for the economy because they complement domestic savings and contribute to financing consumption and investment. However, these investments also create risk and uncertainty for macroeconomic stability because of the speed and ease with which they can withdraw from the country due to the high sensitivity of these flows to changes in their determining variables, which usually occur unexpectedly.

It is highly important for economic authorities to know how portfolio flows behave so as not to be surprised by their volatility and to be prepared to mitigate their financial and real effects. To expand this knowledge, a team of researchers from Banco de la República (the Central Bank of Colombia) conducted a study on the determinants and evolution of portfolio flows in Colombia using the latest tools available in the literature. This work yielded valuable results for the monetary and foreign exchange policy design and has just been published in the Essays on Economic Policy (ESPE in Spanish) journal 105.

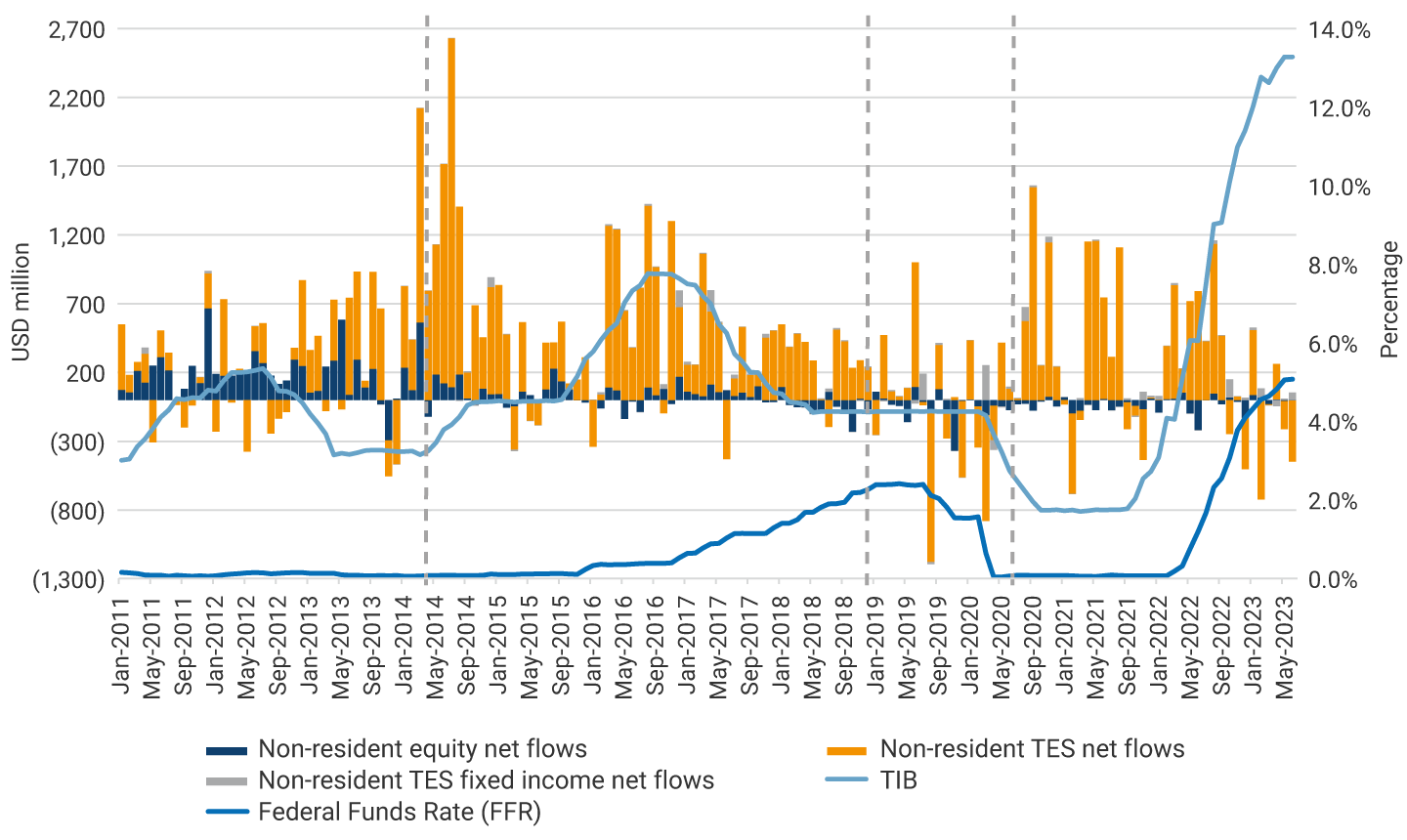

Graph 1, constructed from the financial account of the balance of payments, exhibits the monthly evolution in millions of US dollars of net portfolio flows (i.e., inflows and outflows) of non-resident investors in instruments issued in Colombia. It is observed that most of the flows are concentrated in TES (84% on average during the period), followed by shares (13%) and corporate bonds (3.0%). Throughout the series, it can be seen that increases in the domestic policy interest rate (TIB in Spanish, or interbank interest rate) coincide in some years with increases in TES purchases and that increases in the Federal Reserve's policy rate (i.e., Federal Funds Rate, FFR) coincide with reductions in TES purchases. This behavior is consistent with the expected response of portfolio flows to changes in domestic and foreign interest rates and with recent international evidence. Additionally, certain market shocks have influenced the behavior of these flows. For example, the significant increase in TES purchases during the second quarter of 2014 was associated with the increase in the weightings of Colombian public debt instruments (TES) within J.P. Morgan’s global indexes, which external investors use as a reference for their decisions. The significant outflow of capital from the TES market during the COVID-19 pandemic can also be noted, followed by a rapid recovery associated with the restoration of confidence in the international capital market, the sharp cut in the foreign interest rate (FFR), and the subsequent increase in Colombia’s monetary policy interest rate (TIB in Spanish).

Graph 1. Net portfolio flows of non-resident investors (2011-2023)

In the study, the relationships suggested in Graph 1 are evaluated econometrically by estimating the so-called vector autoregressive models (VAR), which seek to establish the variables that determine portfolio flows. Both contemporaneous and lagged values of the variables considered are used to estimate these models. This introduces an element of dynamics in the statistical relationships between these variables, which are displayed in the so-called impulse-response functions. These functions quantify what happens over time with the investment in each type of instrument when shocks occur in its determining variables, which provides valuable information for understanding the behavior of portfolio flows.

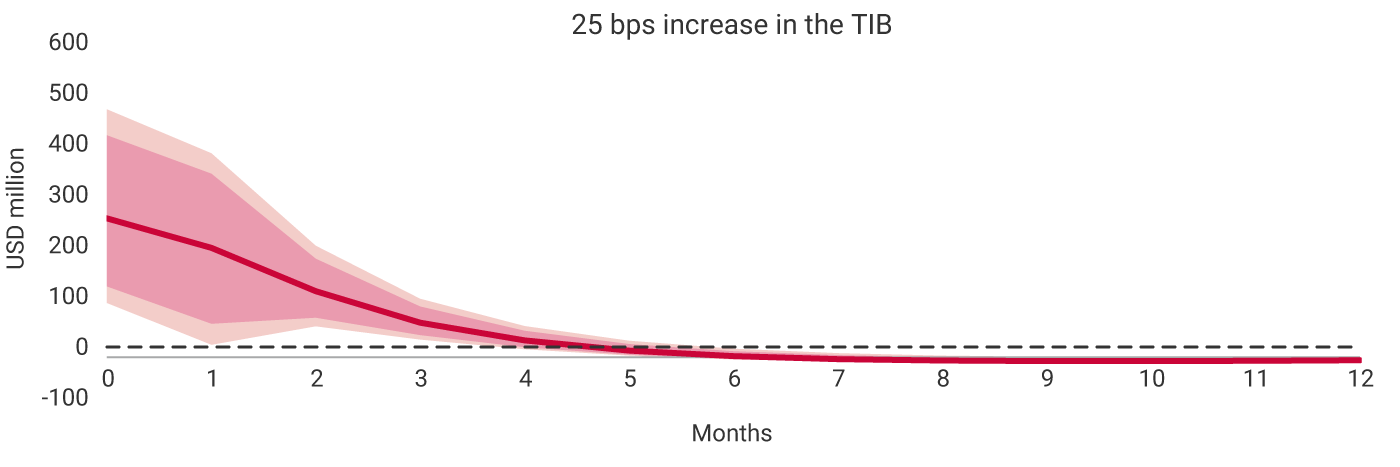

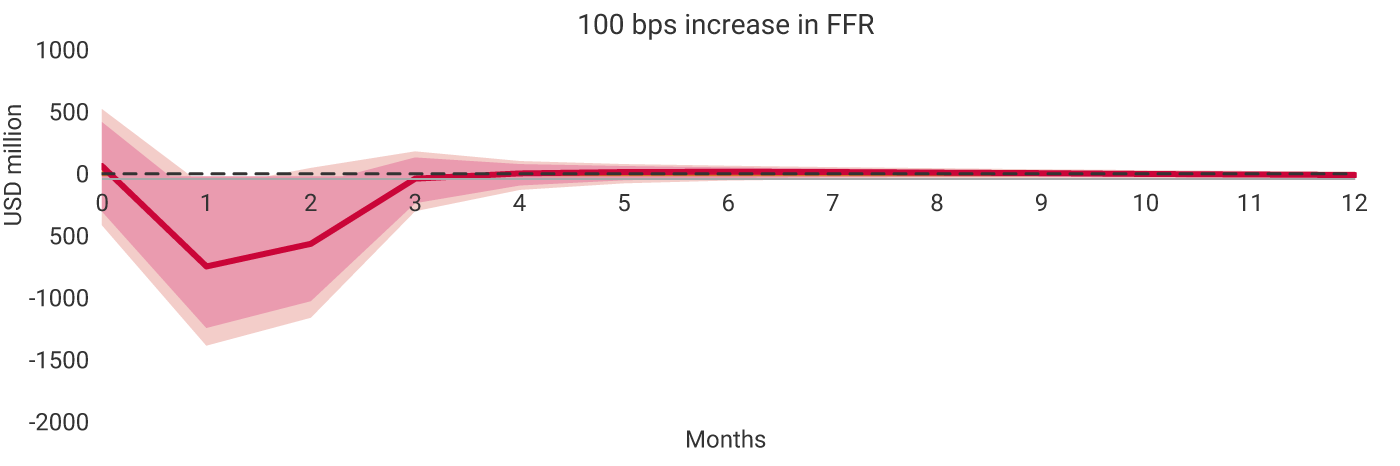

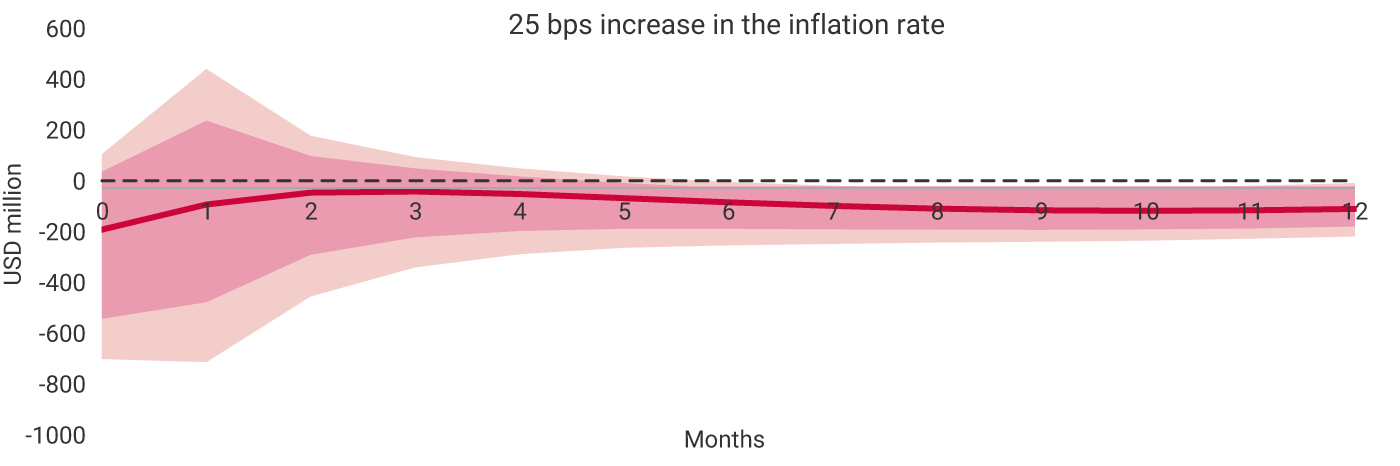

Examples of these results are shown in Graph 2, which exhibits impulse-response functions that describe the effect on net portfolio flows in TES over time when there are shocks in their determining variables. Such effects are considered statistically significant when the confidence interval around the TES investment flow path (red line) does not include the horizontal axis of zero.

Graph 2. Response of TES portfolio flows to shocks in the monetary policy rate, foreign interest rate, and inflation

Panel A: Shock in the monetary policy interest rate (TIB)

PPanel B: Shock in the foreign interest rate (FFR)

Panel C: Inflation shock

Panel A exhibits a positive and statistically significant response of portfolio flows in the TES market to an increase in the domestic monetary policy interest rate, which is proxied by the interbank rate (TIB). Specifically, it is identified that an increase in the TIB of 25 basis points (bps) is associated with an increase in the demand for TES by non-resident investors of approximately USD 270 million (0.10% of GDP) in the initial month after the shock occurs, which weakens in the following months until it becomes insignificant. Panel B exhibits the response of TES portfolio flows to a 100-bps increase in the foreign rate, which approximates the Federal Reserve rate (FFR) shown in Graph 1. It is observed that, although the effect is not significant at the beginning, after one month, there are substantial reductions that approach USD 770 million in the demand for TES by foreign investors. These results confirm that portfolio flows by non-resident investors in the TES market respond to changes in domestic and foreign policy interest rates in the direction predicted by theory, as in other countries. Panel C shows that a 25 bps increase in the local inflation rate leads to marginal reductions in the demand for TES, which is consistent with the lower real return of these securities.

These exercises extend in the work cited above to the analysis of other shocks and portfolio investment instruments. It also examines the behavior of several types of investors and the structural changes that have occurred in these markets in recent years