Central bank transparency refers to the clear and open communication of key information to the public by monetary policymakers. This includes the dissemination of data, forecasts, and decision-making processes that affect the economy. Transparency reduces the information gap between what monetary policymakers know and what businesses, investors, and consumers understand. In this way, central bank transparency helps businesses and consumers to make better-informed decisions and enhances the effectiveness of monetary policy transmission. Additionally, it strengthens accountability, ensuring that central banks remain aligned with their goals of achieving and maintaining low and stable inflation, and fostering long-term potential output growth.

In recent years, Colombia has made considerable progress regarding transparency of its monetary policy. A recent paper published in the Working Papers on Economics series (Borradores de Economía) of Banco de la República (the Central Bank of Colombia), authored by Juan José Ospina and José Vicente Romero, illustrates this progress. Their analysis is based on two common indicators in international literature on this topic: the DEG Index and the CBT-IT Index. The DEG Index measures the political, economic, procedural, policy-related, and operational transparency of central banks and was developed to assess how open central banks are in terms of the information they disclose. The CBT-IT Index, on the other hand, focuses specifically on the operation of central banks that use an inflation-targeting framework, such as Banco de la República, and includes sections that assess transparency regarding goals, forecasting systems, policy analysis, and decision-making processes.

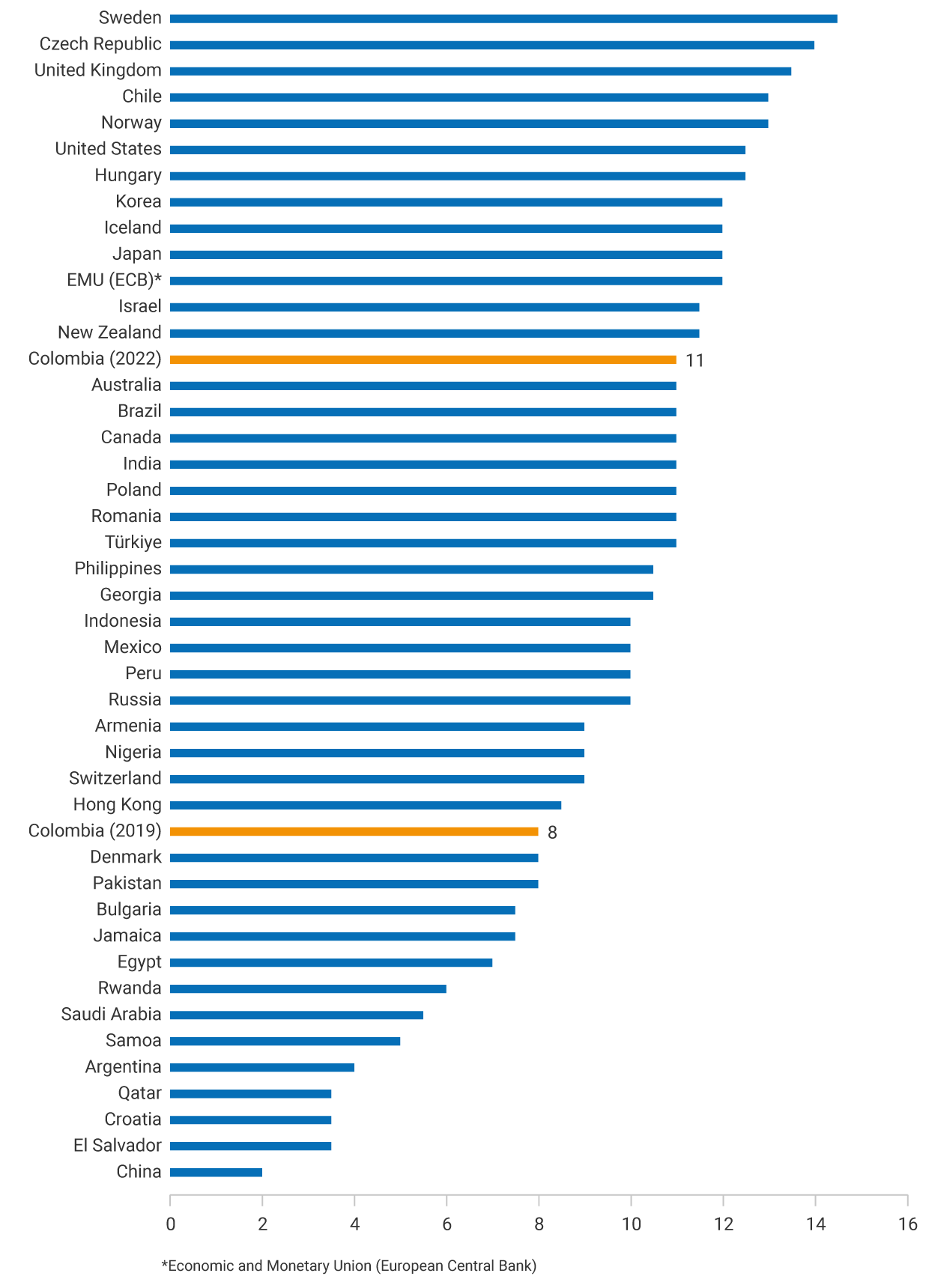

Graph 1 shows the DEG transparency scores calculated by Dinçer et al. (2019), which serve as a benchmark against which Colombia's significant progress from 2019 to 2022 can be measured. With the score rising from 8 to 11, Colombia has improved its ranking, reflecting a substantial improvement in its transparency practices. The data also indicate that Colombia's transparency index is higher than the average for countries with inflation targeting.

Graph 1: DEG Index for a Sample of Countries in 2019 and for Colombia in 2019 and 2022

Source: Data from Dinçer et al. (2022) and authors’ calculations for Colombia's index in 2022.

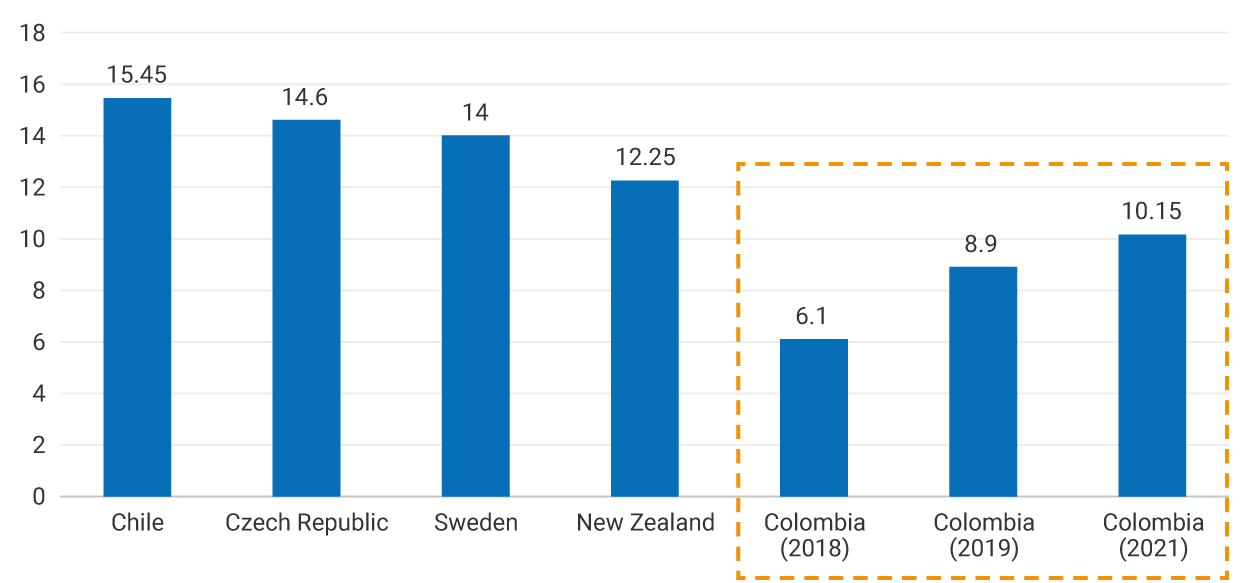

Meanwhile, the evolution of the CBT-IT indicator for Colombia has also shown notable improvement in recent years. Graph 2 shows the scores for countries with the highest levels of transparency in 2021, according to calculations by Kostanyan et al. (2022), including Chile, the Czech Republic, Sweden, and New Zealand. The graph also shows the evolution of Colombia's index between 2018 and 2021. As can be seen, Colombia's CBT-IT score increased from 6.1 in 2018 to 10.15 in 2021.

Graph 2: CBT-IT Scores for Central Banks with High Transparency Indexes (2021) and for Colombia (2018-2021)

Source: Authors’ calculations and Kostanyan et al. (2022).

The improvement in Banco de la República's transparency indicators is due to changes in its communication framework with the public since 2018. The changes adopted include the publication of forecasts and risk assessments in the Monetary Policy Report, technical presentations to journalists and analysts, as well as improvements in the timing of the release of the Monetary Policy Report and the minutes of the Board of Directors’ meetings. Banco de la República also strives to make its information accessible to a wider audience by publishing the key messages from the Monetary Policy Report on its website and social media channels. For businesses, investors, and the public in general, this progress means a better understanding of the economic outlook. For Banco de la República, it translates into greater effectiveness of its policies.