Payroll taxes are a key tool for financing public goods and benefits for workers. However, they may also increase labor costs for formal employers, discouraging formal job creation and shifting labor to the informal sector. The magnitude of these negative effects is uncertain and depends on several factors.

A recent paper by Leonardo Morales, economist at Banco de la República (the Central Bank of Colombia), and Óscar Becerra from Universidad de los Andes, published in the series Working Papers on Economics (Borradores de Economía), analyzes the effect of payroll taxes on the Colombian labor market based on the impact of the Ley del Primer Empleo (First-Job Act), introduced in 2011. The law reduced payroll taxes by 11 percentage points for new workers under the age of 28 while keeping them unchanged for older workers.

The statistical analysis compares labor market outcomes such as wages and employment before and after the enactment of the law. It uses detailed data from the official Colombian Household Survey (GEIH by its acronym in Spanish) by the National Administrative Department of Statistics (DANE in Spanish) and administrative records from the social security system (PILA by its acronym in Spanish). Specifically, it compares people under the age of 28 with older workers who are comparable in terms of other observed demographic variables. This method isolates the effect of the law on workers under 28 from the impact of other factors affecting all workers equally.

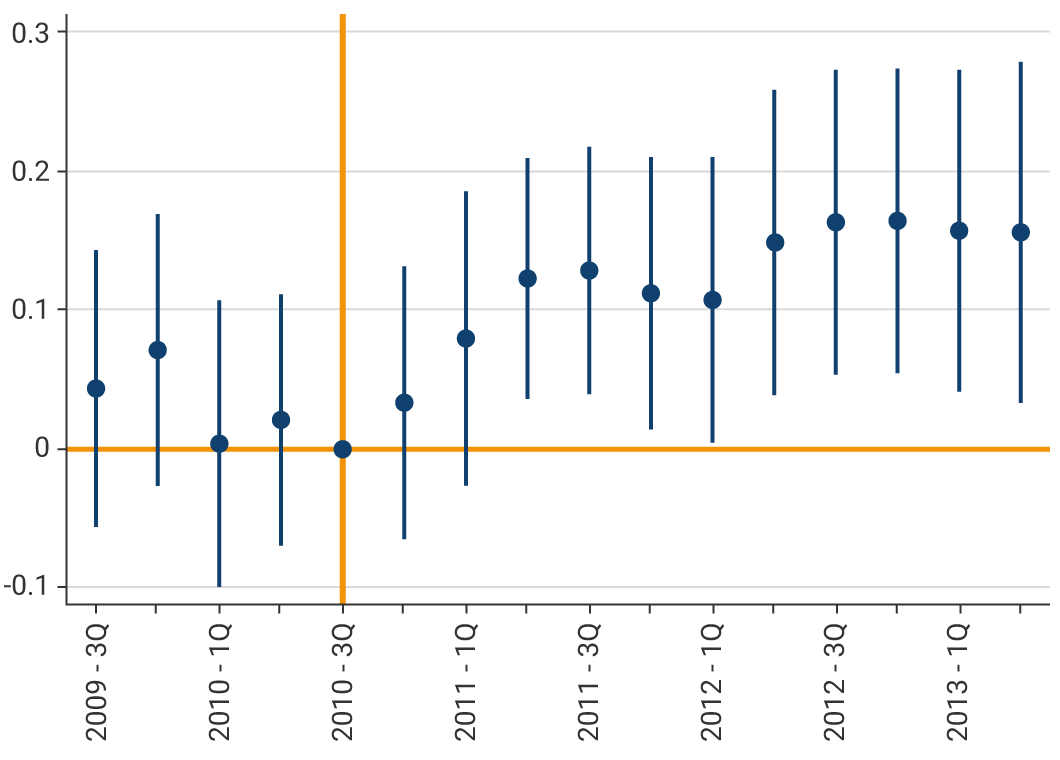

The findings suggest that reduced payroll taxes increased labor demand in the formal sector for young workers, with no significant effects on wages. The econometric estimate based on data from the GEIH suggests that a 10% increase in payroll costs could reduce formal sector employment by more than 5.0%. The main results are summarized in Graph 1, which shows the percentage increase in formal employment before and after the policy for cohorts under the age of 28. In the graph, each dot represents the average increase in employment for cohorts under 28 compared to cohorts of workers over 28 years old after the policy’s implementation. Additionally, lines around each dot represent the statistical significance intervals of the estimate. As shown, after the enactment of the law, the demand for formal employment increased significantly for potential beneficiaries of the reform compared to those over 28 who could not benefit.

Graph 1: Estimated Effect of the Ley del Primer Empleo on Formal Labor Demand for Young Workers

Note: The dots represent the estimate at each point in the study period of the percentage increase in formal employment for cohorts under the age of 28 relative to older cohorts. The bars represent 95% confidence intervals.

The analysis presented in this paper corroborates the results of other studies that exhibit the negative impact of payroll taxes on formal sector employment. In the case of the Ley del Primer Empleo, its reduction led to a significant increase in labor demand for young workers without affecting wages. While the generalization of these results depends on the specific characteristics of the labor market, the study highlights the potential of payroll tax adjustments as a policy tool to generate employment in the formal sector.