Between mid-2014 and late 2015, the Colombian peso experienced a depreciation that took the price of the US dollar from COP 1,900 to COP 3,000. The pass-through of such exchange rate shocks to prices in the economy is a crucial issue for the monetary authority, as it reflects the sensitivity of domestic prices to exchange-rate fluctuations. The pass-through mechanisms at the microeconomic level involve adjustments in the behavior of firms and consumers in each specific market.

A recent paper by researchers at Banco de la República (the Central Bank of Colombia), published in the series Working Papers on Economics (Borradores de Economía), studies the impact of this depreciation on the price of automobiles sold in Colombia. The case of automobiles is interesting because most of the new cars sold in the country are imported, and those that are not imported depend on imported inputs.

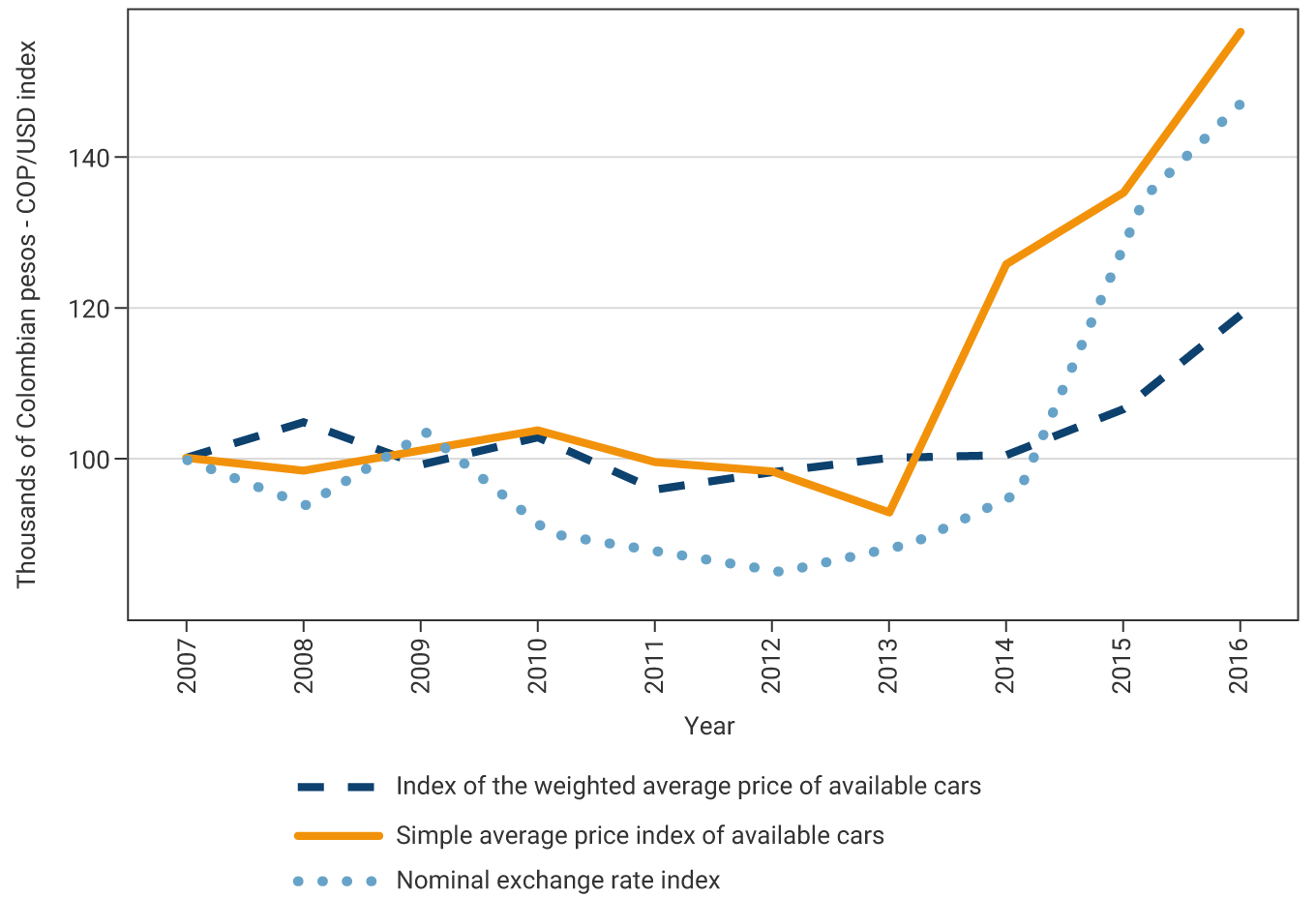

Graph 1 shows the nominal peso-dollar exchange-rate index and two different measures of average prices. As may be seen, the nominal exchange rate index went from 89 in 2013 to over 130 at the end of 2015, reflecting the sharp depreciation that took place. The graph also exhibits a simple average index of the prices of available cars, with a similar increase over the same period. However, the index of the average prices, weighted by the quantities of each car sold, shows an increase of less than 20%, reflecting the growing weight of cheaper car models. In other words, after the sharp depreciation and the consequent increase in prices, the market moved towards relatively low-priced car models, which attenuated the pass-through of the exchange rate shock to retail prices. In other words, in response to the generalized increase in the price of available models, consumers switched to cheaper car models, and car brands introduced cheaper models. These types of reactions are studied in the paper based on a microeconomic model that considers the behavior of car sellers and buyers.

Graph 1. New car prices and exchange rates

More specifically, the paper bases its analysis on an econometric supply-and-demand model that isolates the effect of exchange rates on the cost of cars according to their origin and also discounts the effect of other variables that affect costs and demand, such as tariffs and the attributes of each car model. The simulations performed with the model highlight the market adjustment mechanisms. On the one hand, firms absorb part of the cost increase to compete with their rivals by offering lower prices for existing models and also introduce cheaper models. On the other hand, consumers switch from expensive cars to relatively cheaper ones. The importance of these two mechanisms is such that, during the period mentioned above, the estimated supply-and-demand model implies that the average car price increases less than the increase in costs.

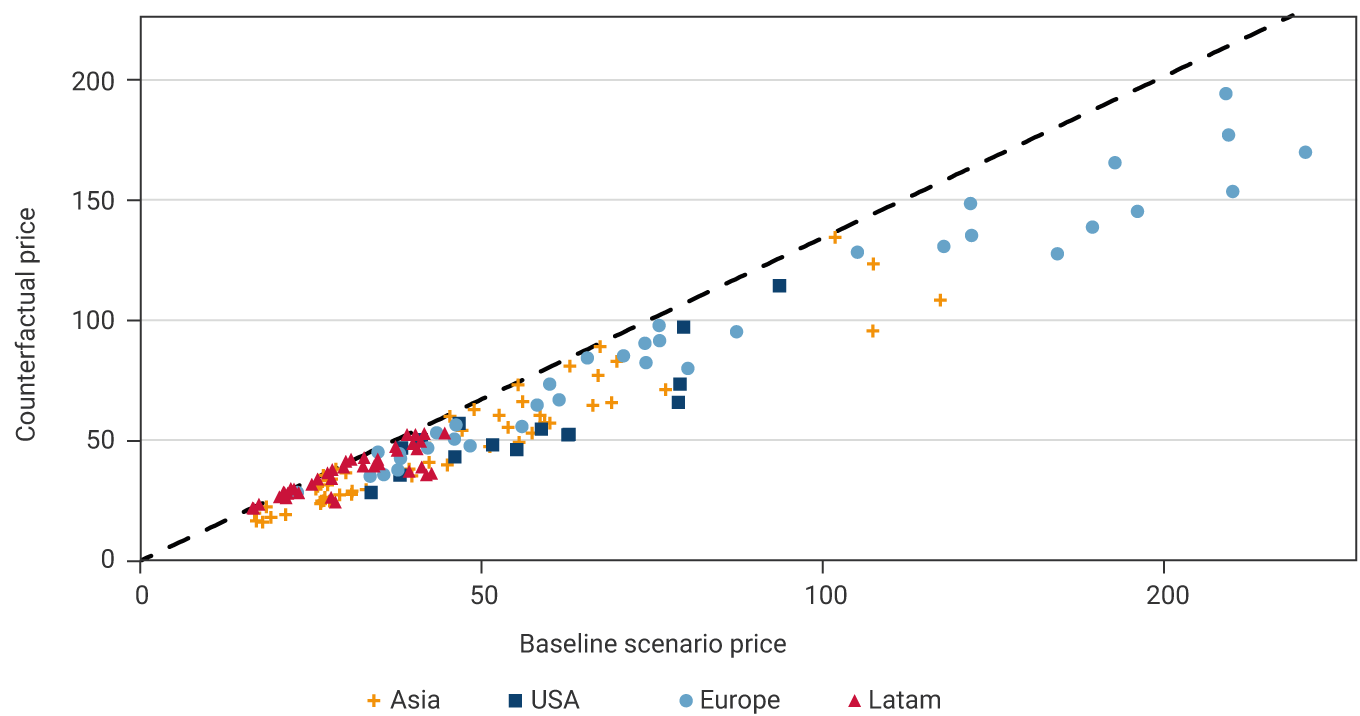

By way of illustration, Graph 2 shows the results of a simulation in which bilateral exchange rates with all trading partners are maintained at the levels prior to the exchange rate shock, but the other determinant variables of car supply and demand are kept at the values observed in 2016. The graph exhibits the price observed in 2016 on the horizontal axis versus the simulated price with constant exchange rates on the vertical axis. Points on the dotted 45-degree line correspond to car models whose prices do not change between scenarios, while points below the line correspond to car categories whose prices increased in response to depreciation. The different colors indicate the origin of the cars in question. The vertical difference between each point and the dotted 45-degree line is precisely the estimated exchange rate pass-through for each car model.

Graph 2. Car prices by origin

The graph illustrates the heterogeneity of each car's price response to the exchange rate shock according to its initial price and origin. Note that, among cars of the same origin, the price increases proportionally more for the more expensive cars. For example, the price of European cars with starting prices above COP 100 million increases proportionally more than the price of the cheapest European cars. The greater price adjustment of higher-end cars is a consequence of the presence of a few close substitutes, which allows their manufacturers to raise prices more aggressively without significantly losing market share to their competitors following the cost increase due to the exchange rate shock. In contrast, the prices of lower-range European cars react less to the cost shock due to the existence of a greater number of close substitutes, including cars from Latin American countries, against whose currencies the Colombian peso showed a lower depreciation.