A recent research paper, authored by Jair Ojeda from Banco de la República (the Central Bank of Colombia), published in the Working Papers on Economics series, examines the impact of remittances from abroad on housing prices in Colombia. The study focuses on the analysis of remittance flow variations to several regions of Colombia and their correlation with changes in prices of specific new housing projects. The findings illustrate a significant aspect of the macroeconomic impact of remittances, which account for 2.0% of the country's gross domestic product (GDP) and over 10% of its exports of goods.

The ambiguity surrounding the direction of causality complicates the investigation of the relationship between capital flows and asset prices. While remittances may increase housing demand and prices, it is plausible that rising housing prices could also induce remittance inflows. Additionally, observed changes in housing prices may respond to systematic changes in housing costs and characteristics.

To avoid this ambiguity, the study uses an econometric method to identify the cause-and-effect relationships between remittances and housing prices across different departments in Colombia. Housing price data is sourced from the Colombian Chamber of Construction (Camacol in Spanish), which tracks individual housing projects throughout their sales process. This database includes specific information about each project such as location, number of units, socioeconomic stratum, area, and type of housing, allowing for a comparative analysis of similar housing price trends across regions.

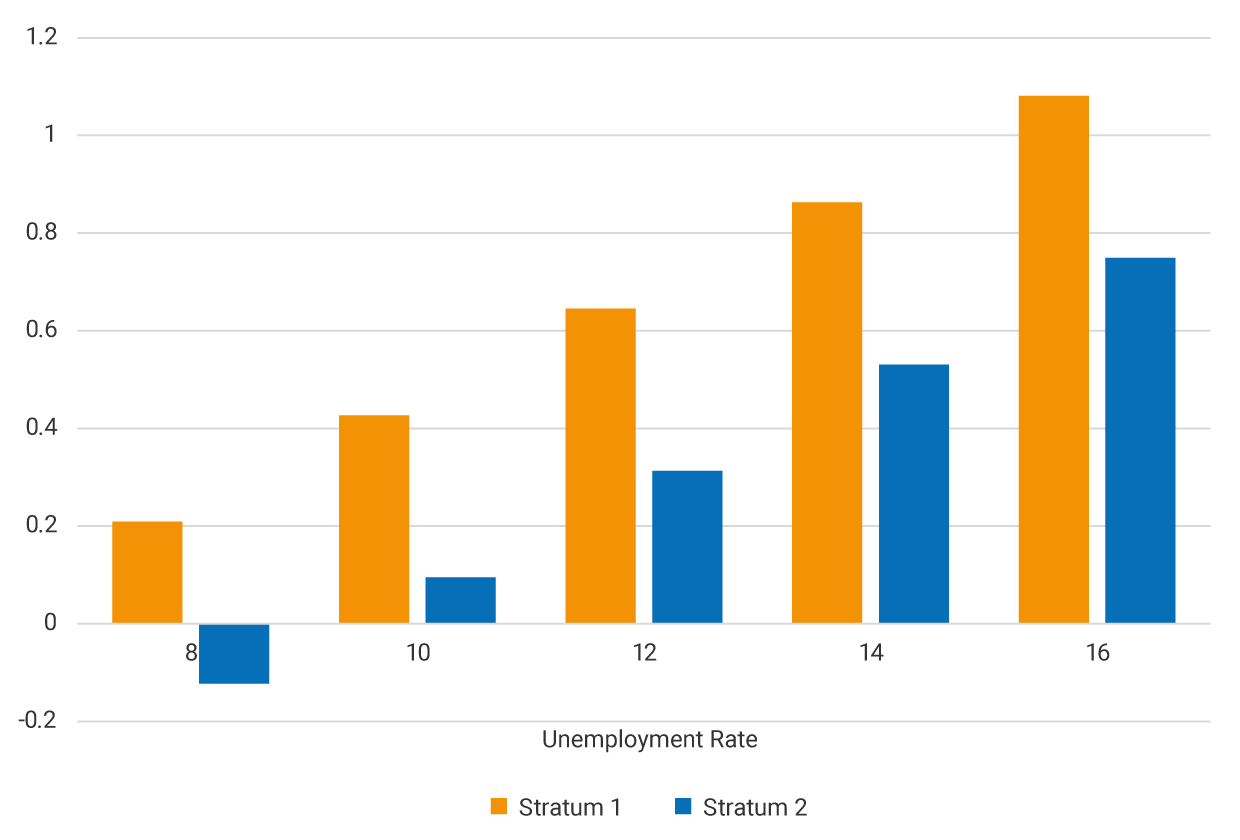

The econometric estimation benefits from the wide variation in remittances and housing prices over time and across the country. The results obtained suggest that remittances have heterogeneous effects based on region and type of housing. Notably, remittance inflows positively affect housing prices for lower socioeconomic strata, with more pronounced effects in regions with higher unemployment rates. To illustrate these findings, Graph 1 displays the percentage change in housing prices for strata 1 and 2 in response to a 10% increase in regional remittances, across various unemployment levels. As can be seen, the impact of remittances on housing prices increases with higher unemployment and is greater for the lowest stratum. Specifically, an annual 10% increase in remittances results in a 0.2% increase in housing prices for stratum 1 when unemployment is at 8.0%, but over 1.0% when unemployment reaches 16%. For stratum 2, the magnitude of the impact is significant but less pronounced, while higher strata experience null or even negative effects.

Graph 1: Impact of a 10% Increase in Remittances on Housing Prices by Socioeconomic Stratum (2010-2019).

The results of the study reflect the relative importance of remittances in the income of poorer households and highlight differences in spending and financing patterns vis-à-vis wealthier households. Generally, poorer households consume a larger portion of their income than wealthier households and use remittances to finance the purchase of fixed assets, such as housing. Beyond their macroeconomic significance, the role of remittances as a financing instrument for housing in lower-income sectors should be considered in the design of sectoral policies.