Followers of monetary policy and inflation are familiar with the decisions made by the Board of Directors of Banco de la República regarding the monetary policy interest rate (MPR), which experiences periods of increase and decrease, always aiming to keep inflation around its 3.0% target. This rate serves as a benchmark to determine the cost of funding that Banco de la República provides to the banking system to meet its liquidity needs. However, the public following these updates rarely questions how the Central Bank ensures that the MPR level deemed consistent with the inflation target is actually the one prevailing in the market. It is certainly not sufficient to merely announce it in a statement: there must be an economic mechanism to achieve this. This mechanism lies in the Central Bank’s power to create money and put it into circulation. A box published in the July 2024 Report to Congress provides an insightful explanation of how Banco de la República manages this exclusive power to ensure that the monetary policy stance associated with a specific MPR level is indeed the one prevailing in the short-term liquidity market, from which it will be transmitted to other interest rates in the economy.

The monetary aggregate issued by the Central Bank is known as the monetary base (or primary money), which consists of cash and bank reserves. Cash includes banknotes and coins held by the public, while bank reserves correspond to the funds held by commercial banks and other financial intermediaries in their non-interest-bearing deposit accounts at Banco de la República or in their own vaults. The Central Bank injects the monetary base into the economy through financial operations that require payments in Colombian pesos, such as the purchase of foreign currencies, the acquisition of public debt instruments (TES: bonds issued by the Colombian Government), the funding of the banking system through repo1 operations, and other investments.

The monetary base is traded in a primary liquidity market, where the equilibrium between its supply and demand determines its price. The supply is determined by the Central Bank through the financial operations mentioned above, while the demand is made by the public, which uses cash as a means of payment or savings instrument, and by financial intermediaries, which need the funds to maintain bank reserves and meet their obligations to clients. In particular, commercial banks are major users of primary liquidity due to the maturity mismatches between their liabilities (mainly short-term public deposits) and their assets (medium- and long-term credit portfolios), which generates liquidity needs.

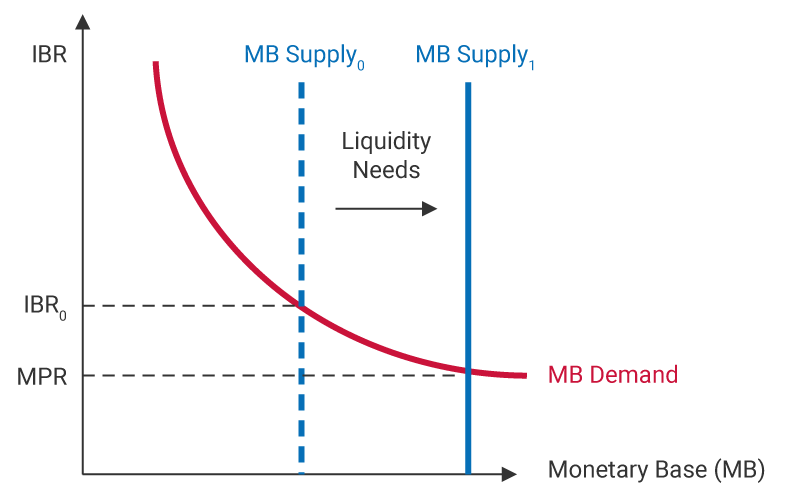

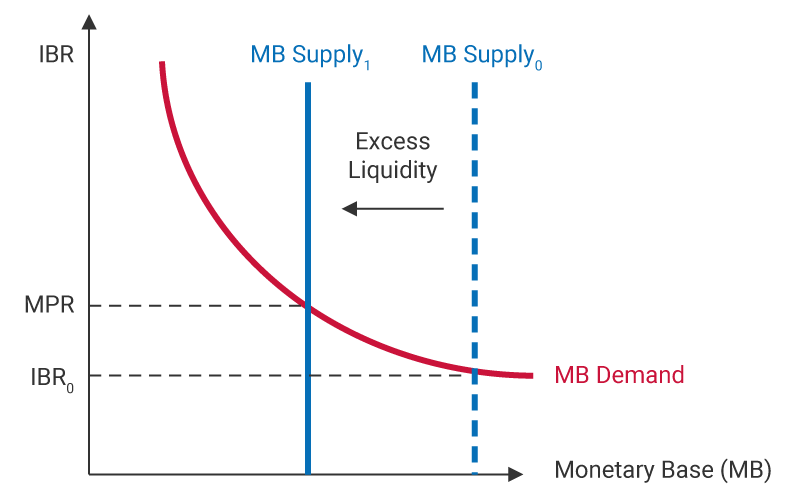

The operation of the primary liquidity market is illustrated in Graph 1. Panels A and B show two alternative scenarios. In Panel A, the vertical axis represents the Reference Banking Indicator (IBR in Spanish), which measures the price (interest rate) assigned by the market to primary liquidity2. The horizontal axis measures the amount of the monetary base. The monetary base supply that the Central Bank has put into circulation (BM0 supply) is illustrated by the dashed blue vertical line. Its demand is represented by the red curve, which shows that the higher the interest rate, the lower the non-interest-bearing deposit balances that banks want to keep at the Central Bank. Panel A presents a situation where the market equilibrium occurs at an interest rate, IBR0, higher than the MPR. If this situation persists, i.e., if the economy's short-term interest rate is higher than the rate considered compatible with achieving the inflation target, monetary policy would in practice be more restrictive than desired. This is because the supply of the monetary base is insufficient to balance the market at a rate close to the MPR. Banco de la República is therefore required to carry out operations that expand the monetary base to the solid blue vertical line. Panel B illustrates the opposite case, where the economy has excess liquidity, leading to a lower market interest rate (IBR0) than the MPR announced by the Central Bank and resulting in a looser monetary policy stance, thus requiring the Bank to collect such excesses.

Graph 1. Primary Liquidity Market

Panel A

Panel B

The situations shown in Graph 1 occur somewhat frequently due to changes in the supply or demand for the monetary base. For instance, since the National Government manages its accounts at Banco de la República, increases in its deposits would contract the supply of the monetary base (by withdrawing funds from commercial banks to deposit in the Central Bank), while withdrawals would expand it. As for the demand for the monetary base, liquidity needs can be affected by dates, patterns, and payment technologies in the economy, as well as by changes in economic activity or the level of public uncertainty.

Banco de la República has several instruments to navigate these situations and minimize deviations of the IBR from the MPR. If the differences between the supply and demand for the monetary base are not significant or are short-lived, liquidity shortages (or excess liquidity) may be supplied (or withdrawn) using temporary instruments. To supply temporary liquidity shortages, Banco de la República uses 1-day and 7-day repo operations, which are awarded through auctions. To withdraw excess liquidity, the Bank uses remunerated non-reserve deposits (DRNCE in Spanish), awarded through auctions, allowing financial institutions to deposit funds with the Bank for a specified period in exchange for a return. When liquidity needs or excess liquidity are significant and persistent, Banco de la República purchases or sells securities in the secondary market, mainly debt securities issued by the National Government (TES).

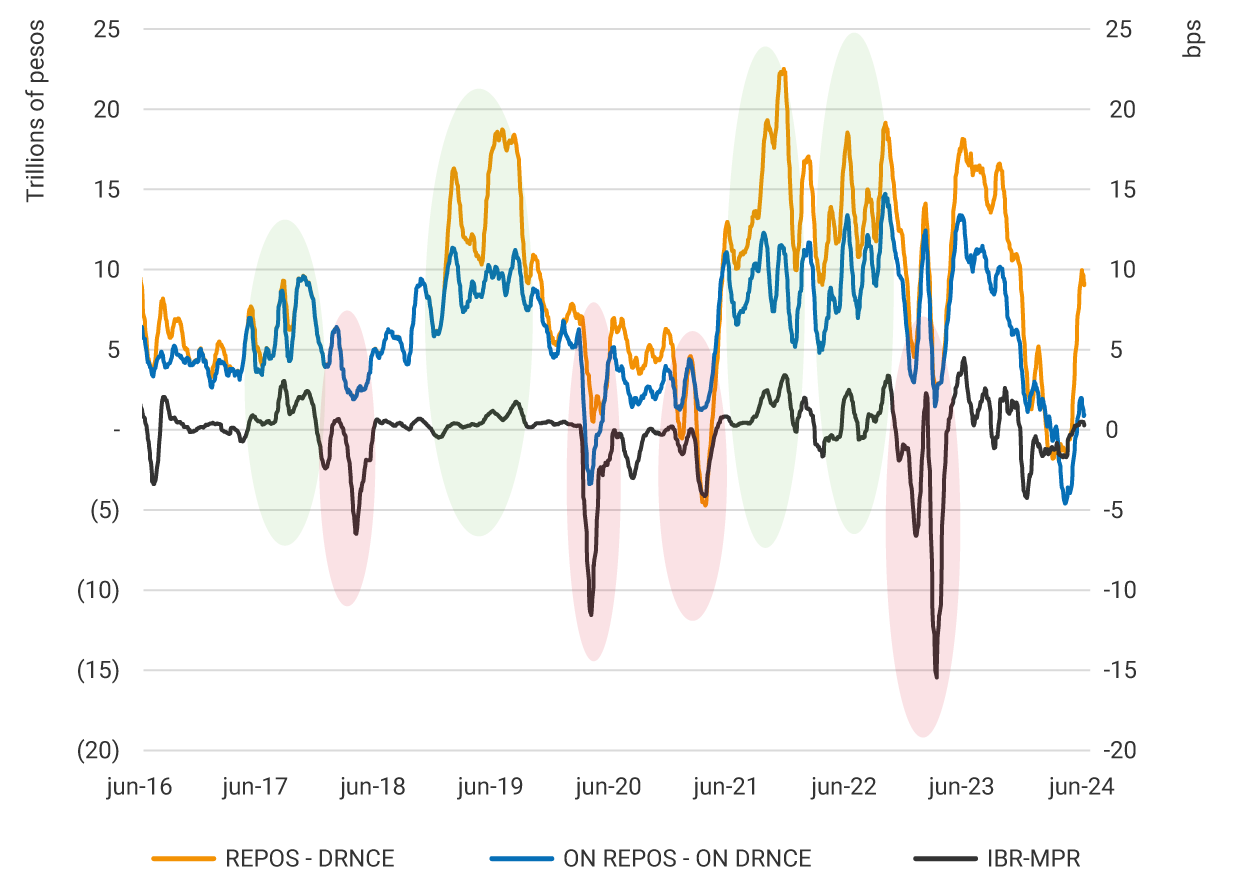

Graph 2 presents Banco de la República’s position in the primary liquidity market over the last eight years, measured as the difference between the amounts of repos and DRNCEs. When this difference is positive, it indicates that the market has liquidity needs, which is reflected in higher repos than deposits. This situation is described in Panel A of the previous graph. Conversely, if the Bank's net position is close to zero or negative, it means that there is sufficient market liquidity, or even excess liquidity, which corresponds to Panel B in Graph 1.

Banco de la República chooses to use the available instruments to maintain a situation in which certain levels of liquidity needs are present in the market. Under such conditions, the IBR usually remains close to the MPR, as represented by the black line around the zero axis in the graph. However, if these liquidity needs exceed a certain level, upward pressures on the IBR are often evident (green ovals). Conversely, when there are low liquidity needs, or even excess liquidity, the IBR has shown more significant and persistent negative deviations from the MPR (pink ovals).

Graph 2. Banco de la Republica’s* Position and IBR vs. MPR Difference

(20-day Moving Average)

*Banco de la República’s position is measured as the difference between the balance of repos and the balance of interest-bearing deposits that do not constitute bank reserves (DRNCE). Both the total position and the position on an overnight (ON) horizon are presented.

As described in this blog, the monetary policy model used by Banco de la República resembles the one used by central banks in many developed and emerging economies that have adopted an inflation targeting scheme. This paradigm differs greatly from the methods used in the 1970s and 1980s, when central banks set the amount of money as an instrument to achieve an inflation target and allowed the interest rate to adjust freely.

1 ↑ Through these operations, a financial institution delivers securities to Banco de la República as collateral and receives money in return. At maturity, the transaction is reversed. Banco de la República offers repos at one- and seven-day terms, which are awarded through auctions, with a total amount announced daily.

2 ↑ For more information on the IBR, see Reference Banking Indicator (IBR)