Foreign Exchange Intervention

The strategy behind Banco de la República’s policy is to keep inflation low and stable, as well as to reach output levels near its potential value. Its policy also helps to preserve the financial and payment system stability. Exchange rate flexibility is regarded as fundamental to achieving these objectives. To begin with, in a flexible exchange-rate regime, the exchange rate operates as an adjustment variable in response to the shocks the economy receives, reducing volatility in economic activity. Secondly, exchange rate flexibility allows for independent use of the interest rate as an instrument to bring inflation and output closer to their desired values. Third, exchange rate flexibility reduces the incentives for excessive exchange-rate risk taking by agents in the economy, which is key to maintaining financial stability.

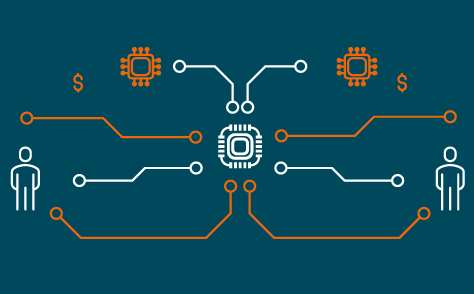

Nonetheless, Banco de la República, as the country’s foreign exchange authority, has the power to intervene in the foreign exchange market. Such intervention does not limit exchange rate flexibility, does not seek to fix or achieve any particular level for the exchange rate, and pursues objectives compatible with the inflation targeting strategy. Specifically, foreign exchange intervention by the Bank is intended to : i) increase the level of international reserves in order to reduce external vulnerability and improve access conditions to external credit; ii) mitigate movements in the exchange rate that do not clearly reflect the performance of the economy's fundamentals and may negatively affect inflation and economic activity; and iii) curb rapid and sustained deviations of the exchange rate from its trend, so as to avoid disorderly performance in financial markets.

To ensure foreign exchange intervention is compatible with the inflation targeting strategy, foreign exchange purchases and sales are sterilized to the extent necessary to stabilize the short-term interest rate at the level the BDBR considers to be consistent with meeting the inflation target and with the development in output to a level near its potential. This means monetary expansion or contraction generated by foreign exchange purchases or sales is offset so the short-term interest rate does not deviate from the level stablished by the BDBR.

Any decision on foreign exchange intervention takes into account its benefits, its costs to the country and its effect on the Bank's financial results. The amounts of foreign currency to be purchased are determined in such a way that the level of Banco de la República’s external liquidity covers the external deficit, external debt payments and other potential capital flows.