The Effects of Foreign Investor Composition on Colombia´s Sovereign Debt Flows

The series Working Papers on Economics is published by the Office for Economic Studies at the Banco de la República (Central Bank of Colombia). The works published are provisional, and their authors are fully responsible for the opinions expressed in them, as well as for possible mistakes. The opinions expressed herein are those of the authors and do not necessarily reflect the views of Banco de la República or its Board of Directors.

The series Borradores de Economía (Working Papers on Economics) contributes to the dissemination and promotion of the work by researchers from the institution. On multiple occasions, these works have been the result of collaborative work with individuals from other national or international institutions. This series is indexed at Research Papers in Economics (RePEc). The opinions contained in this document are the sole responsibility of the author and do not commit Banco de la República or its Board of Directors.

Abstract

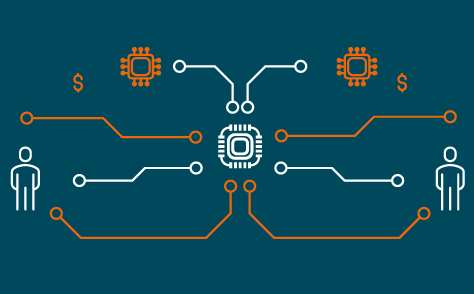

Assessing the composition of sovereign debt holders is important because investors’ behavior varies according to distinctive components, including shareholders’ preferences, regulatory constraints, and profitability mandates. To study this issue, we examine the determinants of offshore investments of mutual funds and pension funds, which concentrate Colombia’s outstanding sovereign debt. Our results indicate that mutual funds exhibit considerable sensitivity to shocks in global factors, such as the Federal Funds Rate, sovereign risk, and the composition of financial indices. This contrasts with findings among pension funds, for which we detected no statistically significant effects when examining these factors, underlining the differences in foreign investor behavior that could impact sovereign debt flows within emerging markets.